Unlocking the Power of Order Flow Footprint Charts for Perpetual Trading

Order flow footprint charts are advanced trading tools that provide a granular view of market activity, offering insights that traditional price charts may not capture. These charts help traders analyze the underlying dynamics of price movements by displaying detailed order data at different price levels.

Key Components of Footprint Charts

- Volume Profile: Displays the total trading volume at various price levels over a specific period. It helps in identifying significant price levels where large trading activities have occurred.

- Delta: Shows the difference between buying and selling volume, indicating whether buyers or sellers are in control.

- Cumulative Delta: Tracks the cumulative buying and selling pressure over time, offering insights into market trends and potential reversals.

Leveraging Order Flow Footprint Analysis in Perpetual Trading

Order flow footprint charts are invaluable for traders in perpetual markets. They offer several advantages, including:

Identifying Support and Resistance with Precision

Footprint charts reveal where large volumes of orders are clustered, providing clear support and resistance levels. By analyzing these levels, you can:

- Predict Breakouts: Identify price levels where the market may break out or reverse.

- Enhance Trade Placement: Place trades around significant volume levels for better execution and reduced slippage.

Analyzing Market Sentiment

Understanding buying and selling pressure through footprint charts allows you to gauge market sentiment. This can help you:

- Spot Institutional Activity: Detect large orders from institutional traders, which may indicate potential price movements.

- Adjust Strategies: Adapt your trading strategies based on real-time order flow data and market sentiment.

Detecting Market Trends and Reversals

Footprint charts assist in spotting trends and potential reversals by:

- Tracking Order Flow Imbalances: Monitor changes in order flow to identify emerging trends or shifts in market direction.

- Analyzing Volume Spikes: Observe significant changes in volume that might signal a trend reversal or continuation.

Optimizing Trade Timing and Execution

Effective trade timing is crucial in perpetual markets. Order flow footprint charts help by:

- Refining Entry and Exit Points: Use detailed order data to time your trades more accurately, minimizing entry and exit slippage.

- Enhancing Trade Management: Adjust stop-loss and take-profit levels based on real-time order flow and market conditions.

Demex: Advanced Trading Platform for Perpetual Markets

Demex stands out as an advanced trading platform that combines the best of both worlds. It delivers the buttery smooth experience of a centralized exchange (CEX) while incorporating the decentralized finance (DeFi) capabilities of a decentralized exchange (DEX). On Demex, you can trade perpetual markets with confidence, benefiting from a range of features designed to enhance your trading experience.

Hot Perpetual Markets and Weekly Listings

Demex ensures that you have access to the most relevant and trending markets. We offer weekly listings of hot perpetual markets that are making headlines or gaining traction. This means you can trade in markets that are currently in the news or trending, aligning your trades with the latest market developments and opportunities.

