Mastering Money Markets: A Trader's Guide

Money markets offer traders valuable opportunities by providing liquidity and leverage. Traders can access additional funds by borrowing assets from money markets, enabling them to increase their position sizes and capitalize on market movements.

Crypto trading is all about seizing opportunities in the fast-paced world of digital currencies. To succeed, traders need access to liquidity – the lifeblood of the crypto market. That's where money markets come in handy.

Money markets in the crypto sphere provide traders with a straightforward way to both borrow and lend funds, and they're proving to be invaluable tools for traders.

Spot Trading Strategies

Using a money market to trade on a spot market involves borrowing an asset at a lower cost (interest rate) and then trading that borrowed asset on a spot market to potentially profit from price differences. Let’s break this down:

Strategy 1: Using a money markets to trade on spot

This strategy entails traders to borrow liqudity and gain off the price movements off the underlying asset on the spot market.

Step 1: Deposit your collateral on a money market

To borrow assets from the money market, you'll typically need to deposit collateral. The amount you can borrow against your collateral is dependent on the LTV (loan-to-value) parameters enabled on the asset.

For example, if you want to deposit $1,000 of ETH, and the LTV is set as 80%, you can borrow $800 (80% of $1,000) worth of assets. The LTV differs for each asset with its own unique parameters depending on the token’s price, market cap, volatility, and supply and borrow trends.

Step 2: Borrow desired assets

Once your collateral is deposited, you can borrow the desired asset from the money market. The amount you can borrow depends on the value of your collateral at the time, the asset’s LTV, and the protocol’s borrow supply. You'll also pay an interest rate on the borrowed amount.

Step 3: Transfer borrowed assets to a spot exchange

After borrowing the asset, transfer it from the money market platform to a cryptocurrency exchange that supports spot trading of that asset.

Step 4: Execute spot trades

On the cryptocurrency exchange, use the borrowed asset to execute spot trades. You can buy and sell the asset as you would with any other trading pair. Your goal is to take advantage of price movements to profit.

Step 5: Repay your loan

Keep a close eye on your borrowed amount's value and the interest rate. When you're ready to close your position or when you've achieved your trading objectives, sell the assets you've acquired through spot trading to repay the loan and the accrued interest to the money market.

Step 6: Retrieve your collateral

After repaying the loan, you can retrieve your collateral from the money market platform. This typically involves returning the borrowed assets, which should now be possible thanks to your spot trading profits.

Step 7: Assess profit or loss

Calculate your profit or loss by subtracting the total interest paid and any transaction fees from the profits earned through spot trading. If you've made a net profit, you've successfully used the money market to trade on the spot market at a lower cost!

Manage your risk

It's important to note that while using money markets to trade on the spot market can provide opportunities for leveraging and profiting from price differences, it also carries risks. Prices in the cryptocurrency market can be highly volatile, and borrowing assets on a money market involves interest costs that can eat into profits or exacerbate losses if the market moves against your position. Therefore, it's crucial to have a well-thought-out trading strategy and risk management plan before engaging in such activities.

