Master Funding Rate Arbitrage Strategies

Embarking on the journey of mastering the Funding Rate Arbitrage strategy offers traders a compelling pathway to navigate the dynamic realm of cryptocurrency trading. This guide, centered on the decentralized exchange Demex, provides a strategic roadmap for capitalizing on the interest rate differentials between centralized and decentralized exchanges. Funding Rate Arbitrage has gained popularity for its ability to unlock lucrative opportunities, allowing traders to navigate the crypto landscape with precision and enhance the potential for consistent profitability.

Decoding Funding Rates and Arbitrage

Funding Rates

Funding Rates are the heartbeat of perpetual swaps, ensuring periodic payments between long and short positions to maintain contract prices in proximity to the spot price. Contrary to a common misconception, these rates are not paid to the exchange but exchanged between users on opposite sides of the trade.

Positive funding rates signify that long positions pay funding fees to short positions. In contrast, when funding rates are negative, short positions pay funding fees to long positions.

Arbitrage

In the realm of crypto trading, arbitrage is a strategy that exploits price differences of the same asset on different exchanges. Funding Rate Arbitrage, in particular, revolves around capitalizing on the interest rate differential between various centralized exchanges (CEXs) or between a CEX and a decentralized exchange (DEX) like Demex.

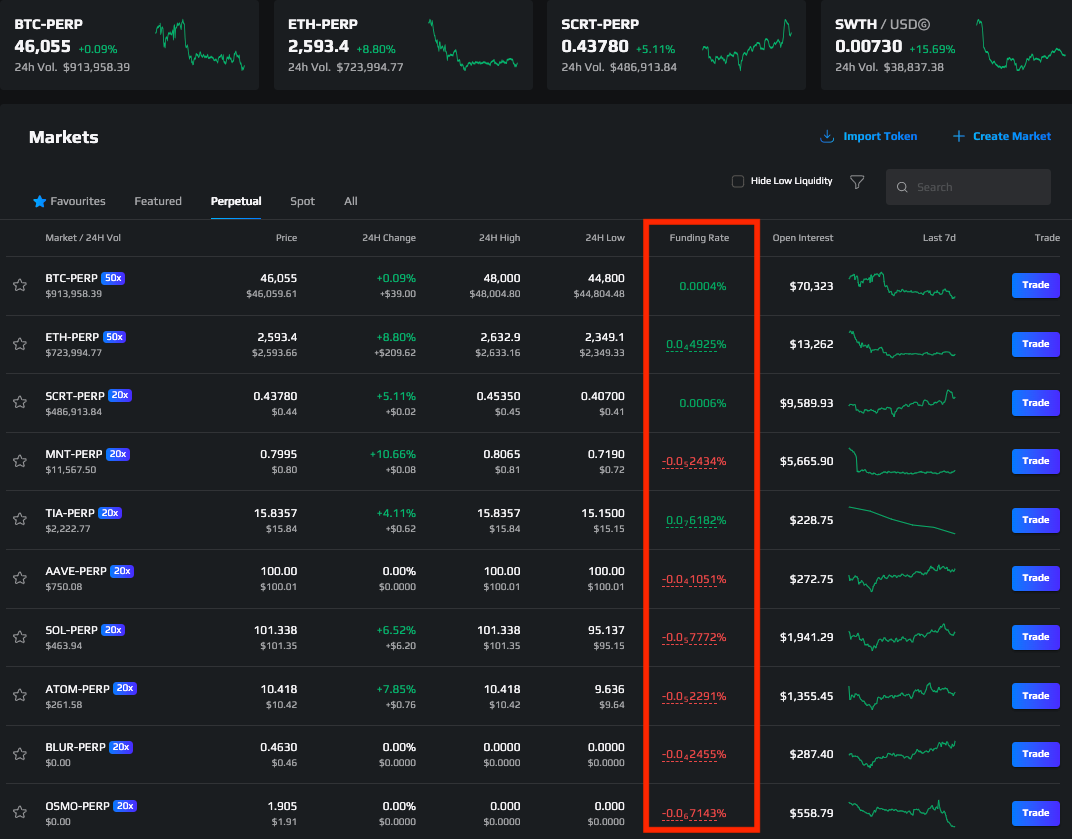

Understanding Funding Rates on Demex

Demex, as a perp DEX, introduces unique dynamics to funding rates. The interplay between user behavior, liquidity, and market conditions shapes the landscape for potential arbitrage opportunities. These funding rates, exclusive to Demex, become the linchpin for strategic trading.

