Bitcoin: The Flight To Safety

Bitcoin remains at the epicenter of the crypto realm, wielding an influence that ripples across the industry, shaping sentiment, and sparking excitement. Traders, investors, and holders should gear up for what promises to be an electrifying bull market rally.

Bitcoin Halving Q4 Narrative: A Profound Rally in Crypto

In this exciting year of 2023, a multitude of new tokens, from established L1 tokens like Arbitrum (ARB) to Mantle (MNT), to the more whimsical meme coins such as HarryPotterObamaSonic10Inu, have made their mark. Yet, amidst this dynamic crypto landscape, one thing remains undeniable - Bitcoin (BTC) is the quintessential OG, captivating the hearts of countless crypto aficionados as a steadfast store of value. It continues to maintain its unassailable status as the preeminent cryptocurrency for trading. This everlasting dominance shows no signs of waning anytime soon.

October Rally Fuels Enthusiasm for BTC

The year 2023 witnessed Bitcoin achieving remarkable milestones, reaching an impressive 18-month high as it soared past the $35,000 price point. The catalyst for this bullish surge was the long-awaited and eagerly anticipated SEC decision, which brought a wave of positive speculation into the crypto ecosystem.

Spot BTC ETF Approval in the Limelight

What triggered this exhilarating surge in the Bitcoin market? The spotlight falls on Grayscale, an undisputed heavyweight in the world of crypto asset management. Grayscale's most notable product offering is the Grayscale Bitcoin Trust (GBTC), a pivotal player in facilitating the adoption of crypto products within both retail and institutional finance sectors. It provides a traditional investment avenue through share ownership, making it accessible even to investors who may lack an in-depth understanding of blockchain technology.

The previous year witnessed Grayscale's application to transform GBTC into spot BTC ETFs, an initiative aimed at bringing this asset in line with traditional ETF structures. However, the SEC, in a controversial move, rejected this conversion on the grounds that GBTC functioned more like a closed-end fund, lacking the flexibility to create or redeem shares based on market demand. Coincidentally, the SEC approved Bitcoin futures ETFs around the same time, even though both products implemented comparable safeguards against market manipulation.

Grayscale's Triumph Over SEC: A Game Changer

The turning point arrived when the District of Columbia Court of Appeals weighed in, deeming the SEC's rejection of Grayscale's proposal flawed and unjustified. In response, the SEC was granted a 45-day window to make a critical decision: adhere to the court's ruling, request a full federal appeals court review, or elevate the matter to the Supreme Court. Surprisingly, the SEC chose not to contest the District of Columbia Court of Appeals' decision, paving the way for the imminent approval of Grayscale's spot BTC ETFs.

Potential Impacts of Spot BTC ETF Approval

Grayscale's victory reverberated across the financial landscape, attracting the interest of prominent asset management firms, including BlackRock, the world's largest asset management entity, and others such as Invesco, WisdomTree, and Bitwise. The approval of spot ETFs signifies that both retail and institutional investors will have unfettered access to real-time Bitcoin pricing, fostering a robust market and attracting a more diverse user base. This includes top-tier market cap firms, further propelling the crypto ecosystem towards broader adoption. This shift can serve as the catalyst for a new bull market, with a myriad of players, investors, and traders entering the crypto arena.

In a bearish market, events such as this are precisely what the digital economy needs to reinvigorate the flow of capital. Many analysts anticipate a Bitcoin price surge following the formal approval of spot ETFs, driven by market demand and the FOMO sentiment gripping the crypto community.

Morgan Stanley's Astonishing Reversal on Cryptocurrency

The year 2017 witnessed Morgan Stanley's CEO, James Gorman, casting doubt on Bitcoin's significance, stating that it garnered more attention than it deserved and that belief in its stability was delusional. At the time, Bitcoin was trading at approximately $7,000.

Fast forward to the present, and the tables have turned dramatically. Morgan Stanley's analysts have released a bold report, asserting that the era of "crypto winter" has come to an end, and the Bitcoin halving will inaugurate a new cycle of bullish growth. The report employs a clever analogy, likening the four-year crypto cycle to the four seasons, suggesting that a new period of growth is upon us. This transformation in sentiment signals a growing acceptance of cryptocurrencies within the traditional financial sector.

Bitcoin as an Inflation-Resistant Asset

Born in response to the 2008 financial crisis that rippled across the globe, Bitcoin symbolizes the quest for a trustless and borderless economy. In a world where economic policies result in the annual printing of millions of dollars, pushing inflation rates to new heights, Bitcoin emerges as a deflationary asset with a finite supply. Much like gold and silver, it has evolved into an alternative asset sought by investors as a hedge against inflation.

