A Guide to Perpetuals Trading

New to cryptocurrency trading? Read this guide to perpetual trading to know the basics and get you ready to trade!

Cryptocurrency has transformed finance, offering innovative ways to trade and invest in digital assets. Among these advancements is perpetual trading.

In the past, a trader needed to own the underlying asset to gain exposure to it. Nowadays, traders use perpetuals when they want exposure to a certain asset.

Perpetuals are derivatives, or financial contracts, that makes it even easier for beginner traders to enter into the world of crypto trading.

In this article, we will explore crypto perpetual trading, highlighting its advantages, the associated risks, including the critical concept of liquidation, and provide a practical example to illustrate these points.

Getting Started

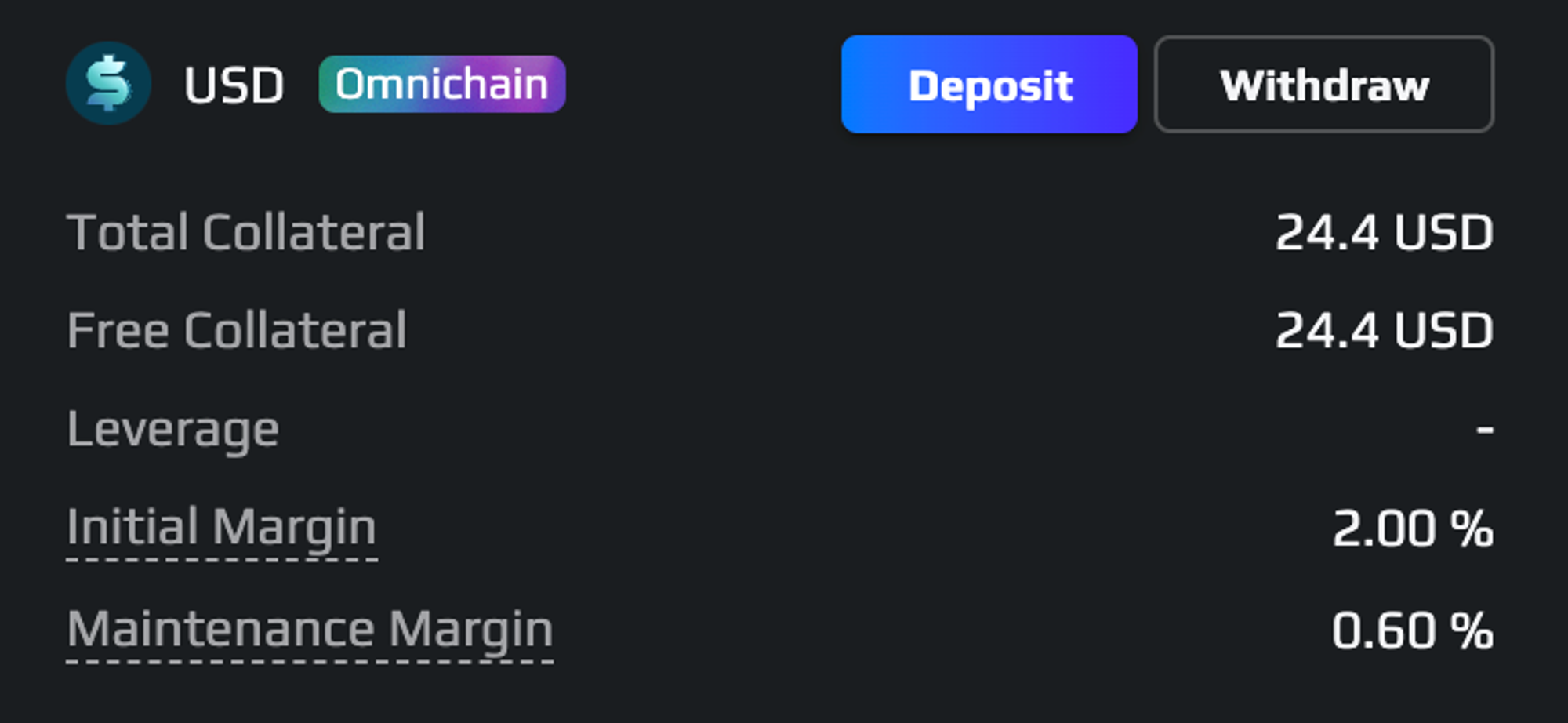

First, you need collateral to begin trading perpetuals. This collateral is often a stablecoin.