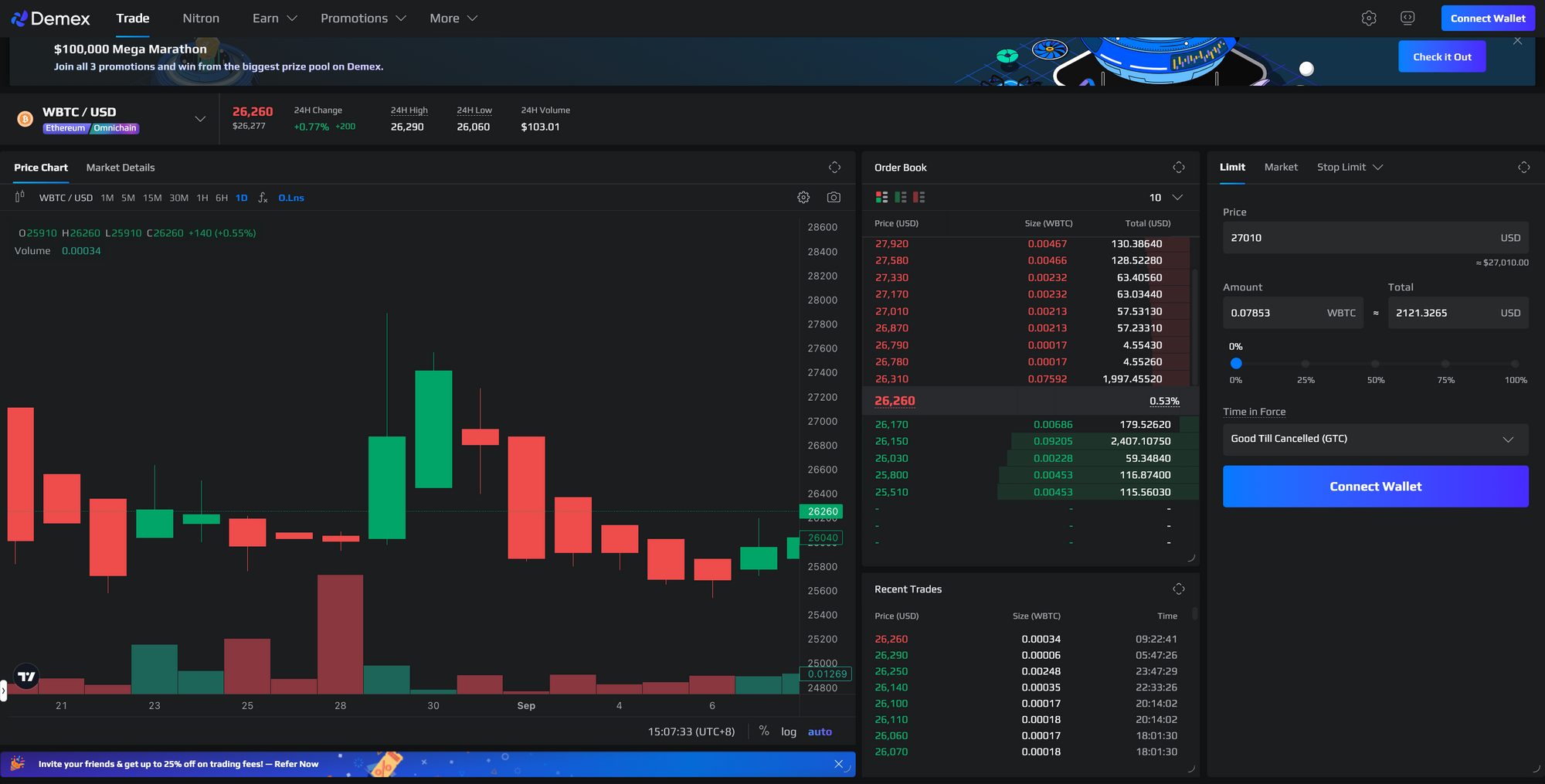

Trade Spot on Demex

Looking for a superior spot exchange? Look no further we got you covered. With Demex's various order types and orderbook format, you are locked and loading with the trading pools to make the trade of a lifetime.

Perp Trading Strategies

Strategy 1: Using a Money Market for Perpetual Market Trading with HODLed Assets

This strategy enables you to trade on a perpetual market without selling your HODLed assets by borrowing stablecoin liquidity from a money market. This way, you can engage in trading perpetual contracts settled in stablecoins while still benefiting from potential long-term asset appreciation.

Step 1: Deposit collateral on a money market

Deposit your assets into the money market platform as collateral. These assets will be used to secure your borrowed stablecoins. The platform will specify the required collateral amount.

Step 2: Borrow Stablecoins

Use your assets as collateral to borrow stablecoins (e.g., USDT, USDC, DAI) from the money market. The amount you can borrow depends on the value of your collateral and the LTV, similar to how we discussed above in the spot strategy.

Ensure you borrow the right asset according to the stablecoin that the selected perpetual market is settled in. This stablecoin liquidity will be used for trading on the perpetual market.

Step 3: Transfer stablecoins to a perpetual exchange

Transfer the borrowed stablecoins from the money market to a perpetual exchange that offers perpetual contracts settled in stablecoins.

Step 4: Execute perpetual market trades

Use the borrowed stablecoins to trade on the perpetual market as you would with any other trading pair. You can take long or short positions based on your market analysis and trading strategy.

