Earn APY On Demex's Liquidity Pools

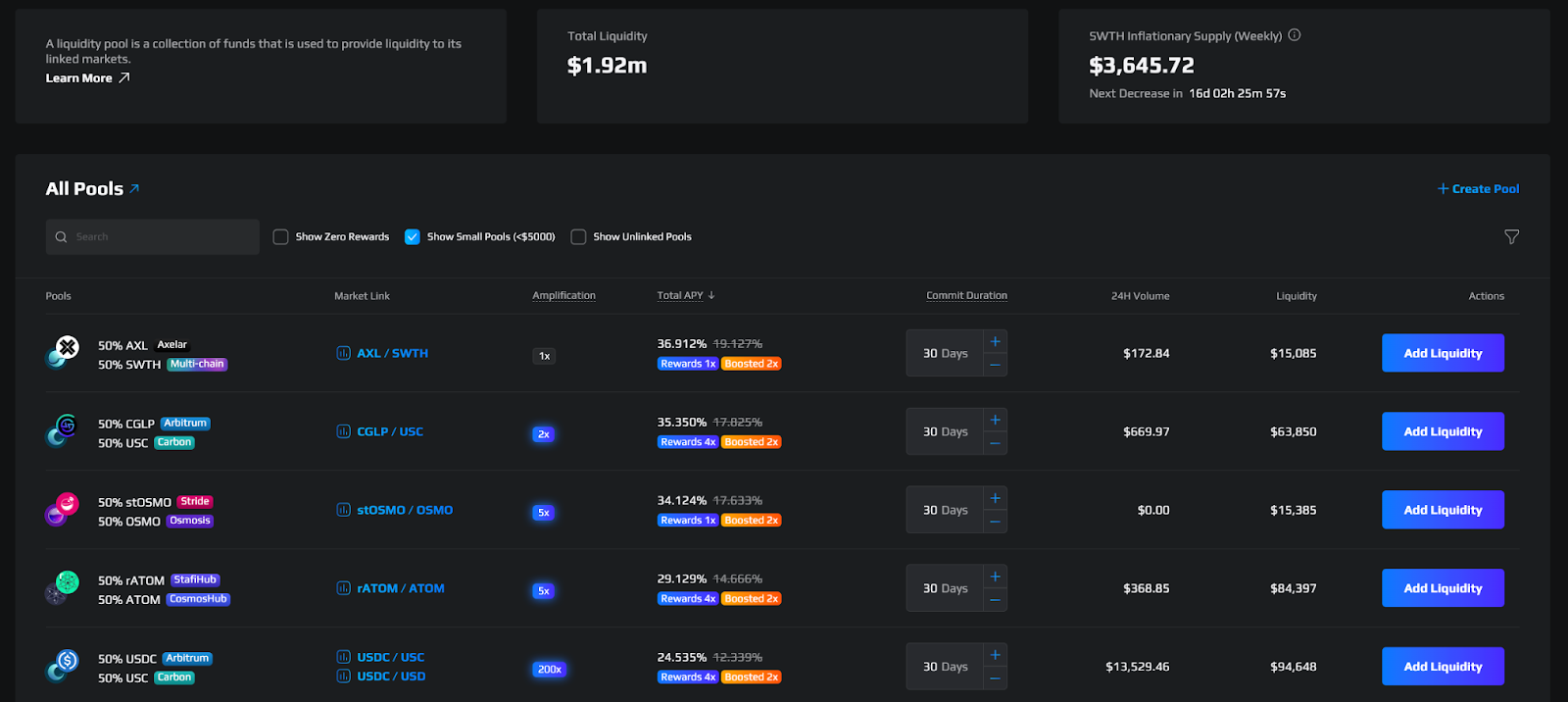

Demex's liquidity pools allow liquidity providers to earn market making fees and liquidity rewards while facilitating deep liquidity.

Demex is a decentralized exchange that has been gaining popularity in the crypto space. One of its key features is its liquidity pools, which work similarly to Balancer AMM Protocol's model. These pools enable liquidity providers to commit liquidity and earn market-making fees and liquidity rewards.