On Demex, perpetual contracts are denominated in USD, a group token which can be obtained by depositing any native USDC into Demex from any popular chain.

The available USD balance represents the collateral that can be used to trade Perpetuals.

Advantages of Perpetuals

Crypto perpetual trading comes with several distinct advantages that make it an appealing choice for traders:

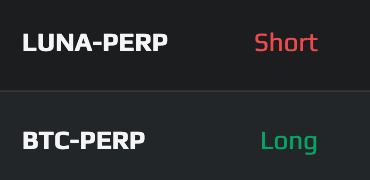

Go Long or Short

One of the most significant advantages of perpetual trading is the ability to go long or short on an asset.

Going long means betting on the price of the cryptocurrency to rise, while going short means speculating on the price to fall.

This flexibility enables traders to profit in both bullish and bearish market conditions, a feature not available in spot trading.

Ease of Trading

The world of cryptocurrency can be very complicated as there are dozens of blockchains, wallets, and dapps to use just to buy an asset you are looking for.

Perpetual trading allows you to skip all of those complications. If Demex has a perp market for an asset you are looking for, you can get exposure to it by just using USD and going long on it.

Use Leverage

Leverage is a powerful tool in crypto perpetual trading. It allows traders to control larger positions than their initial capital would typically allow.

For example, with 10x leverage, a trader can control a $10,000 position with only $1,000 in their account.

While leverage amplifies profits, it also increases the potential for losses. Thus, risk management is crucial for perpetual traders.

Funding Rate Arbitrage

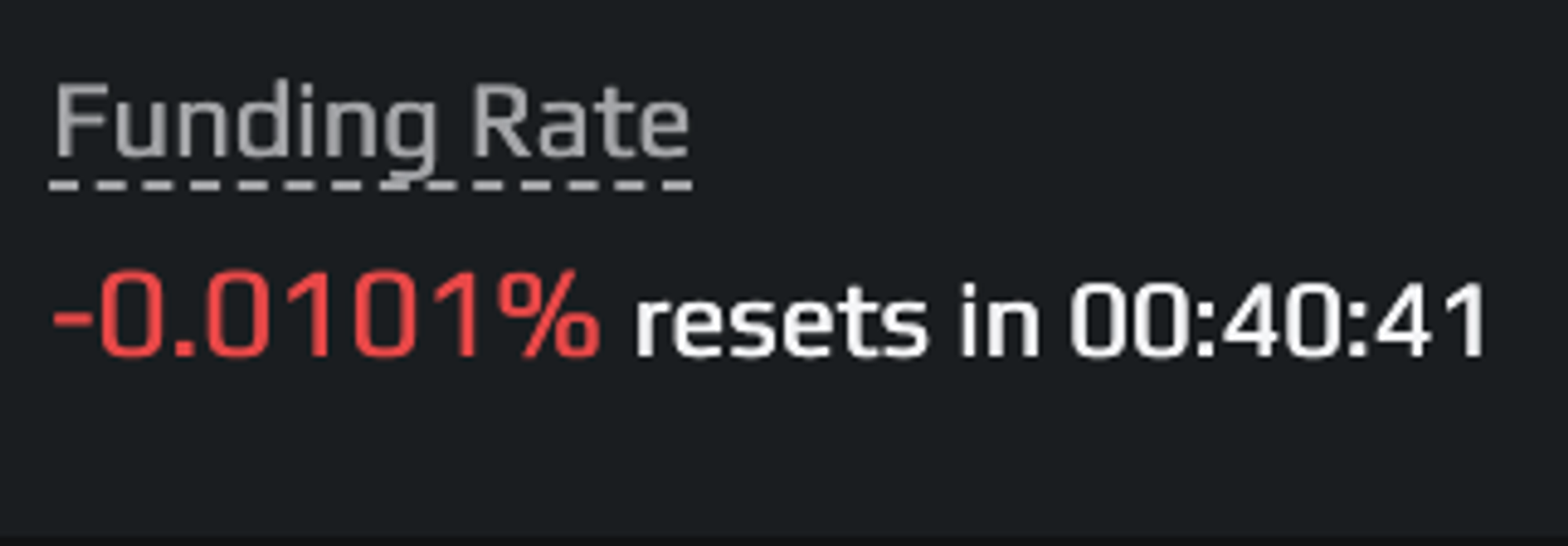

The funding rate is a unique feature of crypto perpetual contracts. It is a mechanism that helps keep the contract's price aligned with the underlying asset's price. This happens every hour on Demex.

