Celestia Raises $100M: Ride the Wave of Success and Trade TIA-PERP on Demex

The Celestia Foundation has announced another successful funding round, raising $100 million with the support of Bain Capital Crypto, Syncracy Capital, 1kx, Robot Ventures, Placeholder, and others. This latest investment brings Celestia’s total funding to $155M, further cementing its position as a leader in the modular blockchain space. With this funding, Celestia aims to expand its unique approach to blockchain scalability, offering developers unparalleled flexibility and throughput potential.

Celestia's Mainnet Beta went live in October 2023, delivering the world’s first modular consensus and data network. Since then, the ecosystem has seen rapid growth, with over 20 rollup chains already deployed and Celestia data blobs accounting for over half of the total data published by rollups. With this foundation, Celestia is enabling developers to deploy high-throughput, unstoppable applications using any virtual machine (VM) without the constraints of monolithic blockchain architectures.

What is Celestia?

Celestia is a revolutionary modular blockchain that separates consensus and data availability from execution, allowing developers to deploy customized rollups with ease. This flexibility stands in stark contrast to traditional blockchains, where applications are often limited by a single, shared execution layer. Celestia's modular design opens new possibilities for developers, who can choose their preferred VM, programming language, and execution framework to scale decentralized applications (dApps) across ecosystems like Cosmos and beyond.

By removing the overhead of a monolithic execution layer, Celestia creates a more scalable and customizable blockchain infrastructure, offering a superior alternative for deploying rollup chains and sovereign networks.

Celestia’s Data Availability Layer

At the heart of Celestia’s architecture is its innovative data availability layer, which is designed to handle large-scale data throughput. By enabling rollups to post compact datablobs, Celestia ensures that data is accessible and verifiable across the network, without overwhelming its resources. This means developers no longer have to worry about data bottlenecks when scaling their applications.

Celestia’s data blobs have already accounted for more than half of the total data published by rollups, demonstrating the platform’s ability to support scalable decentralized applications. With a recently introduced roadmap to scale block size to 1 gigabyte, Celestia aims to achieve a throughput capacity on par with major payment networks like Visa, while maintaining low latency and high verifiability.

TIA Strategies on Demex

If you're aiming to maximize your position in TIA while keeping risks in check, Demex offers several ways to effectively leverage your assets. Let’s dive into a strategy that amplifies your exposure to TIA while also giving you loss protection.

1. Lend TIA on Nitron to Amplify Your Position

Start by lending your $TIA on Demex’s in-app money market, Nitron. By lending, you earn lending APY on your TIA holdings while keeping them active in the market. This forms the first step in increasing your exposure without having to part with your $TIA.

2. Borrow $USD to Increase Buying Power

Once you’ve lent $TIA, you can borrow $USD against your collateral. This gives you extra liquidity to reinvest in the market without needing to sell your $TIA. With borrowed funds in hand, you have more capital to work with, allowing you to amplify your potential gains while holding onto your $TIA.

