Unlock the Best Trading Strategies on Demex for the Memecoin Supercycle

The Memecoin Supercycle: A New Era for Traders

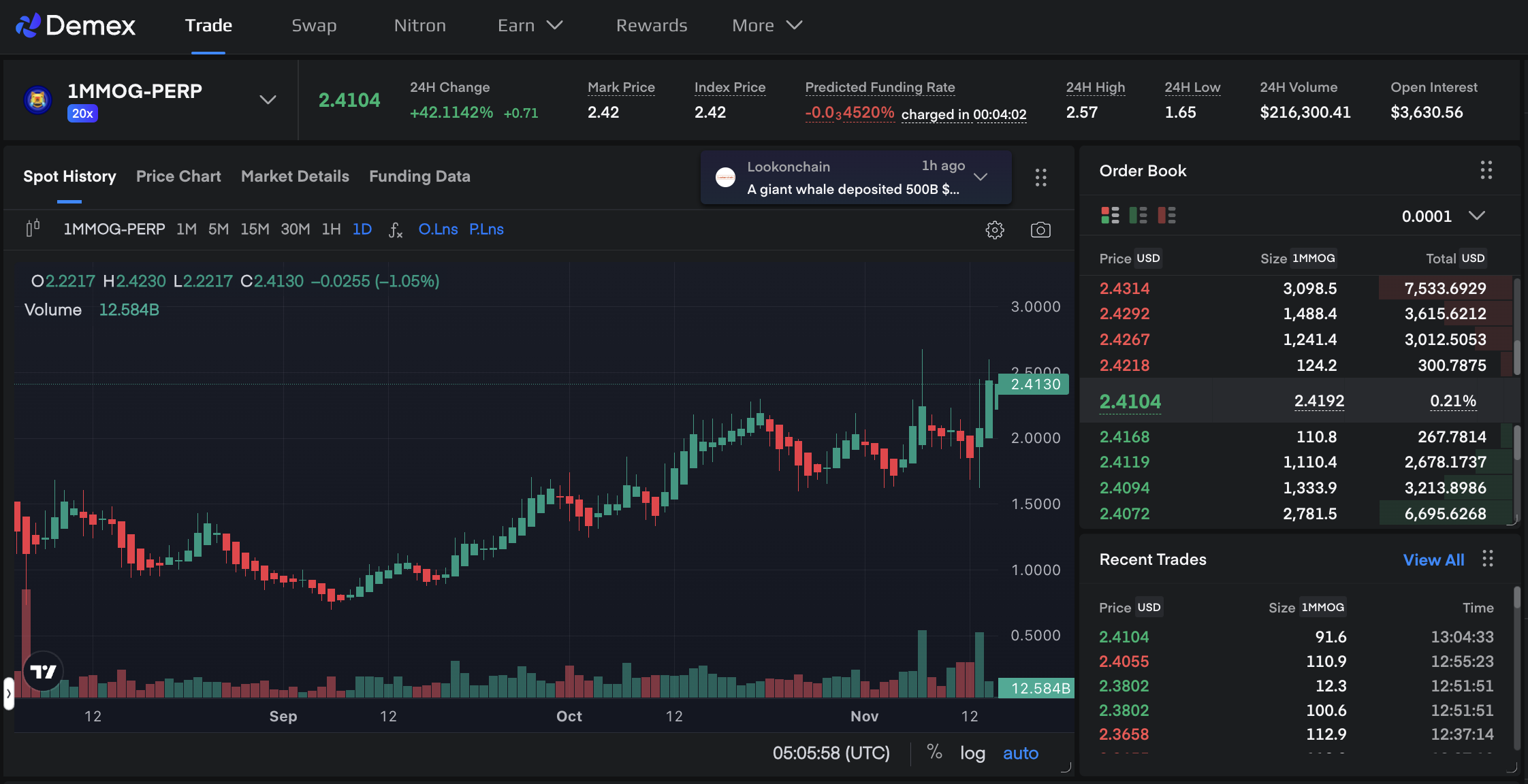

The memecoin supercycle has emerged as one of the most unexpected yet fascinating trends in crypto, drawing traders from all backgrounds. Unlike utility tokens with complex fundamentals and promised functions, memecoins are propelled by community enthusiasm, emotional connection, and the prospect of rapid financial gain. With Demex’s platform offering perpetual markets on meme coins, traders now have the flexibility to go long or short on these highly volatile assets, leveraging both market upswings and downturns to their advantage.

Why Are Traders Choosing Memecoins Over Utility Tokens?

The draw of memecoins goes beyond mere speculation; it represents a collective movement within the cryptocurrency space. Over time, many investors have grown skeptical of utility tokens, which often promise innovative technologies but fail to deliver practical solutions. In contrast, memecoins thrive on sentiment, humor, and cultural relevance.