When the funding rate is positive (green), long traders pay short traders, and when it is negative (red), short traders pay long traders.

Traders can take advantage of this by strategically opening positions to earn the funding rate income.

For instance, if the funding rate for a BTC perpetual contract is positive, long traders pay funding fee to short traders. This incentivizes funding rate arbitragers to go short when the market is bullish, while still holding on to their spot position, in order to profit from this funding rate.

You can find more information about how the funding rate works here.

Lower Fees

Compared to spot trading, crypto perpetual trading often involves lower fees. Traditional exchanges may charge trading fees and spreads, while perpetual contracts typically have a single fee known as the taker or maker fee.

This fee structure can be more cost-effective for active traders, especially when combined with leverage for efficient capital utilization.

For more detailed information about the Demex trading fees, visit this page.

Risks of Perpetuals

While perpetual trading offers exciting opportunities, it also presents risks that traders should be aware of, with liquidation being a central concern.

Liquidation: Managing Risk

Liquidation is a crucial aspect of perpetual trading. When traders employ leverage to open a position, they effectively borrow funds from the exchange to control a larger position than their initial capital would allow. This creates a liquidation price for the trader as well.

If a trader's position experiences losses as the market moves against them and reaches the liquidation price, the exchange will close the position to limit further losses, resulting in the trader losing their entire collateral for that position.

At the moment, there are no liquidation fees for Demex.