Similar to Balancer AMM Protocol

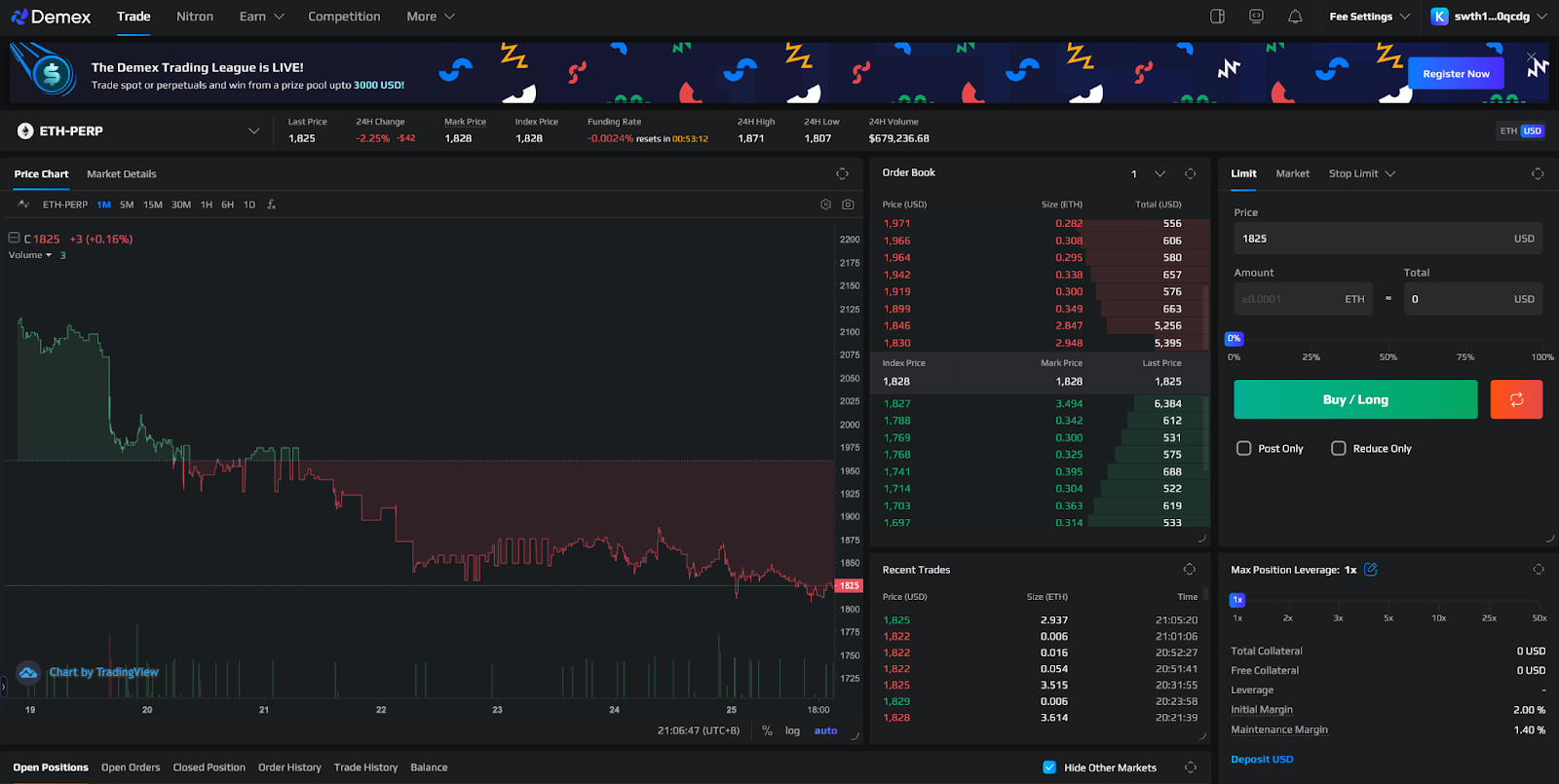

At its core, Demex's liquidity pools are designed to provide liquidity for trading derivatives. Like Balancer, Demex's liquidity pools use an Automated Market Maker (AMM) model to determine prices. In this model, prices are determined by the ratio of assets in the pool. As users trade, the ratio of assets changes, which in turn changes the price of the assets.

