Crypto Market Bloodbath: Understanding the $500 Billion Wipeout and How to Profit on Demex

The crypto market has recently experienced one of its most severe sell-offs in nearly a year, with a staggering $500 billion wiped from its total market capitalization over just three days. This dramatic market crash, marked by a 10% drop in Bitcoin (BTC) and an 18% fall in Ether (ETH), has left many investors reeling. Understanding the dynamics behind this market upheaval and how traders can navigate and profit from such a volatile environment is crucial.

Current Market Situation

In early August, the crypto market faced its largest three-day decline since August 2023. The total market capitalization plummeted by $510 billion from August 2 to August 5. This massive sell-off aligns with a broader decline in equities, with the S&P 500 also falling 4.4% in the same period. Bitcoin and Ether saw significant price drops, with Bitcoin decreasing by 20% and Ether by 28% over the past week. Solana (SOL), a major Layer-1 network, was particularly hard-hit, falling 30.6% since July 30.

Why Is This Happening?

Several factors have contributed to this severe market downturn:

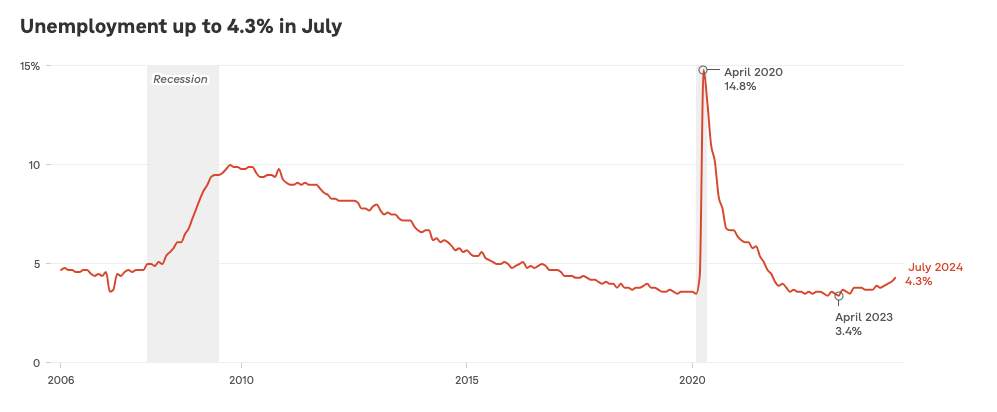

- Weak Employment Data: Recent US jobs reports showed weaker-than-expected growth, fueling fears of a potential economic slowdown or recession.

2. Yen Carry Trade Unwinding: A significant factor contributing to the recent market crash is the unwinding of the yen carry trade. Many traders borrowed in yen at low-interest rates to invest in higher-yielding assets, including cryptocurrencies. However, recent moves by the Bank of Japan (BOJ) and changing economic conditions have led to a rise in the yen's value. This caused traders to sell off their assets to repurchase yen to pay back their loans, creating a liquidation cascade. The reflexive dynamics of this situation are similar to those seen during the Terra unwind, highlighting the risks of hidden leverage in the system.

3. Tech Sector Struggles: Major technology companies, including Microsoft and Intel, reported disappointing second-quarter results. Nvidia, a key player in the tech space, faced negative reactions due to expectations of upcoming rate cuts, which have led to a shift in capital towards smaller, lagging companies.

4. Market Sentiment: The Crypto Fear & Greed Index, which gauges market sentiment, has dropped to its lowest level in 23 days, indicating a heightened state of fear among investors.

5. Institutional Selling: Data from Arkham Intelligence reveals that Jump Crypto, a significant trading firm, has recently offloaded hundreds of millions of dollars worth of assets, exacerbating the market decline.

Stimulants and Chain Reactions

The confluence of negative employment data, tech sector woes, and aggressive selling by institutional players created a perfect storm for the crypto market. The resulting chain reaction saw a widespread panic sell-off, as investors sought to cut losses amid rising fears of a prolonged downturn.

How to Profit in a Volatile Market with Demex

Despite the bearish trend, opportunities for profit still exist, particularly through strategic trading on Demex, a premier perpetual trading exchange. Here’s how you can take advantage of the current market conditions on Demex:

- Shorting Tokens: Demex offers perpetual contracts, or "perps," that allow you to short tokens. By taking short positions, you can profit from the decline in asset prices. This is especially advantageous in a market experiencing sharp downturns.

2. Leveraged Trades: With Demex's leverage options, you can amplify your gains from short trades. This means you can potentially earn more from falling markets, though it's important to manage your risk to avoid significant losses.

3. Fresh Market Listings: Demex provides fresh new market listings every week, featuring some of the hottest tokens in the market. This allows you to capitalize on emerging opportunities and potentially profit from volatility in new and trending assets.

4. Perpetual Pools: Another way to benefit on Demex is by participating in perpetual pools. By depositing assets into these pools, you can earn returns while being exposed to the dynamics of the perpetual markets. This can be a passive way to benefit from market movements without active trading.

5. Technical Analysis Tools: Demex offers a range of technical analysis tools to help you make informed trading decisions. Utilize these tools to identify key levels, trends, and potential entry and exit points for your trades.

6. Staying Ahead of the Curve: With Demex's constant updates and new market offerings, you can stay ahead of market trends and position yourself strategically to benefit from both rising and falling markets.

The TLDR

The recent $500 billion wipeout in the crypto market, triggered by a global market crash and heightened volatility, underscores the significant risks and opportunities in trading today. This market downturn, marked by a sharp decline in major assets like Bitcoin and Ether, highlights the volatility that traders face. Despite the challenges, there are ways to profit and protect your portfolio through strategic trading on Demex. Utilize Demex's perpetual contracts and advanced analysis tools to navigate this turbulent environment. Whether you're an institution or a retail trader, leveraging tools for shorting and leverage can help you turn market volatility into potential profit. Stay informed and use Demex’s comprehensive offerings to manage risks and capitalize on market movements effectively.