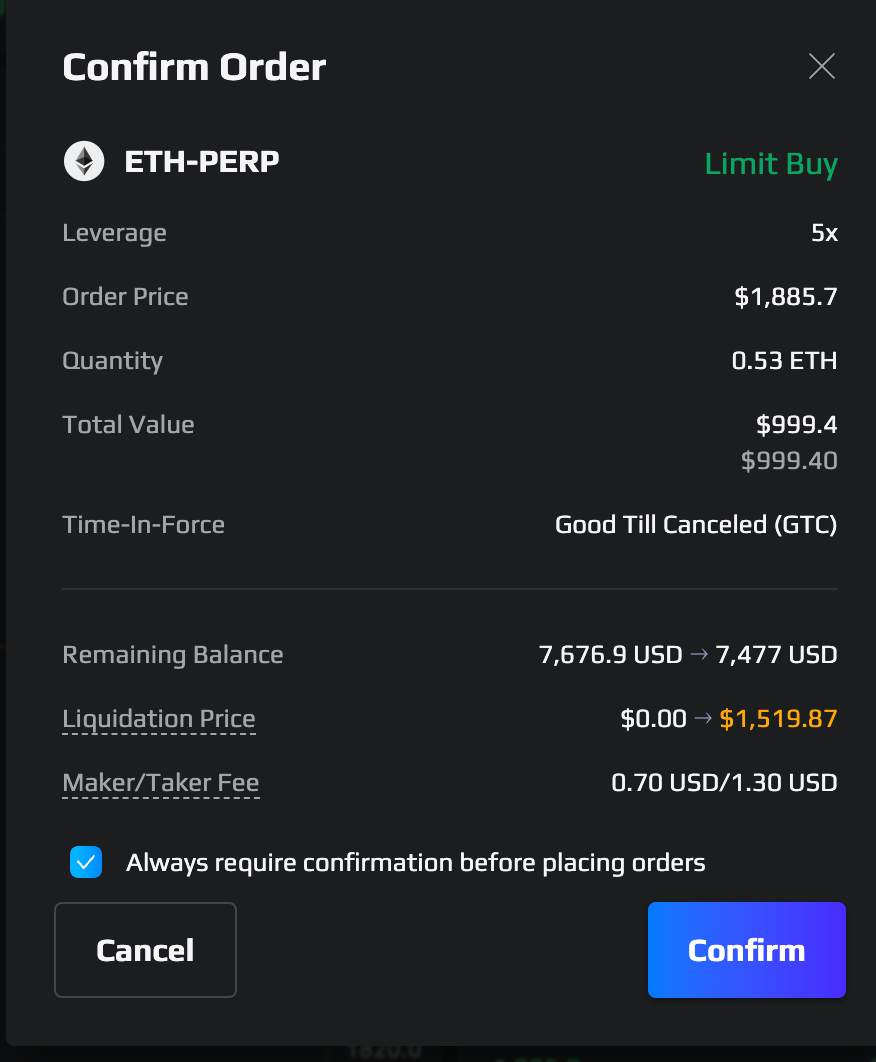

Practical Example: BTC Perpetual Trading with Liquidation

Suppose you believe that the price of Ether (ETH) will increase in the near future. You decide to open a long position on a ETH perpetual contract with 10x leverage and an initial margin of $1,000. The liquidation price for your position is set at $1519.

As ETH's price rises as anticipated, you can profit from the price difference, multiplied by your leverage factor.

However, if the price starts to decline and approaches the liquidation price, you must closely monitor your position. If the ETH price reaches the liquidation price, you will lose your initial $1,000 investment.

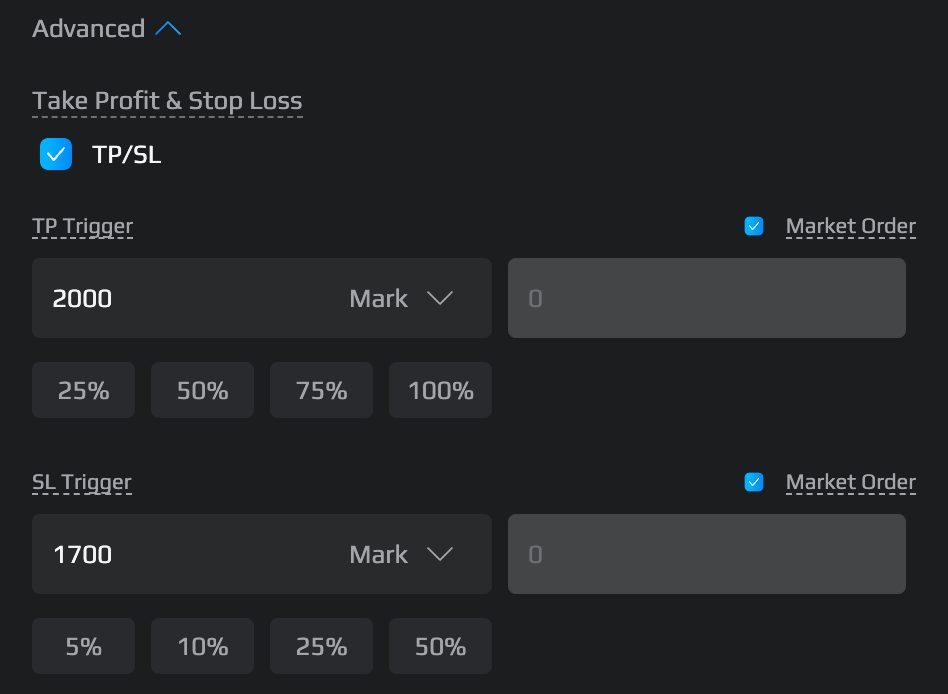

To mitigate this risk, you can set a stop-loss order at a price slightly above your liquidation price, perhaps at $1,700. Should the market move against your position and reach this stop-loss level, your position will be automatically closed, limiting your losses to around $100.

Learn more about Take Profit and Stop Loss orders in our guides as well.

The TLDR

Crypto perpetual trading offers traders a flexible way to engage with cryptocurrency markets, complete with opportunities and risks. The ability to go long or short, leverage positions, and potentially earn from funding rates makes perpetuals attractive.

However, the risk of liquidation underscores the importance of responsible risk management. Understanding and managing liquidation, as well as employing protective measures such as stop-loss orders, can help traders protect their capital and navigate the dynamic world of perpetual trading more effectively.