Donald Trump Assassination Attempt: Crypto Market Surge and Election Odds Explained

The attempted assassination of former President Donald Trump has sparked widespread repercussions in financial and political circles, significantly impacting the cryptocurrency market. This incident has triggered notable fluctuations in various cryptocurrencies, particularly those linked to Trump, alongside Bitcoin. This article delves into the details of the event, its implications for the cryptocurrency market, and its broader implications for the political landscape of the United States.

Who is Donald Trump?

Donald Trump, a businessman and television personality turned politician, served as the 45th President of the United States from 2017 to 2021. Known for his controversial and polarizing style, Trump has been a significant figure in American politics. His policies and statements have often influenced various markets, including cryptocurrencies.

As the 2024 US presidential election approaches, Trump has remained a dominant figure in the political arena. His influence extends beyond traditional markets and into the cryptocurrency space, where his statements and actions can cause significant volatility. Understanding who Donald Trump is and his impact on various sectors is crucial to comprehending the broader effects of recent events.

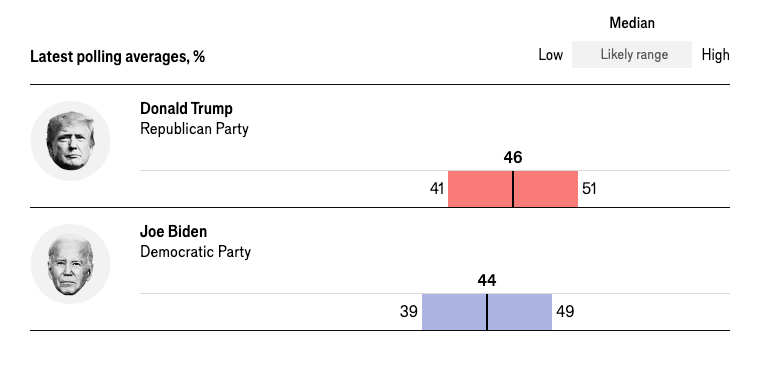

The Current State of the US Presidential Election

The 2024 US presidential election is shaping up to be one of the most contentious in recent history. Donald Trump and President Joe Biden are set to face off once again, with both candidates presenting starkly different visions for the country's future. The political climate is highly charged, with significant implications for both domestic and international policies.