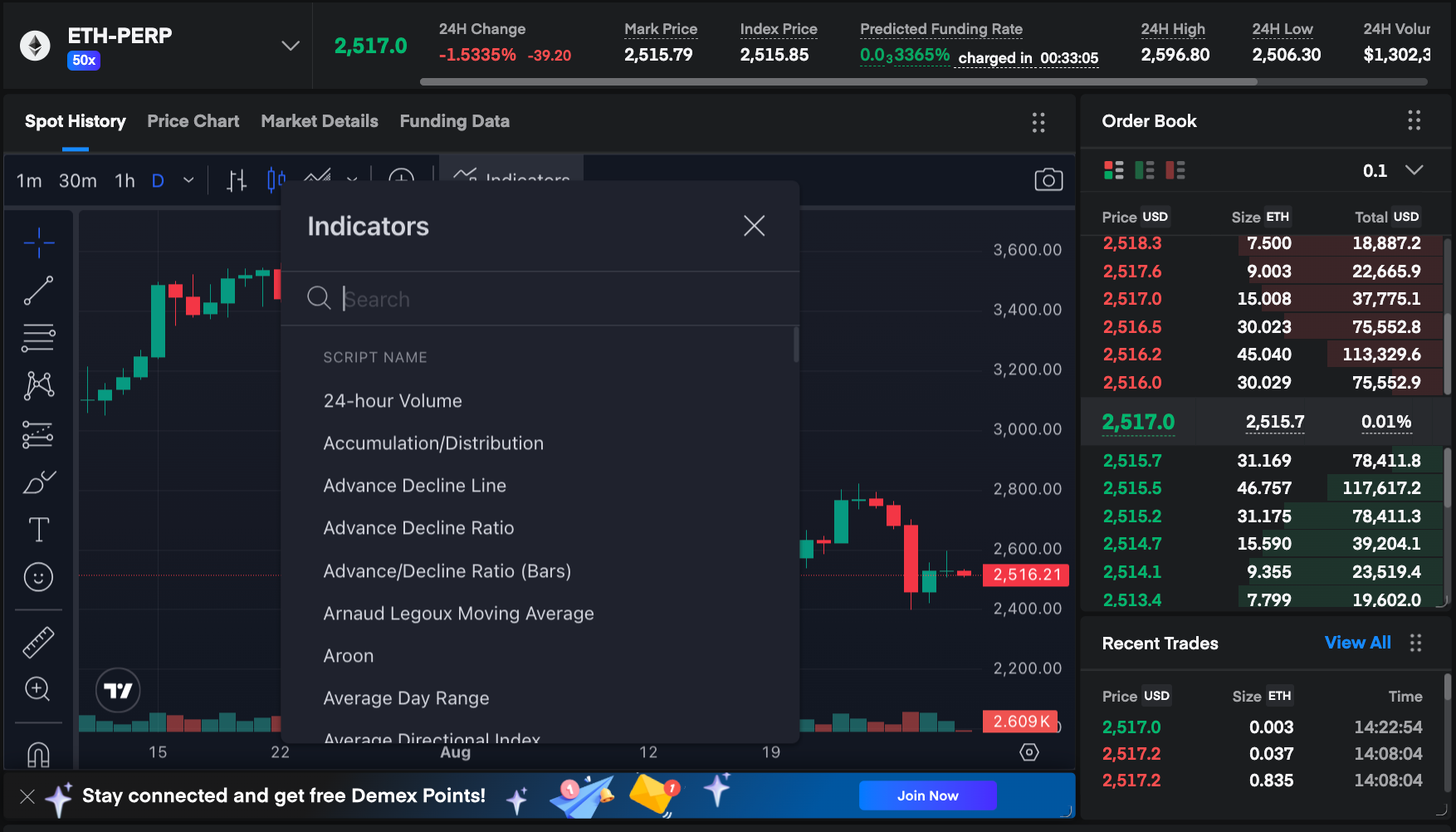

Cutting-Edge Technical Tools

Demex provides a comprehensive suite of advanced trading tools, including:

- Order Flow Footprint Charts: For detailed market analysis.

- Volume Profiles: To identify key price levels.

- Technical Indicators: Such as moving averages, RSI, and MACD for enhanced analysis.

These tools ensure you can conduct in-depth analysis and execute trades with precision, making the most of the order flow data available.

