Best USDC Yield: Top 3 Strategies for Earning Passive Income on Demex

Looking to earn passive income on your USDC holdings? Whether you're a seasoned trader or new to the world of decentralized finance, generating yield on stablecoins like USDC can offer great opportunities to grow your assets while minimizing exposure to market volatility. Demex, as a leading DeFi hub, provides multiple ways to earn competitive returns on USDC through perpetual liquidity pools, spot liquidity pools, and an extensive money market.

In this guide, we'll break down the top three strategies for earning the best USDC yield on Demex. From high-risk, high-reward options to lower-risk alternatives, you’ll discover how to turn your stablecoin holdings into a source of passive income that suits your risk tolerance and goals.m

1. Perpetual Liquidity Pools: High Risk, High Reward

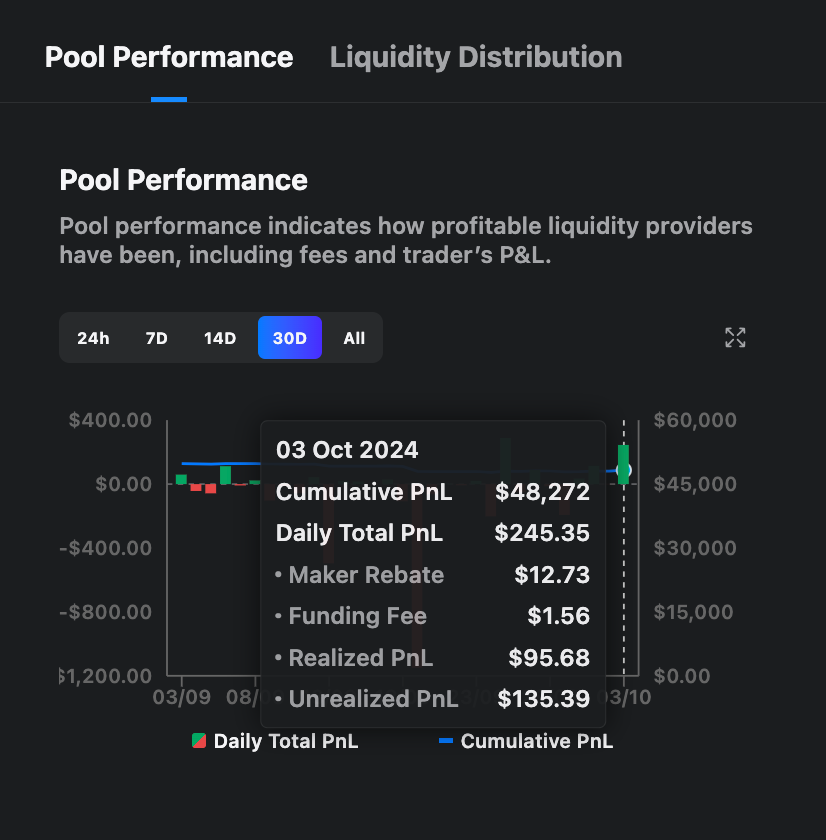

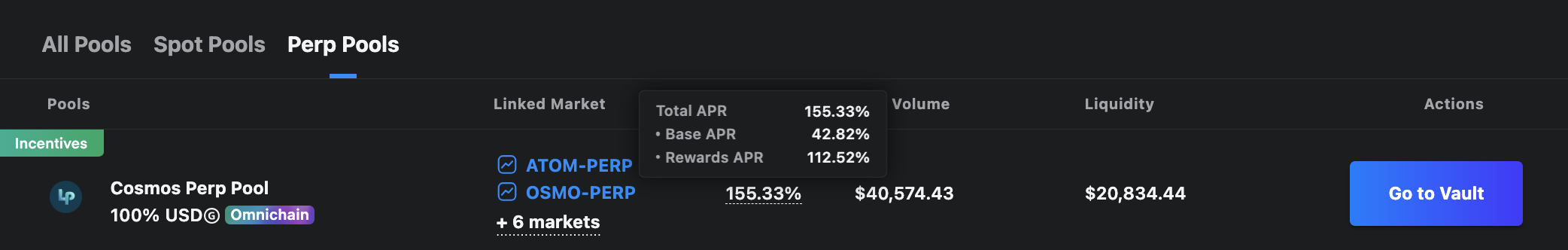

For those looking to maximize yield with a higher risk appetite, Perpetual Liquidity Pools (Perp LPs) on Demex offer one of the most lucrative ways to earn on your USDC. By participating in perp DEX liquidity pools, you can earn a high APY through multiple streams, including market making fees, funding fees, traders’ PnL, and additional incentives.

As a liquidity provider, you earn a portion of the trading fees generated by leveraged perpetual contracts, which are often in high demand during market fluctuations. This makes it a high-reward strategy to earn attractive 3 digit APYs for users willing to navigate the risks involved.

