The Allure of Small Market Cap Coins

The allure of small market cap coins in the cryptocurrency market has captured the attention of investors and traders alike. These micro-cap cryptocurrencies present a unique landscape, offering both opportunities for high growth and quick returns. This article aims to delve into the reasons behind the growing interest in small market cap coins, examining their potential, associated risks, and the psychological factors that contribute to their appeal.

The Appeal: Potential for High Growth and Quick Returns

1. High Growth Potential

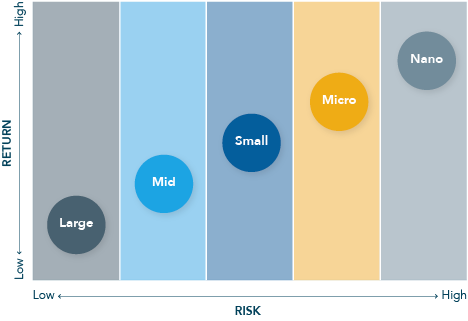

Small market cap coins, often referred to as low cap or micro cap cryptocurrencies, entice investors with the promise of significant growth. These coins are typically in their early developmental stages, providing investors with the chance to engage from the ground level. The potential for substantial price appreciation becomes a driving force if the underlying technology and use case gain traction in the market.

2. Quick Returns

Investors are drawn to the prospect of quick returns offered by small market cap coins. The early stages of these cryptocurrencies often mean that price movements can be more pronounced, offering a pathway to swift and substantial returns on investment.

Understanding the Risks: Volatility, Liquidity, and Fraud

1. Volatility

The very characteristics that make small market cap coins appealing—early development and potential for high growth—also make them highly volatile. Abrupt and large price fluctuations are not uncommon, posing a considerable risk to investors. It is imperative for investors to be aware of the inherent volatility and carefully consider their risk tolerance.

2. Limited Liquidity

Unlike top-tier cryptocurrencies such as Bitcoin and Ethereum, small market cap coins often suffer from limited liquidity. This lack of liquidity can exacerbate price swings, making it challenging for investors to enter or exit positions without impacting the market.

3. Risk of Fraud

The nascent nature of small market cap coins makes them susceptible to fraudulent activities. With smaller communities and less experienced development teams, these coins may lack the safeguards established by more established projects. Investors must exercise caution and conduct thorough due diligence to mitigate the risk of falling victim to scams or fraudulent schemes.

Psychological Dynamics of Small Market Cap Coin Trading

1. Illusion of Control and Gambling Parallels

The unique nature of small market cap coin trading introduces several risk factors, making it distinct and potentially addictive. The illusion of control, comparable to gambling, involves a subjective overestimation of one's ability to control outcomes. This illusion is fueled by biased attributions, hindsight bias, and the hot-hand fallacy, especially during favorable market conditions.

2. Social Learning and Reinforcement

Social learning and reinforcement play a crucial role in small market cap coin trading, with a strong social media culture featuring crypto advisors and influencers. This creates a culture of mutual social reinforcement, where individuals share successes and read about gains scored by others.

3. Preoccupation or Salience

Preoccupation or salience, a recognized feature in addiction models, is prevalent in small market cap coin trading. Continuous monitoring of price movements, news, and online media about coins can lead to difficulty disengaging from the activity.

4. Fear of Missing Out (FOMO) and Anticipated Regret

FOMO, a psychological factor influencing small market cap coin trading, is intensified due to the vast array of coins and constant market activity. Traders may experience regret for both acts of commission (selling too early) and omission (missing potentially successful investments). Anticipated regret, a cognitive factor, plays a significant role in decision-making, leading to stronger feelings of regret compared to other forms of gambling.

Protective Factors and Strategies

To mitigate the risks associated with small market cap coin trading, individuals are advised to adhere to budgets, avoid spending beyond their means, and dispel erroneous beliefs regarding predictability and control. Satisficing, or discouraging the pursuit of optimal decision-making, is recommended to reduce impulsive decisions during market fluctuations.

The TLDR

The allure of small market cap coins lies in the potential for high growth and quick returns. However, this appeal is accompanied by inherent risks, including volatility, limited liquidity, and the potential for fraudulent activities. Investors interested in exploring opportunities in the small market cap cryptocurrency space must understand the psychology behind this attraction, conduct comprehensive research, and exercise caution. Small market cap coins can offer significant opportunities, but a well-informed and strategic approach is essential to navigate the associated risks successfully.