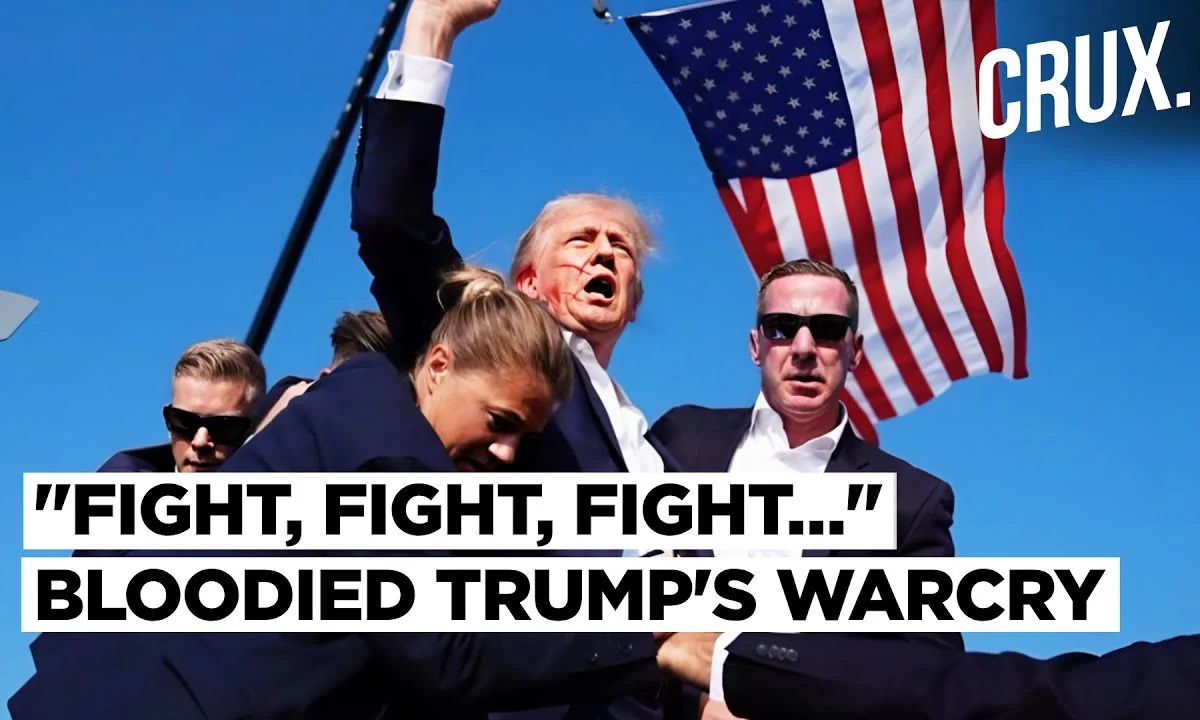

About the Event

On July 13, 2024, during a rally in Butler, Pennsylvania, Donald Trump was the target of an assassination attempt. Trump was addressing his supporters when gunfire erupted, causing panic among the crowd. Trump quickly dropped to the ground as Secret Service agents rushed to protect him. Remarkably, amidst the chaos, Trump stood up, blood streaking his face, and defiantly raised his fist.

Although shaken, Trump was reported to be fine and received medical treatment at a local facility. The assailant, identified as 20-year-old Thomas Matthew Crooks, was shot down by a Secret Service sniper.

Immediate Reactions

The immediate aftermath of the assassination attempt saw a flurry of activity across various sectors. News outlets scrambled to cover the event, while social media platforms were inundated with real-time updates and reactions. The incident not only impacted the political landscape but also had significant repercussions on the financial markets, particularly the cryptocurrency sector.

The Impact on Trump-Themed Coins

The assassination attempt had a profound impact on Trump-themed memecoins, which saw dramatic price movements in the wake of the incident. These memecoins, often considered speculative investments, reacted swiftly to the news.

MAGA (TRUMP) Coin

Following the assassination attempt, the largest Trump-themed memecoin, MAGA (TRUMP), experienced a substantial surge in value. The coin's price jumped from $6.31 to $10.36, marking a 30% increase. This rapid price movement resulted in a significant boost in the coin's market capitalization, which rose from $293 million to $469 million in less than 45 minutes.

Other Trump-Themed Coins

Several other Trump-themed coins also saw notable gains:

- Tremp (TREMP), a Solana-based memecoin, surged more than 63% in the hour following the news.

- MAGA Hat (MAGA), another memecoin, briefly spiked 21% within the same timeframe.

These price movements highlight the speculative nature of memecoins and their susceptibility to political events. The assassination attempt created a perfect storm for these assets, driving speculative trading and significant price volatility.

