Ethena Labs (ENA): Redefining DeFi with Yielding Stablecoin USDe

Ethena Labs, a rising star in the decentralized finance (DeFi) arena, has taken a significant step towards community-driven governance with the recent airdrop of its native token, ENA. This strategic move distributes 750 million ENA tokens, constituting 5% of the total supply, directly to the hands of its user base. This article delves into the innovative world of Ethena Labs, explores the unique features of its USDe stablecoin, and analyzes the implications of the ENA airdrop for the future of the protocol.

Ethena Labs: Redefining Stablecoins with Native Yield

The stablecoin market is a crowded landscape, with established players like Tether (USDT), USD Coin (USDC), and DAI dominating the scene. However, Ethena Labs has carved a distinct niche by introducing a revolutionary concept – a stablecoin that offers a native yield directly to its holders. Their brainchild, USDe, boasts a compelling 35% APY (Annual Percentage Yield), making it an attractive option for yield-hungry investors seeking a stable asset with passive income generation capabilities.

Understanding USDe: The Mechanism Behind the Yield

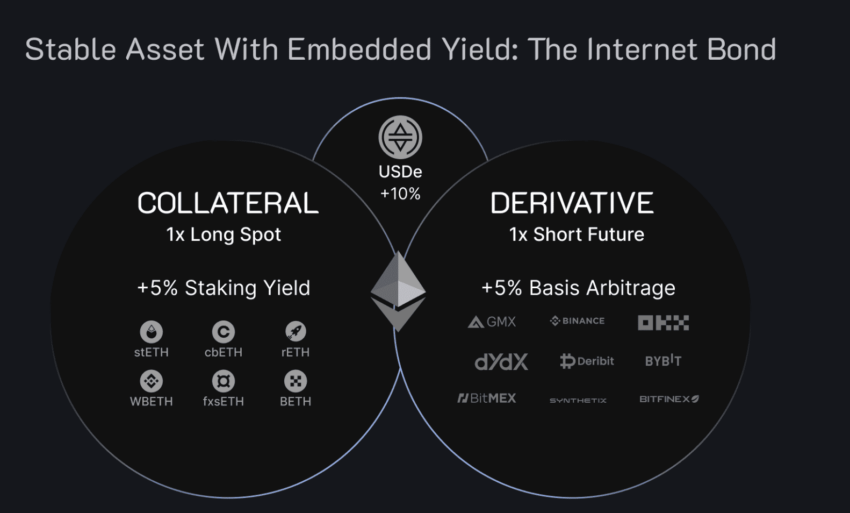

Unlike traditional stablecoins pegged to fiat currencies like the US dollar, USDe leverages a sophisticated combination of financial instruments to maintain a target price of $1 while offering its holders a significant yield. Here's a breakdown of the mechanism:

Staked ETH and ETH Holdings

A portion of USDe is backed by staked Ethereum (ETH), a process that generates rewards for token holders. This staking process contributes to the stability of the USDe peg.

Short ETH Hedges

To maintain the peg close to $1, Ethena Labs employs short ETH positions on cryptocurrency exchanges. This means they essentially borrow ETH and sell it at the current market price, with the expectation of repurchasing it later at a lower price to close the position and capture the difference. This hedging strategy helps mitigate price fluctuations and ensures USDe stays close to its target price.

Rapid Growth and Market Recognition for USDe

Ethena Labs' innovative approach has resulted in impressive growth for USDe. Launched just recently, the stablecoin has already surpassed a $1.4 billion market capitalization, a testament to its growing user base and adoption. This rapid rise can be attributed to several factors:

Competitive Yield

The 35% APY offered by USDe is significantly higher than the interest rates offered by traditional savings accounts or even other DeFi protocols. This high yield makes USDe an attractive option for investors seeking passive income opportunities.

Backing by Prominent Investors and Exchanges

Ethena Labs has secured the backing of well-respected investors and leading cryptocurrency exchanges like Binance, Bybit, and OKX. This strong backing instills confidence in the project and contributes to its legitimacy.