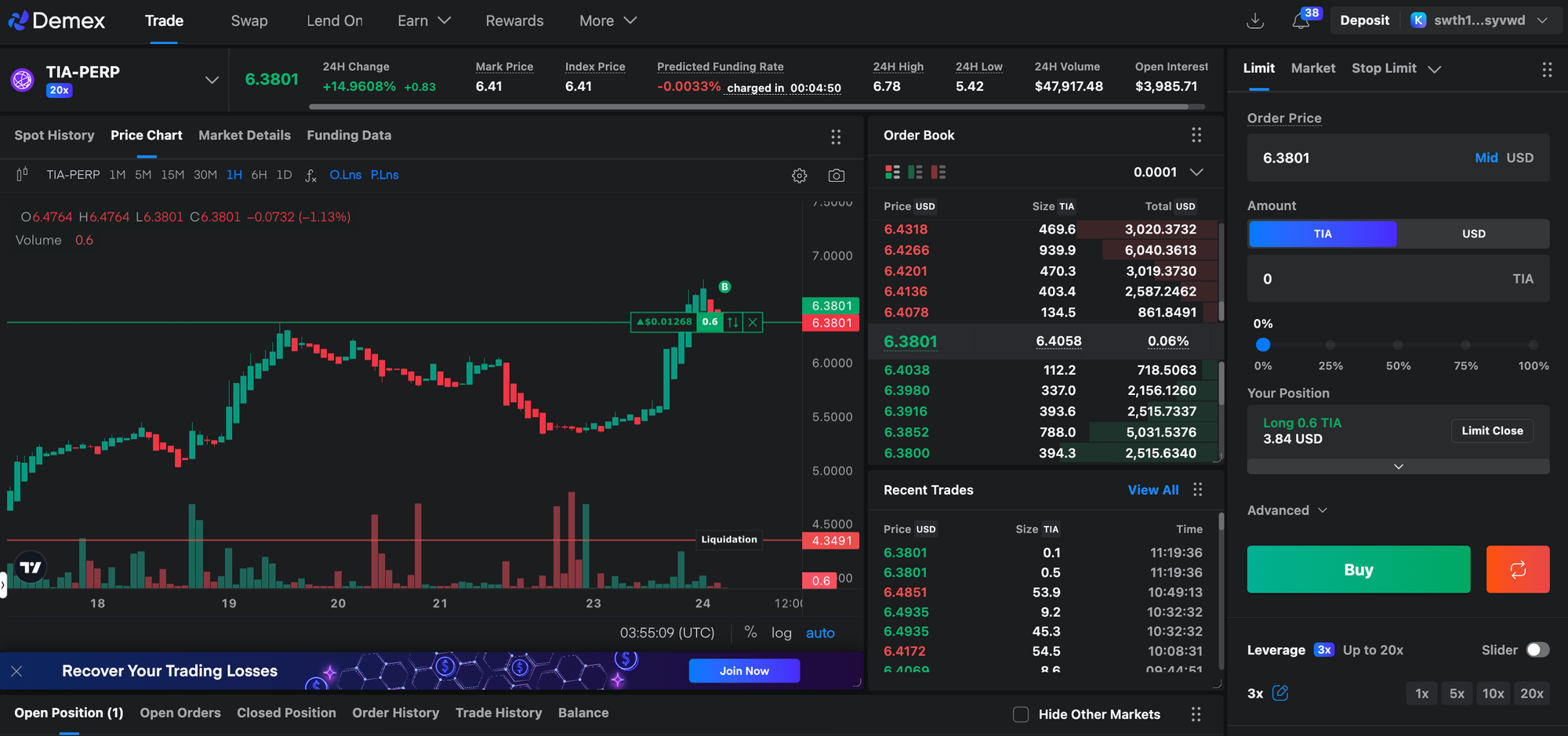

3. Use Borrowed Funds to Long TIA-PERP

Now, use the borrowed $USD to enter a leveraged long on the TIA-PERP market. This is where the strategy really shines—betting on TIA’s price appreciation by increasing your position through perpetual futures. Even a slight upward movement in $TIA’s price can lead to significant gains, as you’re amplifying your exposure through leverage. It’s a powerful way to ride $TIA’s momentum, without having to cash out your initial investment.

