TIA Strategies on Demex and Nitron

Farm airdrops, accumulate Demex Points and earn Carbon Credits using stTIA and milkTIA alone!

The year 2024 began with a bang, and there's a hint of a potential bull market. It has quickly shaped up to be the year of Celestia, witnessing a substantial surge in interest and traction for the entire Celestia Ecosystem. The Celestia chain has seen notable developments, introducing new roll-ups, wallets, bridges, liquid staking providers, and enhanced infrastructure.

Demex is deeply ingrained in the Celestia narrative and is currently even hosting the Celestia Trading League. This article delves into how Demex stands out as the quintessential all-in-one DeFi platform, providing an optimal environment to maximize the potential of TIA.

Partnership with Milkyway

Milkyway, the inaugural liquid staking provider on the Celestia Network, introduced its first liquid staking derivative - milkTIA. Representing the value accruing token of staked TIA, Nitron joined forces with Milkyway to list milkTIA as collateral, unlocking expanded DeFi opportunities for minters, or as colloquially referred to, "milkers."

🌌 great news, milkers @milky_way_zone

— Demex (@demexchange) January 10, 2024

Nitron is the first money market to list $milkTIA as collateral 🔥

✨this week's exclusive✨ on top of staking APY, earn up to 40,064 extra SWTH rewards by lending $milkTIA!

🥛 deposit milkTIA now to score $DMX airdrop:… pic.twitter.com/PG2b79uCOo

The demand for milkTIA on Nitron has skyrocketed, prompting a threefold increase in the cap since its launch. Even with this surge, the appetite for milkTIA continues to grow.

To sweeten the deal, Milkyway introduced the mPoints system, allowing users to actively and retroactively earn points by staking milkTIA and engaging in DeFi activities. Demex has earned its place on the whitelist as a participating partner in the mPoints system. This means milkTIA users who have lent milkTIA on Nitron can accumulate and continue earning points, leading up to the eagerly anticipated MassDrop event. Users will earn $MILK tokens based on their mPoints during the Massdrop.

Partnership with Stride

Stride, a familiar name to Demex and a leading Cosmos liquid staking provider, has found a home and steady growth on Nitron. From stATOM to stOSMO to stDYDX and now stTIA, Stride has brought various liquid staked derivatives to Nitron.

Announcing the launch of stTIA 🎉

— Stride 🦸 (@stride_zone) February 1, 2024

stTIA is @CelestiaOrg's most neutral & secure LST — stTIA is modular money 🧱

In an unprecedented move, 5M STRD (5% of max supply) being airdropped to early stTIA holders.

Details 🧵 pic.twitter.com/61Gxw1ct34

We are working hard with Stride to make lenders on Nitron eligible for the STRD airdrop as well.

Top TIA Strategies

1. Compete in the Celestia Trading League

- Lend and collateralize stTIA/milkTIA.

- Borrow USDⒼ.

- Register in the Celestia Trading League.

- Start trading perpetual markets to earn Demex Points.

- Compete and climb the leaderboard to win from a prize pool of 150 milkTIA.

liquid-stake ↪ DeFi ↪ earn rewards + Demex Points = max capital efficiency 🙌🏻

— Demex (@demexchange) January 26, 2024

1️⃣ lend stSTARS or milkTIA to earn extra SWTH incentives on top of staking APY: https://t.co/SAWFxMw62i

2️⃣ borrow USDⒼ to earn extra $SWTH incentives: https://t.co/IJMP4q0Cl7

3️⃣ participate in the… pic.twitter.com/0h7VUtOdK5

2. Accumulate Demex Points

- Lend stTIA/milkTIA on Nitron and engage in DeFi activities to accumulate Demex Points.

- View your Demex Points here in the future.

3. Earn Carbon Credits

- Lend and collateralize stTIA/milkTIA on Nitron.

- Borrow USD.

- Engage in perpetual trading.

- Earn carbon credits for every dollar generated in trading fees.

- These carbon credits are rewarded in SWTH tokens and can be utilized to offset your trading fees.

big news 🫣

— Demex (@demexchange) February 7, 2024

we are thrilled to announce the launch of Carbon Credits, an initiative designed to reward traders who contribute to the success of Demex 🌱

starting on Feb 13 at 8am UTC, season 1 will kick off, bringing exciting opportunities for our trading community 🔥 pic.twitter.com/Eg5iaeoPdP

4. Farm mPoints and farm the upcoming MILK Airdrop

- Lend and collateralize milkTIA on Nitron.

- Check your mPoints here, earned for your participation in DeFi activities on Demex.

5. Farm the STRD Airdrop

- Lend and collateralize stTIA on Nitron.

- By holding stTIA, you'll receive a daily allocation of STRD proportional to your percentage of the total eligible stTIA supply. Claim your fully liquid STRD six months after the allocation.

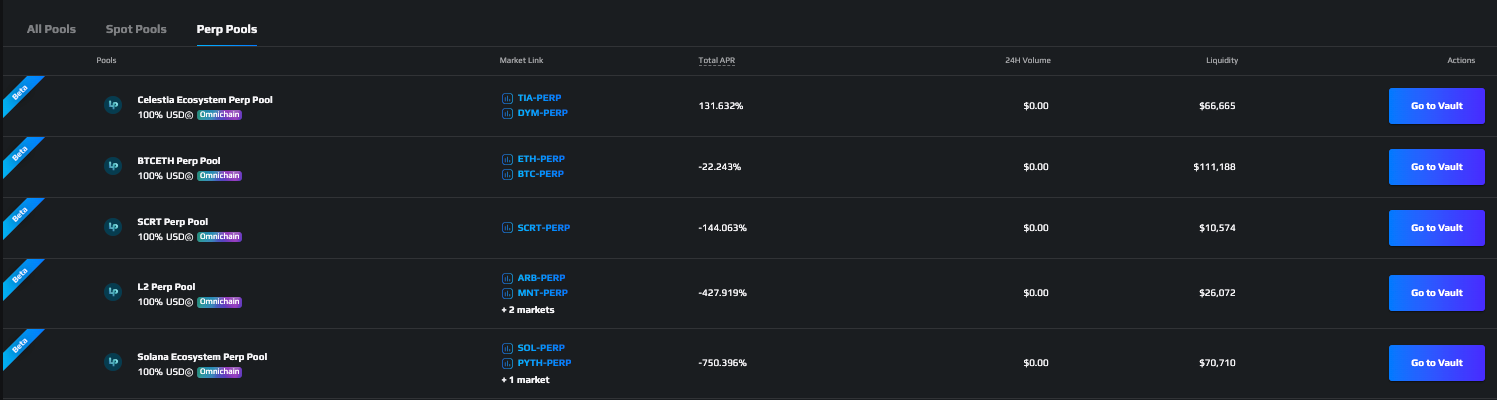

6. Farm the upcoming FLUO Airdrop

- Lend and collateralize stTIA/milkTIA on Nitron.

- Borrow USDⒼ.

- Deposit it in any of Demex’s Perpetual Pools powered by Fluo Finance.

- Farm the speculated FLUO airdrop.

The TLDR

In 2024, Celestia gains momentum, drawing interest to the Celestia Ecosystem. Demex, deeply involved, hosts the Celestia Trading League and serves as a comprehensive DeFi platform for TIA optimization. Strategic partnerships with Milkyway and Stride introduce derivatives, like milkTIA and stTIA, expanding opportunities. The surge in milkTIA demand on Nitron, combined with Milkyway's mPoints system, positions Demex as a major player. Ongoing collaborations with Stride aim to make Nitron lenders eligible for the STRD airdrop, while top TIA strategies highlight multifaceted DeFi engagement.