Strategies for Funding Rate Arbitrage on Demex

Identifying Opportunities: A Key Step in the Strategy

The crux of the Funding Rate Arbitrage strategy lies in identifying opportunities. Regularly monitoring funding rates within Demex and strategically comparing them with selected centralized exchanges is essential. The goal is to pinpoint instances where the funding rates on Demex differ significantly from those on centralized platforms.

Executing Trades on Demex: The Delta-Neutral Approach

Executing positions on Demex while simultaneously engaging in the opposite trade on a different exchange is fundamental. This delta-neutral approach enables traders to capitalize on the funding rate gap between CEX and DEX, irrespective of market direction. The arbitrage play unfolds as traders exploit the differential funding rates to their advantage.

Mastering the Subtle Art of Funding Rate Arbitrage:

— xulian (@KingJulianIAm) June 30, 2023

Exploiting the Funding Rate Discrepancies Between CEXs and DEXs.

🧵🫧 pic.twitter.com/wvAD3cu8XA

Enhancing Returns with Money Markets on Demex

Demex introduces the potential to leverage Decentralized Finance (DeFi) strategies, contributing to the overall returns of the Funding Rate Arbitrage strategy. By depositing spot holdings on Nitron, Demex’s money markets, traders can earn lending APY, aligning with the strategy's overarching goal.

Risk Management on Demex

Monitoring Funding Rates on Demex

A vigilant approach to risk management involves regular assessment of funding rates, exclusively on Demex and selected centralized exchanges. By strategically adjusting positions, traders can optimize returns and navigate the intricacies of the Funding Rate Arbitrage landscape.

Setting Stop-Loss and Take-Profit Triggers

Mitigating risks on Demex requires setting predetermined triggers for stopping losses and taking profits. This strategic approach helps limit market exposure and ensures a disciplined execution of the Funding Rate Arbitrage strategy within the decentralized perpetual futures exchange.

Walkthrough Example with BTC-PERP on Demex

Preliminary Research on Demex

1. Understand Demex's interfaces, fee structures, and funding rate mechanisms.

2. Investigate historical funding rate performance on both Demex and selected centralized exchanges.

Monitoring Funding Rates on Demex

1. Regularly monitor rates exclusively on Demex.

In this case, you can see that longs are paying shorts 210% funding rate over 1 year. 2. Compare them with the funding rates on the chosen centralized exchange.

Executing Short Position on Demex

1. Open a short position on the BTC-PERP market within the Demex platform.

Leveraging a Money Market on Demex

1. Simultaneously deposit the equivalent amount into a chosen money market within Demex.

Calculating Profit on Demex

1. Regularly check the funding rate on Demex to assess profits, emphasizing the differential between the CEX and DEX rates.

Managing Risks on Demex

1. Create Limit Orders with a “Take Profit & Stop Loss” trigger to minimize your losses.

2. Keep a vigilant eye on Bitcoin market conditions and the ongoing funding rate dynamics.

Closing the Position on Demex

1. Close your position, ensuring a strategic exit from the arbitrage play.

Leveraging CEX-DEX Dynamics on Demex

The unique advantage of executing a Funding Rate Arbitrage strategy on Demex lies in the interplay between centralized and decentralized exchanges. While CEX platforms may offer liquidity, Demex introduces transparency, security, and flexibility, creating a unique environment for strategic trading.

Risks to Consider on Demex

As with any trading strategy, Funding Rate Arbitrage involves risks. Market volatility, liquidity challenges, and potential smart contract vulnerabilities should be thoroughly assessed within the Demex platform before engaging in this strategy.

The TLDR

Mastering the intricacies of Funding Rate Arbitrage on Demex is a strategic journey demanding precision, thorough research, and vigilant monitoring within the dynamic cryptocurrency trading landscape. Whether you're an experienced trader or venturing into the crypto market, the key takeaway is clear: Aligning your trading strategies with the nuanced dynamics of CEX-DEX interactions on Demex holds the potential for consistent and profitable outcomes.