Step 5: Repay your loan

Monitor your trading performance and keep track of the borrowed stablecoins. When you're ready to close your positions or when you've achieved your trading objectives, close your position, and use your profits to repay the stablecoin loan plus accrued interest.

Step 6: Retrieve your collateral

Once the stablecoin loan is repaid, you can retrieve your assets from the money market platform. This effectively means you've used your HODLed assets as collateral to access leverage for perpetual trading without selling them.

Step 7: Assess Profit or Loss

- Calculate your profit or loss by subtracting the total interest paid and any transaction fees from the profits earned through perpetual trading. If you've made a net profit, you've successfully used the money market to engage in perpetual trading without selling your assets.

Strategy 2: Using a Money Market for Hedging Perpetual Market Trades

This strategy involves using the money market to hedge your positions in the perpetual market to mitigate potential losses in volatile markets.

Step 1: Deposit Collateral on Money Market

Select a money market platform and deposit collateral assets (e.g., stablecoins or cryptocurrencies) that you are willing to use for hedging.

Step 2: Borrow Stablecoins

Borrow stablecoins from the money market using your deposited collateral. The borrowed stablecoins will serve as your hedge.

Step 3: Transfer Stablecoins to Perpetual Market Exchange

Transfer the borrowed stablecoins to the perpetual market exchange where you have open positions or intend to open positions.

Step 4: Use Stablecoins to Hedge

Use the borrowed stablecoins to open positions on the perpetual market that offset your existing positions. For example, if you have a long position, you can open a short position of equal size using borrowed stablecoins to hedge against potential losses.

Step 5: Monitor and Adjust

Continuously monitor the performance of your hedged positions in the perpetual market. If your original position is profitable, you may incur losses on the hedged position, and vice versa. Adjust your positions as needed to manage risk effectively.

Step 6: Repay the Stablecoin Loan

Once you've completed your hedging activities and achieved your risk management objectives, use your profits or other funds to repay the stablecoin loan and any accrued interest to the money market.

Step 7: Retrieve Collateral

Retrieve your collateral assets from the money market platform.

Step 8: Assess Overall Profit or Loss

Calculate your overall profit or loss by considering the gains or losses in the perpetual market and the costs associated with the stablecoin loan. This strategy allows you to manage risk and protect your positions in the volatile perpetual market effectively.

Manage your Risk

Both of these strategies provide traders with additional tools and flexibility for navigating the cryptocurrency market, allowing them to participate in perpetual trading while preserving their long-term holdings or effectively hedging their positions to reduce risk. However, it's crucial to thoroughly understand the risks associated with both strategies and have a well-defined trading plan in place.

Trade Perps on Demex

We've got you covered with the most powerful cross-chain perp DEX right here. We got lite mode and pro mode for all our perp lovers, are you ready to trade? We offer upto 50x leverage on selected perps! 👀

Demex and Nitron - A Trader's Dream

Just like peanut butter and jelly come together to create a classic and harmonious combination, Demex and Nitron offer crypto traders a seamless and powerful synergy. Demex, a powerful cross-chain DEX that boasts both spot and perpetual markets, seamlessly integrates with Nitron, its own built-in money market. This unique pairing empowers traders to execute all the strategies we've discussed without the hassle of bridging assets between multiple projects or worrying about gas fees. Execute all of the above strategies on one platform!

Think of it like having all your trading tools neatly organized in one toolbox. Whether you're looking to trade on spot markets, leverage your positions on perpetual markets, borrow stablecoins against your HODLed assets, or hedge your positions – Demex and Nitron work hand in hand to make it all possible within a single ecosystem.

Demex and Nitron unite to provide traders with a smooth and efficient trading experience. With a user-friendly interface and a wide range of supported assets, Demex ensures that traders can easily transition between spot and perpetual markets, all while utilizing the borrowing and lending capabilities of Nitron. This is why we confidently say Demex is truly the only DEX you need!

The TLDR

Money markets offer traders valuable opportunities by providing liquidity and leverage. Traders can access additional funds by borrowing assets from money markets, enabling them to increase their position sizes and capitalize on market movements. This liquidity and leverage are essential tools for traders seeking to optimize their strategies and enhance their trading results.