However, this strategy does come with high risk, as you're exposed to impermanent loss and the volatility inherent in perpetual markets. stablecoins, Perp LPs.

With Demex being a decentralized finance platform, you maintain full control over your assets while enjoying the benefits of participating in one of the most innovative DeFi strategies available. The combination of multiple income streams makes Perp LPs an attractive option for maximizing your USDC yield while engaging in a dynamic trading environment.

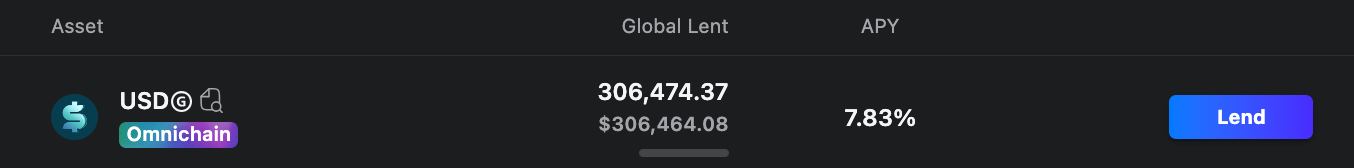

2. Lending USDC on Nitron: Medium Risk, Medium Reward

If you're looking for a balanced option with medium risk and medium reward, lending your USDC on Nitron, the in-app money market on Demex, is an ideal choice. When you deposit USDC, it is automatically converted into USDG, a basket of whitelisted stablecoins that includes USDC. This not only simplifies the lending process but also enhances the overall liquidity and stability of your assets.

By lending USDG on Nitron, you earn competitive lending APY while allowing other users to borrow stablecoins. Nitron ensures that you can generate yield without exposing yourself to excessive risk. Additionally, you can use your USDG as collateral to borrow other assets, allowing you to take on more advanced DeFi strategies such as leveraged yield farming or cross-market arbitrage.

This flexibility makes Nitron a strong option for those looking to diversify their yield strategies while maintaining a steady income. You can enjoy a consistent yield from your stablecoins while also expanding your portfolio through sophisticated trading strategies.

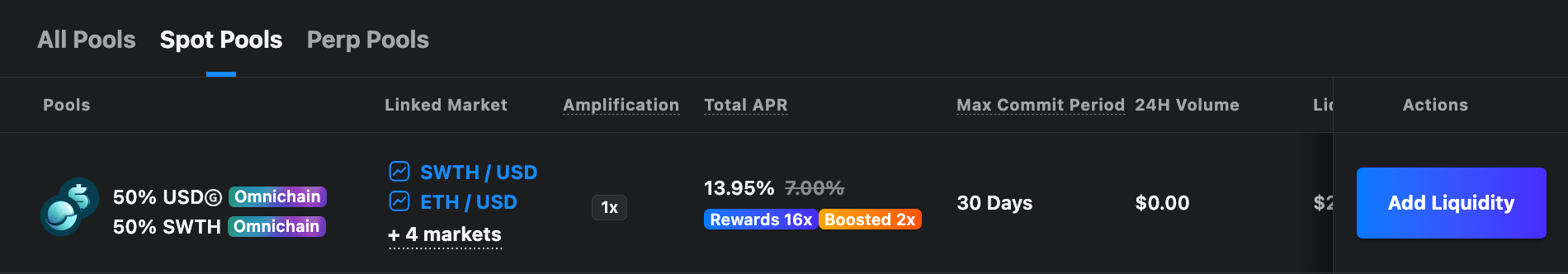

3. Spot Liquidity Pools: Low Risk, Low Reward

For those who prefer low risk, Spot Liquidity Pools on Demex offer a reliable way to earn yield on USDC with minimal exposure to market fluctuations. By providing liquidity to AMMs (Automated Market Makers) in the spot markets, you earn passive income through trading fees and market-making fees generated by users trading stablecoin pairs.

While the APY might be lower compared to perp LPs or lending, this strategy allows you to hold stable assets while still earning returns. The fees accrued from trading activity in the spot markets provide a consistent revenue stream, making it perfect for conservative investors who want to use their stablecoins as a store of value.

This approach allows users to enjoy passive income without the higher risks associated with perpetual trading. By participating in Spot Liquidity Pools, you can achieve a balanced income strategy, ensuring your USDC holdings are not just sitting idle but actively working for you.