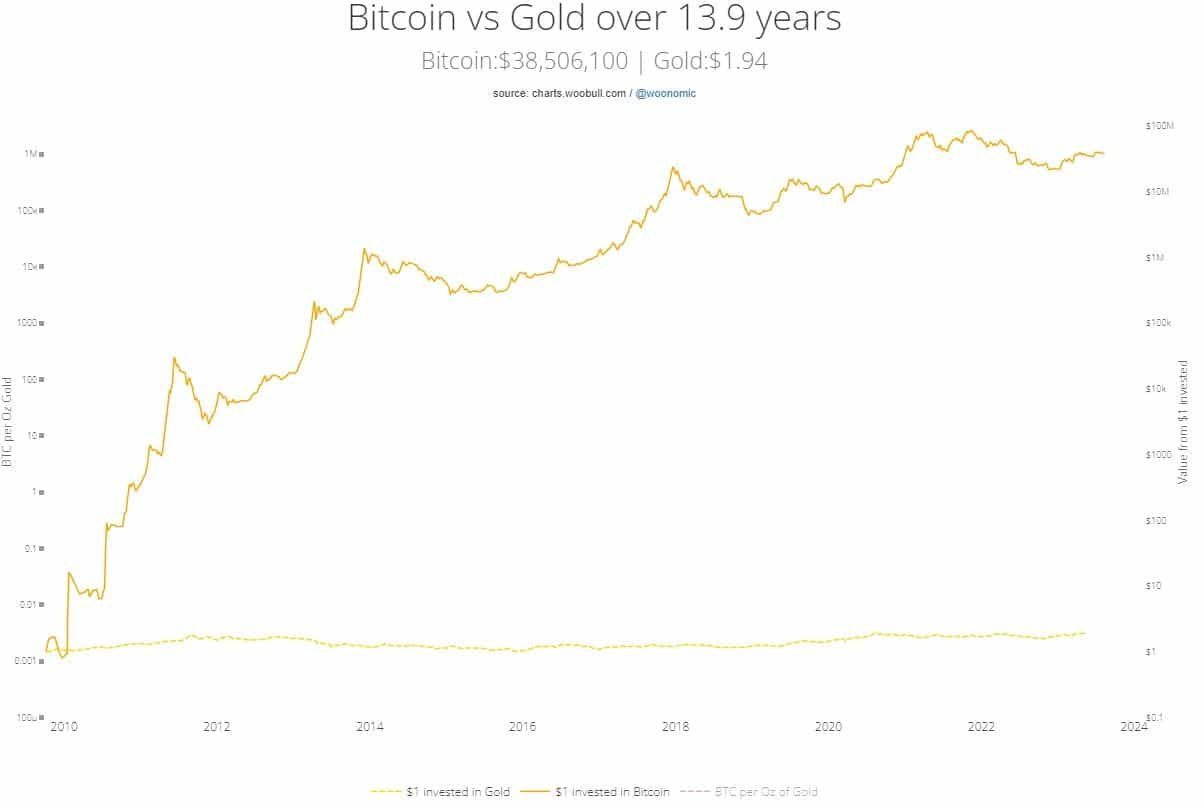

You'd be surprised to see the performance of Bitcoin Vs Gold since 2010!

What Lies on the Horizon for Bitcoin?

The next significant event in Bitcoin's journey is the impending halving, scheduled for 2024. Halving events occur every 210,000 blocks or roughly every four years. These events cut in half the rewards received by Bitcoin miners for confirming transaction blocks, thereby maintaining a controlled supply and thwarting inflation.

While there are no guarantees in the world of cryptocurrencies, history has shown that past halving events often led to price surges. Only time will unveil whether the forthcoming halving will adhere to this trend. To provide further insights, let's examine price charts from previous halving events over the years.

Trade Bitcoin with Demex: Your Premier Crypto Exchange

For those seeking a platform to trade Bitcoin, look no further than Demex. Offering the seamless trading experience of a centralized exchange (CEX) and the added advantages of a decentralized exchange (DEX), complete with trustless wallets and no registration requirements, Demex caters to all types of traders.

Demex offers a pro mode specifically tailored to advanced traders, equipped with indispensable trading tools for making well-informed decisions. Trade BTC-PERP here to go long or short with up to 50x leverage!

Alternatively, if simplicity is your preference, Demex also provides a straightforward swap mode for convenient on-the-go trading. Trade spot here!

The TLDR

Bitcoin remains at the epicenter of the crypto realm, wielding an influence that ripples across the industry, shaping sentiment, and sparking excitement. Traders, investors, and holders should gear up for what promises to be an electrifying bull market rally. Recent developments in the crypto landscape, such as the impending approval of spot BTC ETFs and the evolving stance of institutional giants like Morgan Stanley, are compelling indicators of a prosperous future for Bitcoin and the broader cryptocurrency market.