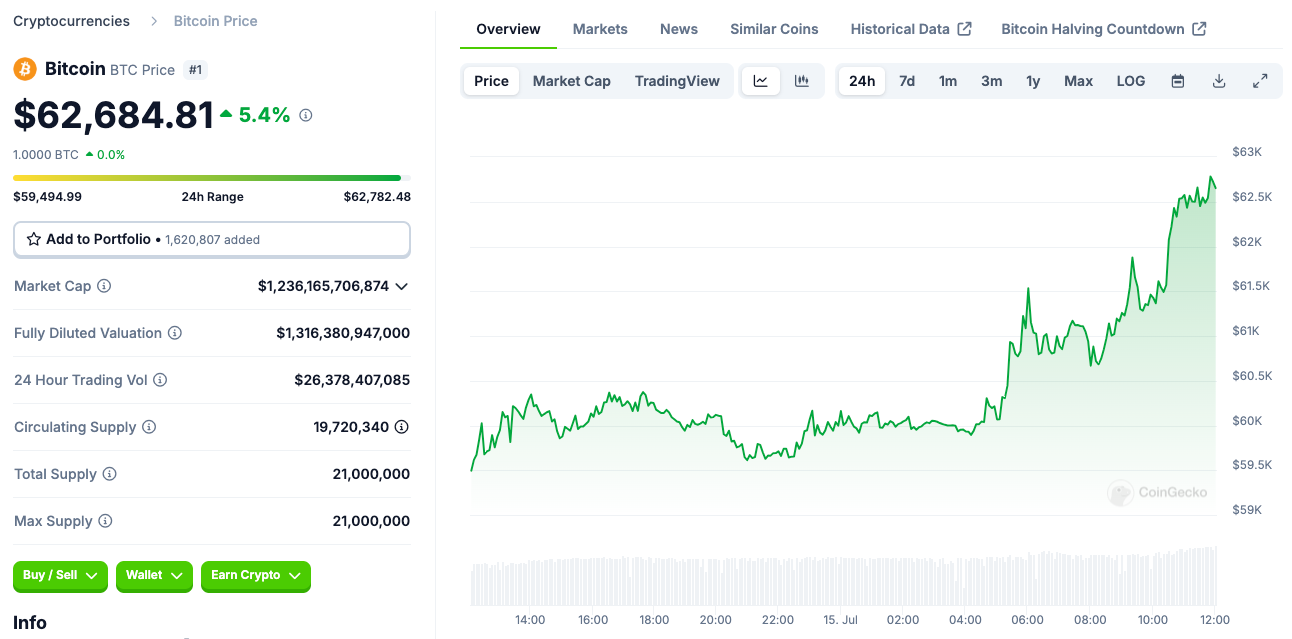

The Surge in Bitcoin

The assassination attempt also caused a significant surge in Bitcoin prices. Bitcoin, known for its continuous trading, soared to more than $60,000 following the attack. Traders likely headed to Bitcoin as a response to the political instability, viewing it as a safer investment amid the uncertainty.

Bitcoin as a Safe Haven

In times of political and economic uncertainty, investors often seek out safe-haven assets. Traditionally, gold and the Swiss franc have served this purpose. However, the recent surge in Bitcoin's price suggests that it is increasingly being viewed as a digital safe haven. The assassination attempt on Trump prompted a flight to safety, with many investors turning to Bitcoin to hedge against potential market turbulence.

Market Reactions

The reaction in the Bitcoin market was swift and significant. The price of Bitcoin surged from just below $60,000 to over $60,000 within hours of the news breaking. This price movement was driven by both retail and institutional investors seeking to protect their portfolios from the anticipated volatility in traditional financial markets. The event underscored Bitcoin's growing role as a hedge against geopolitical risks.

Donald Trump's Sentiment Towards Crypto vs. Biden

Donald Trump has recently expressed a more favorable stance towards cryptocurrencies, a marked shift from his earlier skepticism. On June 14, Trump vowed to end President Joe Biden’s "war on crypto" if elected, promising to ensure the future of Bitcoin and other digital assets in America. In contrast, President Biden has maintained a more stringent regulatory approach towards the crypto industry.

Trump's Commitment to Crypto

Trump's commitment to fostering a crypto-friendly environment has resonated with many in the industry. He has criticized Biden's policies, arguing that the US must lead in the crypto space. This promise has likely contributed to the recent spikes in Trump-themed cryptocurrencies.

Biden's Regulatory Approach

President Joe Biden's administration has taken a more cautious approach to cryptocurrency regulation. This includes increased scrutiny of crypto exchanges, enforcement actions against fraudulent projects, and calls for comprehensive regulatory frameworks. While these measures aim to protect investors and ensure market stability, they have also been perceived as hindering innovation and growth within the industry.