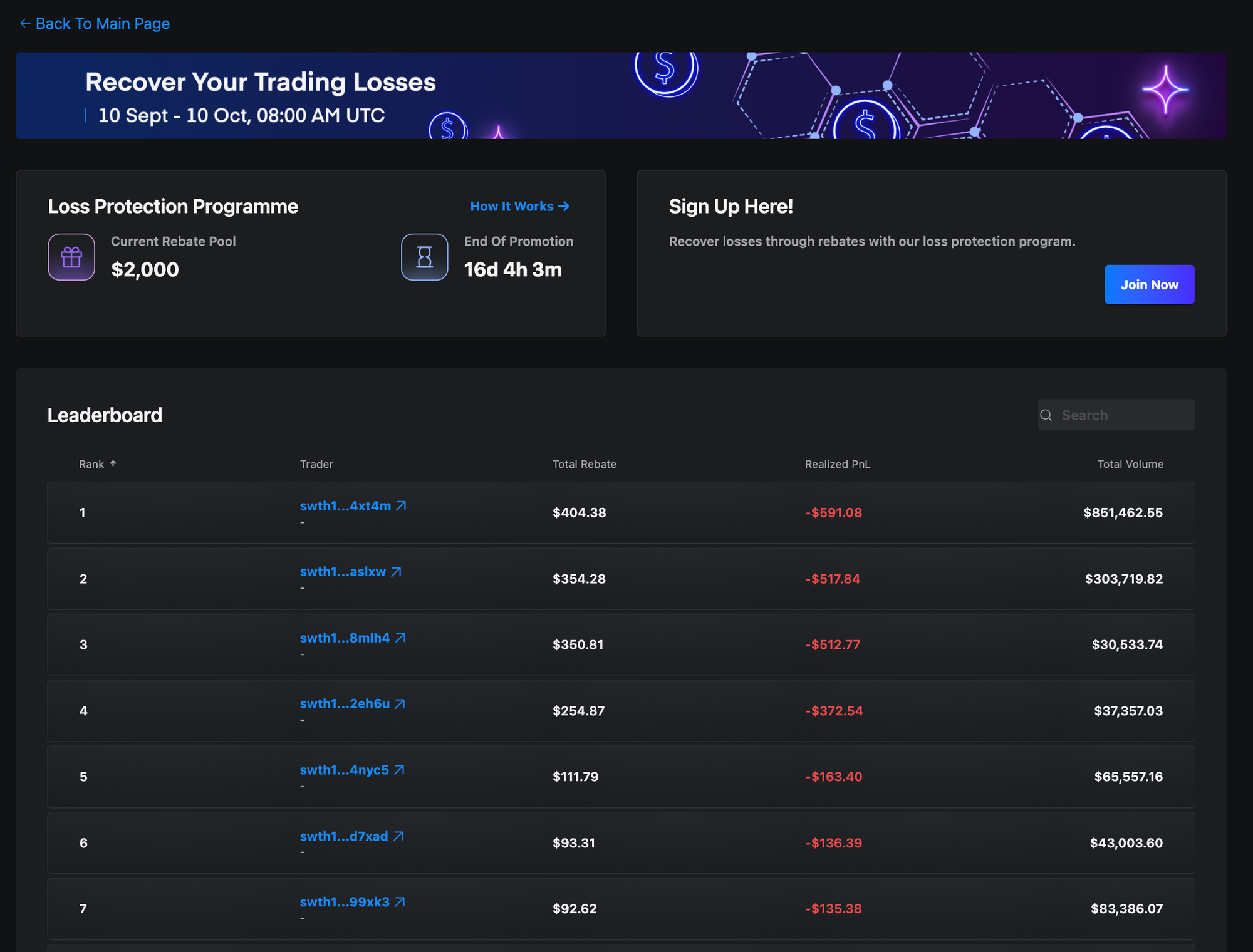

Bonus: Loss Protection Program for First-Time Traders

To make this strategy even more attractive, Demex offers a Loss Protection Program for first-time traders to make this strategy even more attractive100% of their losses back if their trade doesn’t go as planned. Conversely, if your $TIA trade is profitable, you get to keep all your gains!

This creates a win-win scenario for new traders—either you walk away with profits, or you’re protected from losses. To check if you’re eligible for the program, visit the Loss Protection Program page on Demex and ensure you’ve registered before entering your trade.

Maximizing Gains with Confidence

By following this strategy, you’re not only leveraging your TIA holdings through lending, borrowing, and longing TIA-PERP, but you’re also ensuring that you have loss protection in case the market moves against you. This combination of a leveraged long strategy and the Loss Protection Program puts you in an optimal position to trade with confidence, knowing that you’re covered on both ends.

The TLDR

Celestia has raised an additional $100M, bringing its total to $155M, further advancing its modular blockchain that enables high-throughput, customizable applications. With its data availability layer already powering over half the data from rollups, Celestia is rapidly scaling since its Mainnet Beta launch in 2023. On Demex, traders can leverage $TIA by lending on Nitron, borrowing $USD, and taking a leveraged long on TIA-PERP. First-time traders are also eligible for the Loss Protection Program, which offers up to 100% loss recovery or full retention of profits.