Here are some reasons why traders are increasingly turning to memecoins over traditional utility coins:

- Transparency and Simplicity

Memecoins are unpretentious in their objectives. They’re not presented as technical solutions or groundbreaking projects; they’re straightforward about their purpose as speculative assets. This honesty has won over many traders who have experienced disappointment with projects that market themselves as game-changing but lack real-world utility. - Community-Driven Hype

Memecoins rely on community support, a shared vision, and often a touch of satire or social commentary. Communities behind meme coins exhibit strong engagement, as seen in the social momentum of stocks like AMC and GameStop, and now in various meme cryptocurrencies. By gathering traders under a common ideal, memecoins form tight-knit communities that feed off each other’s enthusiasm, driving volatility that traders can capitalize on through long and short positions on Demex. - Mimetic and Anti-Institutional Sentiment

Many traders view memecoins as a counter to venture capitalism and traditional financial structures. They’re skeptical of utility tokens tied to venture capital, as these often lead to token releases that harm retail investors. Memecoins, by contrast, feel more democratic and accessible, aligning with a sense of collective power among retail investors.

The Demex Advantage for Memecoin Traders

For traders keen to engage with the memecoin supercycle, Demex offers unique advantages. Unlike spot markets, Demex’s meme coin perpetual (perps) markets enable traders to go both long and short, meaning they can potentially profit from both upward and downward price movements. With features like high leverage, low fees, and a permissionless environment, Demex is positioned as the go-to platform for memecoin trading. Here’s what makes Demex a top choice:

- Access to Perpetual Markets

Demex’s perp markets allow traders to harness volatility to their advantage, opening both long and short positions in response to price swings. This flexibility is essential in the memecoin supercycle, where prices often change on a whim. - Low Fees, High Liquidity

Low trading fees mean traders can hold onto more of their gains, especially important in high-turnover trading strategies often employed with memecoins. Demex also offers high liquidity, allowing traders to enter and exit positions smoothly, even in a rapidly fluctuating market. - Permissionless Trading Environment

Demex’s permissionless structure enables users to trade meme coins without the limitations often seen on centralized platforms, providing access to a wide range of trending markets. - Your Best Friend in These Markets

Demex is more than just a trading platform; it’s the best friend you need in these unpredictable markets. With trading rebates on fees, regular trading competitions that pay you to trade and win, and on-chain alerts via email and Telegram, Demex ensures you stay ahead of the game. Plus, you get access to the hottest markets, including pre-launch tokens, allowing you to tap into fresh opportunities before others.

Top Trading Strategies for the Memecoin Supercycle on Demex

Strategy 1: Momentum Trading for Quick Profits

Momentum trading involves capitalizing on rapid price shifts within a short time frame. Memecoins are ideal for this strategy due to their extreme volatility. Traders watch for breakout trends, using tools on Demex to track real-time price movements and set up buy/sell points. Momentum trading on a platform like Demex, where traders can go both long and short, allows quick reaction to both upward and downward swings.

Strategy 2: Shorting Over-Hyped Coins

When meme coin prices are artificially inflated by social media hype, there’s often an eventual correction. Shorting enables traders to profit from this downturn. On Demex, traders can enter short positions with leverage, making it possible to magnify potential gains. This strategy is useful for profiting from the “hype-and-dump” cycles that frequently characterize meme coins.

Strategy 3: Leveraging Up for Amplified Gains

One of the main appeals of trading on Demex is the ability to use leverage, allowing traders to increase their exposure to potential profits while being mindful of risk. Leverage can turn small price movements into significant gains, especially useful in a memecoin supercycle where price volatility is expected.

Strategy 4: Swing Trading with News and Social Signals

Meme coins often react sharply to news events, social media trends, or endorsements from influencers. Swing traders can capitalize on this by holding positions for a few days or weeks, depending on the hype cycle. By monitoring social signals, traders can time their entries and exits to ride the momentum on Demex’s perp markets.

Strategy 5: Cash-and-Carry for Stable Returns

Although cash-and-carry is more common in stable markets, it can be adapted for memecoin trading as well. This strategy involves going long on a low-priced asset and shorting it as it reaches anticipated peaks. Demex’s perp markets allow traders to apply this strategy, helping manage risk while taking advantage of price discrepancies.

Essential Risk Management Tips for Trading Meme Coins

Due to their volatility, memecoins can be risky assets. Effective risk management is crucial to ensure that trades don’t lead to outsized losses. On Demex, traders can set stop-loss and take-profit points to manage exposure, use position size controls, and limit leverage to avoid overextension. In the memecoin supercycle, careful risk management can make the difference between a profitable trade and a costly one.

Diversify Beyond Memecoins on Demex

If you ever feel like you've had enough of the memecoin frenzy, Demex has plenty of other options to explore. We list a wide range of categories beyond memecoins, including ecosystem tokens, Layer 1s (L1s), DeFi tokens, AI tokens, and much more. With Demex, you can always diversify your trading strategy across different market segments, keeping things fresh and aligned with your long-term goals.

The TLDR

The memecoin supercycle presents exciting opportunities for traders, and Demex’s perpetual markets are designed to let you capitalize on this trend. Key strategies include momentum trading, where quick reactions to price swings yield fast gains, and shorting over-hyped coins to profit from inevitable price corrections. Leverage is also a powerful tool on Demex, enabling traders to increase their exposure, though careful risk management is crucial. Swing trading allows you to time your positions based on social and news signals, while cash-and-carry can be adapted to add stability even in a volatile market. With its advanced features, low fees, and permissionless access to trending meme markets, Demex is an ideal platform for traders looking to profit from the memecoin supercycle.

The memecoin supercycle offers significant potential for well-prepared traders. Demex’s perp markets provide the tools and freedom to engage meaningfully with this new era in crypto trading.