Anticipation of the ENA Airdrop

The upcoming airdrop of the ENA governance token further fueled interest in the Ethena ecosystem. Users saw the airdrop as an opportunity to participate in the growth of the protocol and potentially gain significant value.

The Shard Campaign: Engaging the Community Before the ENA Airdrop

In the lead-up to the ENA airdrop, Ethena Labs launched a unique initiative called the "Shard" campaign. This campaign aimed to incentivize user participation and engagement within the Ethena ecosystem. It's important to note that the term "shard" used here is not related to blockchain sharding technology. Instead, it represented points earned by users for actively contributing to the platform.

Here are some of the activities that allowed users to earn Shards:

Providing Liquidity

Users who provided liquidity to USDe pools on decentralized exchanges were rewarded with Shards. This incentivized users to contribute to the smooth functioning of the USDe market.

Staking USDe

Staking USDe tokens also earned users Shards. This encouraged users to hold onto their USDe tokens and participate in the long-term growth of the protocol.

Social Media Engagement

Participating in social media campaigns promoting Ethena Labs and USDe also contributed to earning Shards. This strategy helped spread awareness about the project and build a strong community.

The Shard campaign proved to be a resounding success, with over 100,000 users actively participating. This high level of engagement highlights the strong interest in the Ethena ecosystem and its potential for future growth.

The ENA Token: Shaping the Future of Ethena Labs

The airdrop of the ENA token marks a pivotal moment in the evolution of Ethena Labs. ENA is a governance token that grants holders the power to vote on crucial proposals that will shape the future direction of the Ethena protocol. These proposals can encompass a wide range of topics, including:

Fee Structure

ENA token holders can vote on the fees associated with various activities within the Ethena ecosystem, such as swapping tokens, adding liquidity, and staking USDe. This allows the community to have a say in how the protocol generates revenue and distributes it.

Protocol Upgrades

The future development roadmap for Ethena Labs will likely involve introducing new features and functionalities. ENA token holders will have the opportunity to vote on proposed upgrades, ensuring that the protocol evolves in a way that aligns with the community's needs and interests.

Strategic Partnerships

Ethena Labs may consider collaborating with other DeFi projects or blockchain platforms to expand its reach and utility. ENA token holders will have the right to vote on potential partnerships, ensuring that such collaborations are strategically beneficial for the long-term growth of the protocol.

The introduction of ENA signifies a shift towards a more decentralized governance model for Ethena Labs. By empowering the community through voting rights, Ethena fosters a sense of ownership and incentivizes active participation in the protocol's development. This approach fosters long-term sustainability and aligns the project's direction with the collective vision of its user base.

Looking Ahead: Ambitious Goals and a Bright Future for Ethena Labs

Ethena Labs has set an ambitious target for its Shard campaign, aiming to propel the USDe market capitalization to a staggering $10 billion. This represents a significant increase from its current level and signifies the project's long-term aspirations. Achieving this goal hinges on several key factors:

Widespread Adoption of USDe

For USDe to reach a $10 billion market cap, it needs to be adopted by a much larger user base. This can be achieved by continuously improving the platform's usability, expanding its integration with other DeFi applications, and potentially exploring new use cases for USDe beyond its current yield-generating capabilities.

Maintaining Competitive Yield

The 35% APY offered by USDe is a major draw for investors. However, the DeFi landscape is highly competitive, and other stablecoin offerings may emerge with even higher yields. Ethena Labs will need to maintain a competitive yield structure while ensuring the long-term sustainability of the USDe peg.

Continued Innovation

The DeFi space is constantly evolving, and Ethena Labs must remain at the forefront of innovation. Introducing new features, exploring interoperability with other blockchains, and staying adaptable to market trends will be crucial for maintaining user interest and driving long-term growth.

The TLDR

Ethena Labs has carved a unique niche in the DeFi arena with its innovative USDe stablecoin offering a native yield. The recent airdrop of the ENA governance token marks a significant step towards community-driven governance, allowing users to actively participate in shaping the future of the protocol.