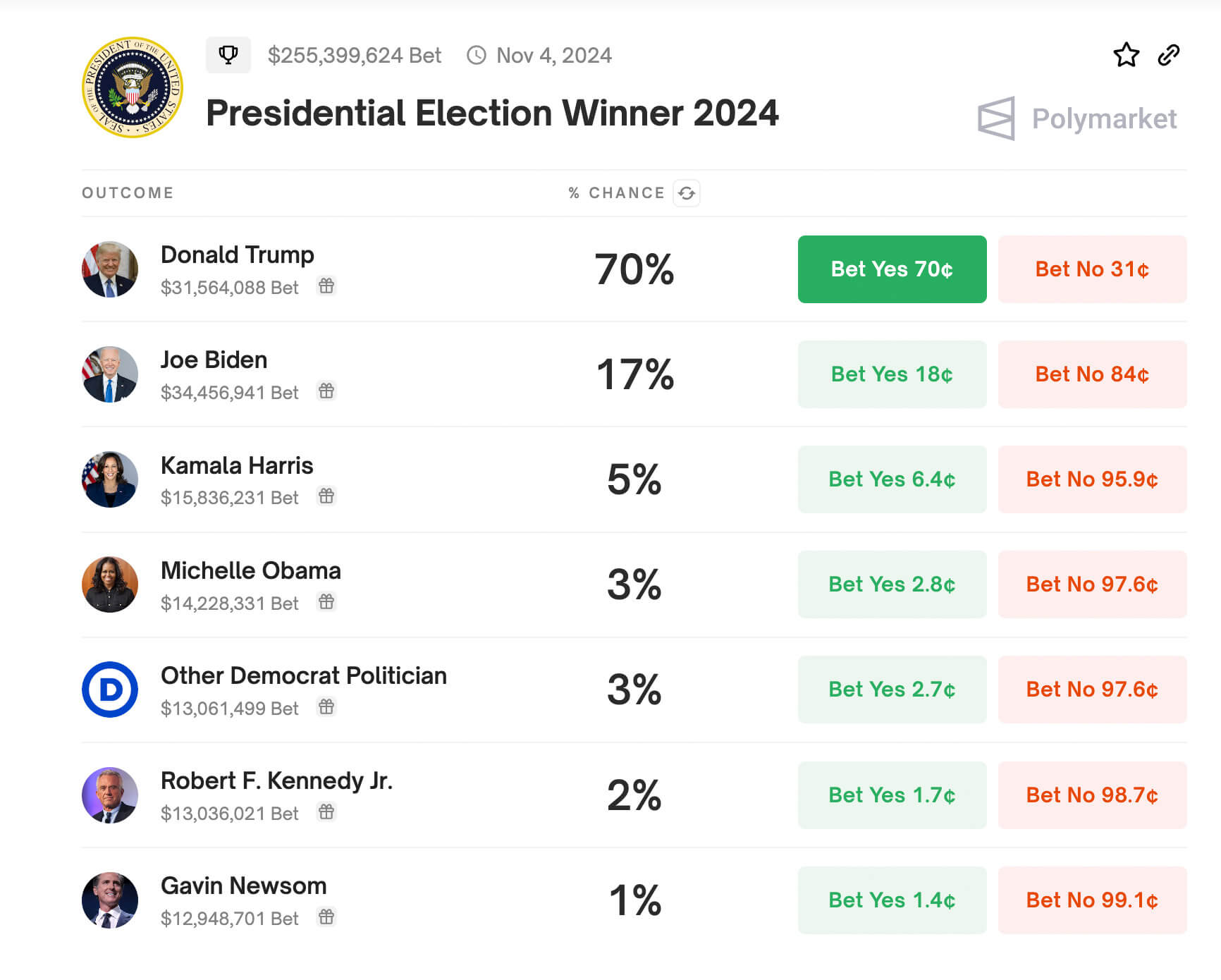

Trump's Increased Election Odds and Endorsements

Following the failed assassination attempt, Donald Trump's chances of winning the U.S. presidential election surged dramatically. Data from Polymarket, a prediction-based cryptocurrency platform, shows that the ‘Yes’ shares of the contract on whether Trump will win the election rose from $0.60 to $0.70, indicating a 70% chance according to traders. In contrast, Biden's odds fell from 30% to 17%, reflecting diminished confidence among traders in his reelection.

Market and Analyst Views

Analysts and traders alike anticipate that the assassination attempt will bolster Trump's support and electoral prospects. Experts such as Tina Fordham and Nick Twidale believe the incident will accelerate the consensus view of a Trump victory in the markets. Historical parallels, such as Ronald Reagan's post-assassination attempt surge in popularity, further support this sentiment.

Endorsements from Elon Musk and Justin Sun

In a surprising turn, prominent figures like Elon Musk and Justin Sun publicly endorsed Donald Trump following the assassination attempt. Musk, known for his influence in the tech and crypto sectors, released his first public endorsement for Trump on social media platform X, stating his endorsement and wishing for Trump's rapid recovery. Similarly, Justin Sun, founder of the Tron blockchain, shared Musk's post, highlighting Trump's potential positive impact on the crypto industry and fairer treatment policies.

Conclusion

The assassination attempt on Donald Trump has had immediate and significant effects on the crypto market, particularly among Trump-themed memecoins and Bitcoin. As the 2024 presidential election approaches, Trump's evolving stance on cryptocurrencies and his promises to support the industry contrast sharply with Biden's regulatory approach. The political and financial landscapes remain intertwined, with each development potentially impacting the volatile crypto market.

In conclusion, the assassination attempt on Donald Trump serves as a stark reminder of the interconnectedness of politics, finance, and digital assets. The event has driven significant market movements and highlighted the growing influence of political figures on cryptocurrency markets globally. Investors and stakeholders alike must navigate this evolving landscape with caution and foresight, as political events continue to shape the future of digital finance.

For a deeper exploration of how US elections and cryptocurrency interact, delve into our comprehensive analysis on The Interplay Between US Elections and Cryptocurrency