For DeFi Users New to Perp Trading: Safe Opportunities to Start

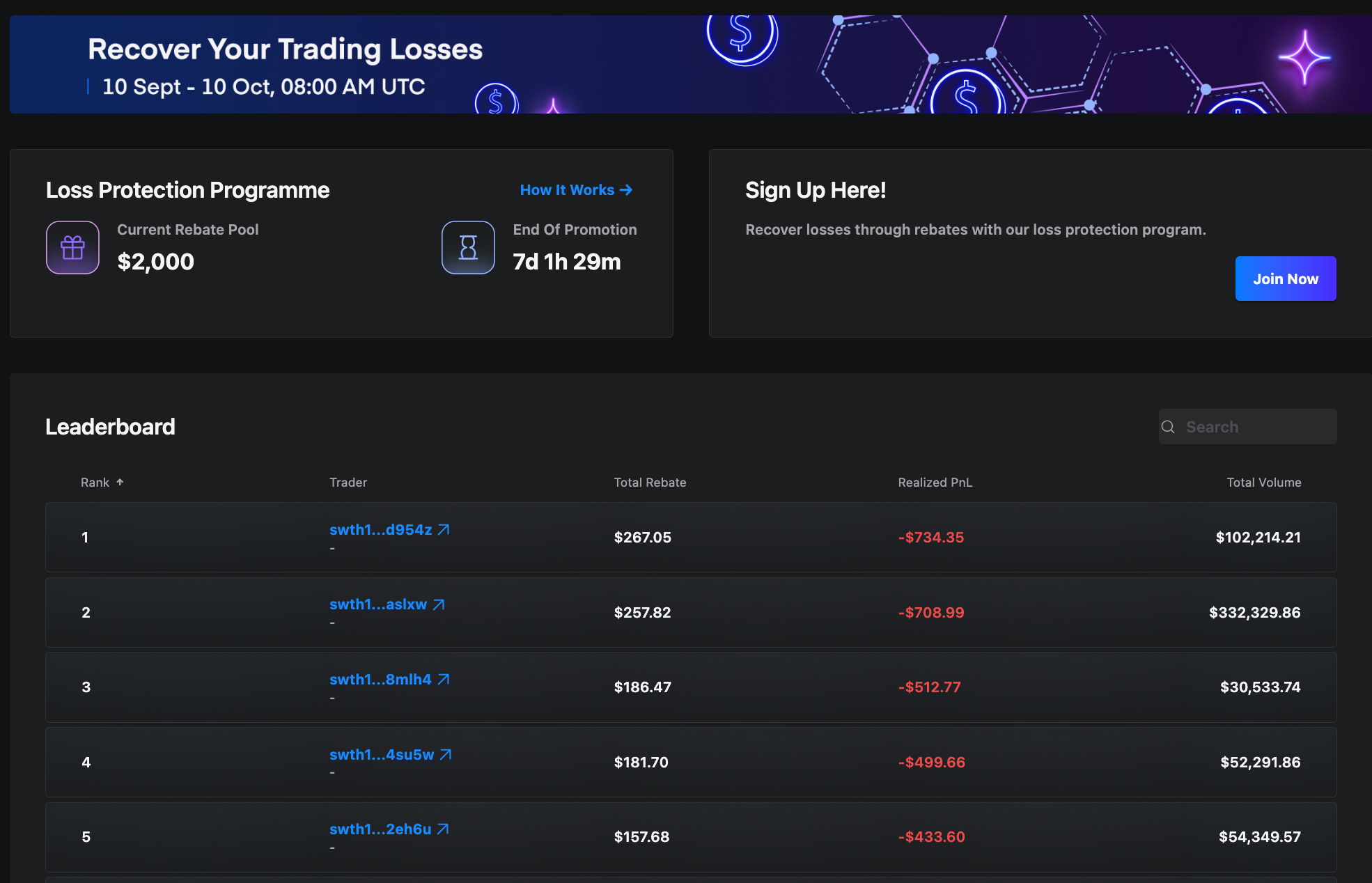

If you're more comfortable with traditional DeFi but haven't explored perp trading, Demex makes it easy and rewarding to venture into perpetual markets. Demex offers new users incentives like the ongoing loss protection program, cash rebates, and opportunities to earn Demex points, all designed to ease the transition into more advanced trading strategies.

This makes Demex a great platform for users who want to experiment with higher-risk, higher-reward strategies in a decentralized finance ecosystem that prioritizes user safety. Whether you’re looking for passive income through spot liquidity, lending on Nitron, or trying out perp DEX trading, Demex has something for every type of trader.

The TLDR

If you're looking to earn the best USDC yield, Demex has you covered with three main strategies. Perpetual Liquidity Pools (Perp LPs) offer high risk and high reward, allowing you to earn through market making fees, funding fees, and traders' PnL. Lending USDC on Nitron presents a medium risk and medium reward scenario, enabling you to generate consistent interest while maintaining the flexibility to borrow other assets for more advanced DeFi strategies. Lastly, Spot Liquidity Pools provide a low-risk, low-reward option where you can earn passive income through trading and market-making fees with minimal exposure to market volatility. No matter your risk tolerance or experience level, Demex provides a range of opportunities to generate passive income on your USDC holdings. Explore perpetual, lending, or spot liquidity solutions today and maximize your earnings in the DeFi space!