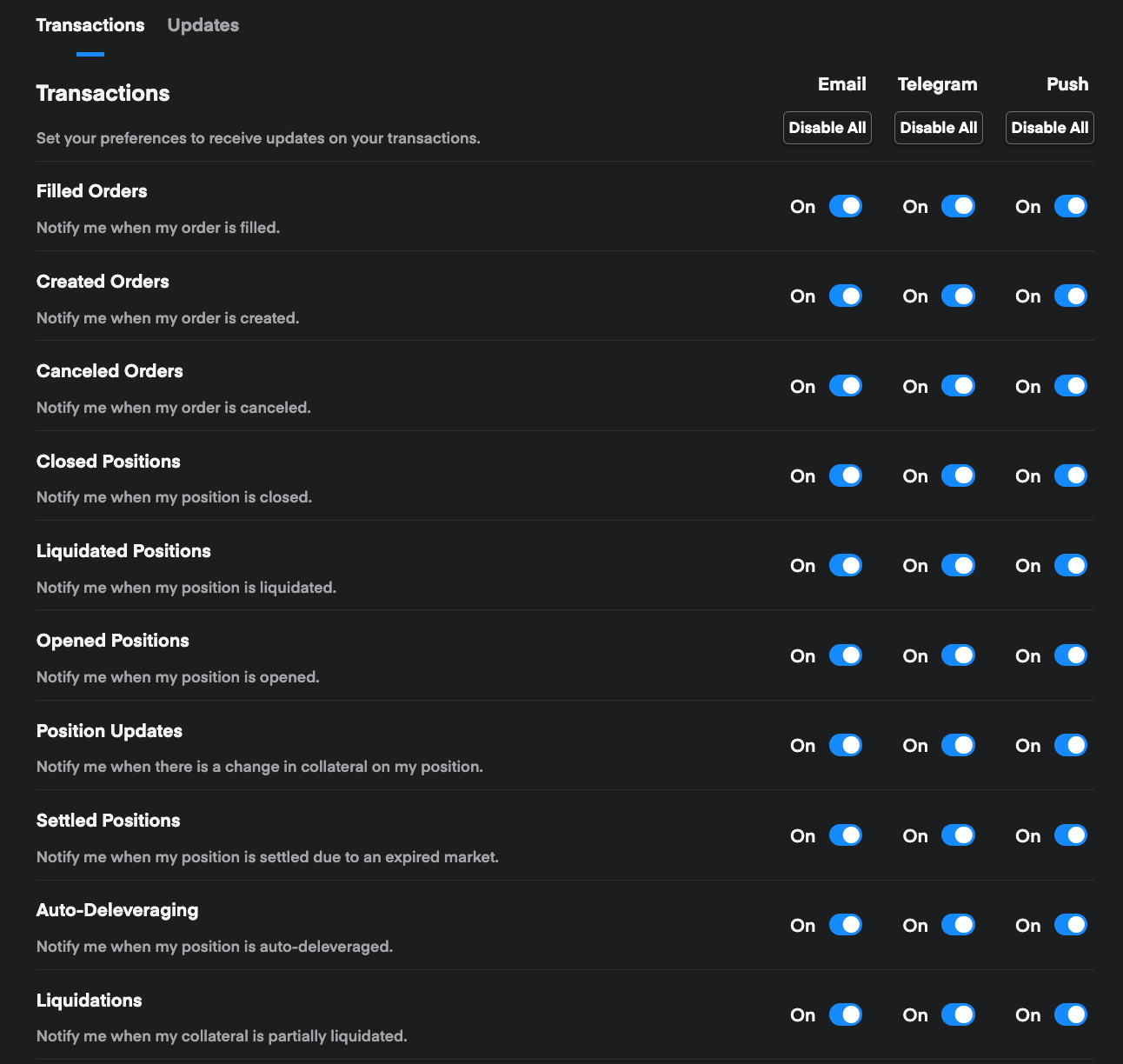

Demex Alerts: Real-Time On-Chain Notifications

Introducing Demex Alerts—a powerful feature designed to keep you informed and in control of your trading activities. Demex Alerts offer real-time notifications on crucial events related to your positions, including:

- Position Updates: Receive alerts when your position is filled and active.

- Collateral Management: Get notifications when you need to top up your collateral.

- Liquidation Risks: Warnings if your position is at risk of liquidation.

Demex Alerts are available across multiple channels, including:

- Demex Inbox: Alerts directly within your Demex account.

- Browser Push Notifications: Instant updates while browsing.

- Telegram: Alerts sent to your Telegram account.

- Email: Detailed notifications via email.

These alerts ensure you stay informed about market conditions and your trading status, allowing you to make timely and well-informed decisions.

The TLDR

Order flow footprint charts provide detailed insights into market activity, crucial for traders in perpetual markets. Demex enhances your trading experience with its advanced tools, similar to those on TradingView, and offers a seamless trading experience that blends CEX and DEX capabilities. With weekly listings of hot perpetual markets and Demex Alerts for real-time notifications, you can stay updated and make informed trading decisions effectively.