Compound Your Yield with Ondo Finance’s USDY Yieldcoin on Demex

Demex is proud to introduce USDY, the first-ever Yieldcoin secured by US Treasuries, as a collateral option. With USDY, users can enjoy the benefits of a yield-bearing stablecoin while opening up DeFi possibilities to earn even more. As the first Cosmos money market to offer USDY as collateral, Demex enables traders to boost their returns, adding layers of income on top of the real yield USDY already generates from US Treasury bonds.

What is USDY? The Global Yieldcoin by Ondo Finance

USDY is a revolutionary yield-bearing token issued by Ondo Finance, providing users with a secure, stable way to earn yield from US Treasury bonds. With an APY of 5.05%, USDY accrues yield daily, making it ideal for both individual and institutional investors. It offers the utility of traditional stablecoins but with the added benefit of consistent, real-world yield backed by US Treasuries.

Unlike other stablecoins, USDY is available on multiple blockchains, including Ethereum, Noble, Arbitrum, and more. It is freely transferable after 40-50 days of issuance and fully backed by proof of reserves to ensure its stability and transparency. This unique Yieldcoin can be used in DeFi, cash management, lending, and borrowing, or simply held to earn auto-compounded yield over time.

Ondo Finance: The Backbone of Yieldcoin USDY

Ondo Finance is the creator and issuer of USDY—the first-ever permissionless yieldcoin designed to offer daily, secure yields from US bonds. Ondo’s mission is to bridge the gap between DeFi and traditional finance, providing yield-bearing tokens like USDY for non-US retail and institutional investors. Ondo ensures that USDY remains over-collateralized and bankruptcy-remote, making it a reliable asset in the evolving blockchain space.

Noble: The Issuance Platform for USDY Yieldcoin

Noble, a dedicated Cosmos app-chain, is the chosen platform for issuing USDY Yieldcoin. As a stable, IBC-enabled chain, Noble specializes in the issuance of native assets within the Cosmos ecosystem. Its technical infrastructure ensures smooth and secure transfers of tokens like USDY across multiple blockchains. By utilizing Noble, Ondo Finance guarantees seamless issuance and management of USDY, allowing both retail and institutional investors to tap into the yield-bearing benefits of US Treasuries with a tokenized, blockchain-based solution.

Lending USDY on Demex: Unlock New Yield Opportunities

On Demex, you can now leverage USDY Yieldcoin for more than just passive earnings. As a collateralized asset, USDY can be used in DeFi strategies to earn additional rewards:

- Lend USDY to the Nitron money market on Demex.

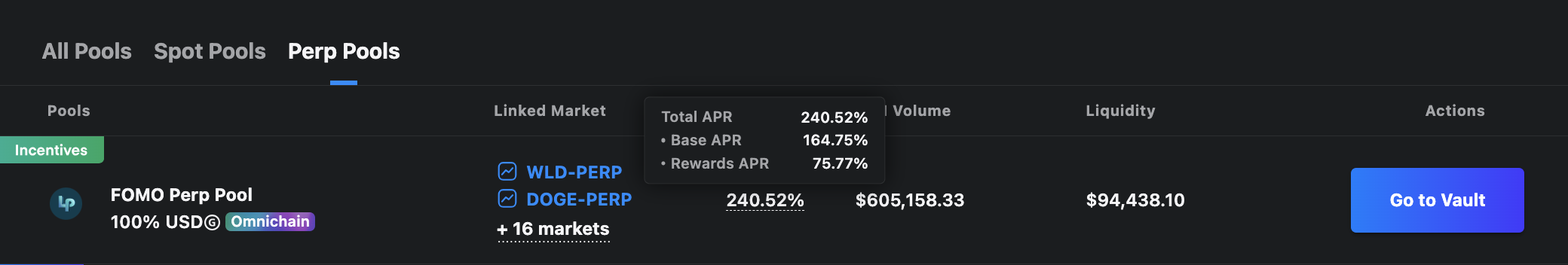

- Borrow USDG (Demex’s stablecoin) against your USDY collateral and deposit it into perp pools to earn market-making fees, funding fees, and PnL from traders.

- Use borrowed USDG as margin for trading perps (perpetual contracts) on Demex, allowing you to maximize profits with minimal collateral.

These strategies give you access to multiple streams of income—yield from US Treasuries, trading profits, and DeFi incentives—all while keeping your core capital in a yield-bearing asset.

Advanced DeFi Strategies with USDY Yieldcoin on Demex

Demex opens the door to advanced DeFi strategies using USDY. Here are two powerful ways to maximize your returns:

1. Earn SWTH & Market Making Fees

Lend USDY on Demex to unlock your capital. Then, borrow USDG against your USDY collateral and deposit it into perp pools, where you can capture market-making fees, funding fees, profit from traders’ PnL and SWTH incentives.

2. Margin Trading with USDG

Lend USDY and borrow USDG to use as margin for trading perps on Demex. This strategy allows you to trade perpetual contracts with leverage, magnifying your trading profits while earning yield from your USDY collateral.

Why Demex is Your Ultimate DeFi Playground

Demex is more than just a trading platform—it’s your gateway to endless DeFi possibilities. As the first Cosmos money market to offer USDY, Demex allows you to take advantage of yield-bearing assets in multiple ways. Whether you’re a retail investor looking to optimize your yield or an institutional investor seeking a secure, permissionless solution, Demex provides the tools you need to build the most effective DeFi strategies.

From lending, borrowing, and trading to accessing some of the best DeFi markets and earning auto-compounding returns, Demex is your playground for maximizing your yield and securing your financial future.

The TLDR

USDY Yieldcoin by Ondo Finance is a secure, yield-bearing stablecoin backed by US Treasuries, offering a unique opportunity to earn real yield. As the first Cosmos money market to offer USDY as collateral, Demex enables users to unlock new layers of income through advanced DeFi strategies. Ondo Finance issues and manages USDY, while Noble serves as the platform for its issuance. On Demex, users can lend USDY to unlock your capital, borrow USDG, and engage in margin trading or market making to maximize profits. Demex serves as the ultimate DeFi playground, combining yield and innovative trading strategies for optimal returns.