Supporting Order Books

The liquidity pools work in sync with Demex's order books to provide a smooth trading experience. When a user places a trade, the system checks the order book to see if there is enough liquidity to fill the trade. If there is not enough liquidity in the order book, the system will look to the liquidity pools to fill the trade. This ensures that trades can be executed quickly and efficiently, even during times of high volatility.

Best and Safest Option

One of the key benefits of using Demex's liquidity pools is that they provide a safe and secure way for liquidity providers to earn market-making fees and liquidity rewards. The platform has been designed with security in mind, using a multi-signature system to secure user funds. This means that even if one of the signers is compromised, the user's funds remain safe.

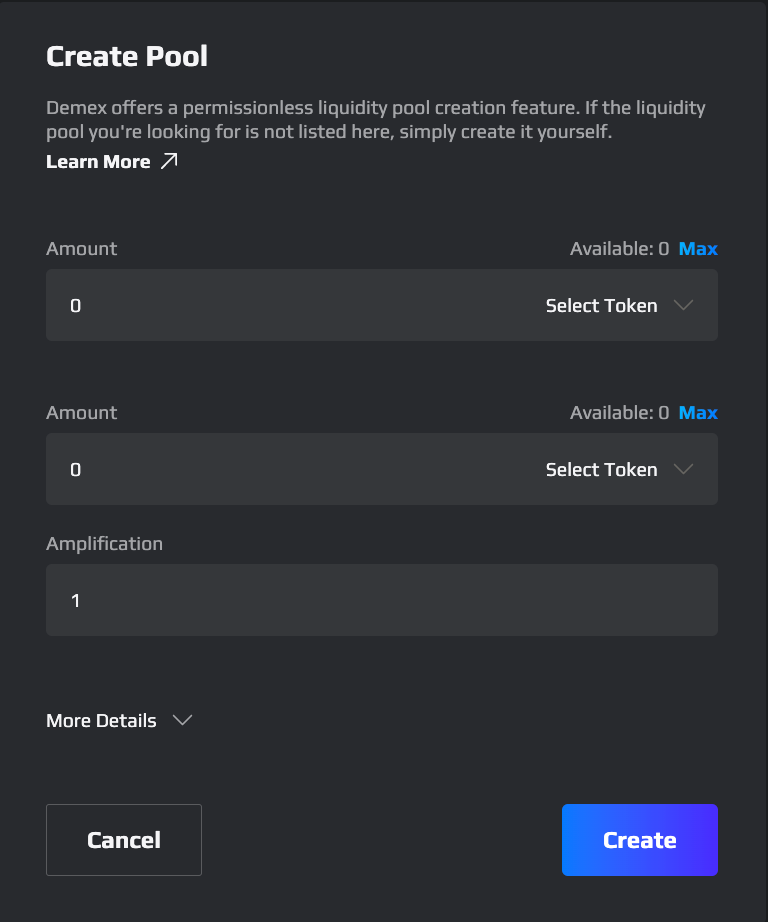

Permissionless Liquidity Pool Creation

Demex's permissionless liquidity pool creation feature is a major advantage for liquidity providers. By allowing anyone to create a pool, the platform opens up more opportunities for users to earn liquidity rewards. This feature is particularly useful for users who hold assets that may not be available on other platforms. By creating a pool for these assets, liquidity providers can earn market-making fees and liquidity rewards while providing more trading options for users.

Additionally, Demex's permissionless liquidity pool creation feature helps to promote a more decentralized ecosystem. By allowing anyone to create a pool, the platform reduces the reliance on centralized intermediaries and provides more opportunities for users to participate in the platform.

Why you should become a liquidity provider on Demex

As a user, there are several reasons why you may want to consider providing liquidity on Demex:

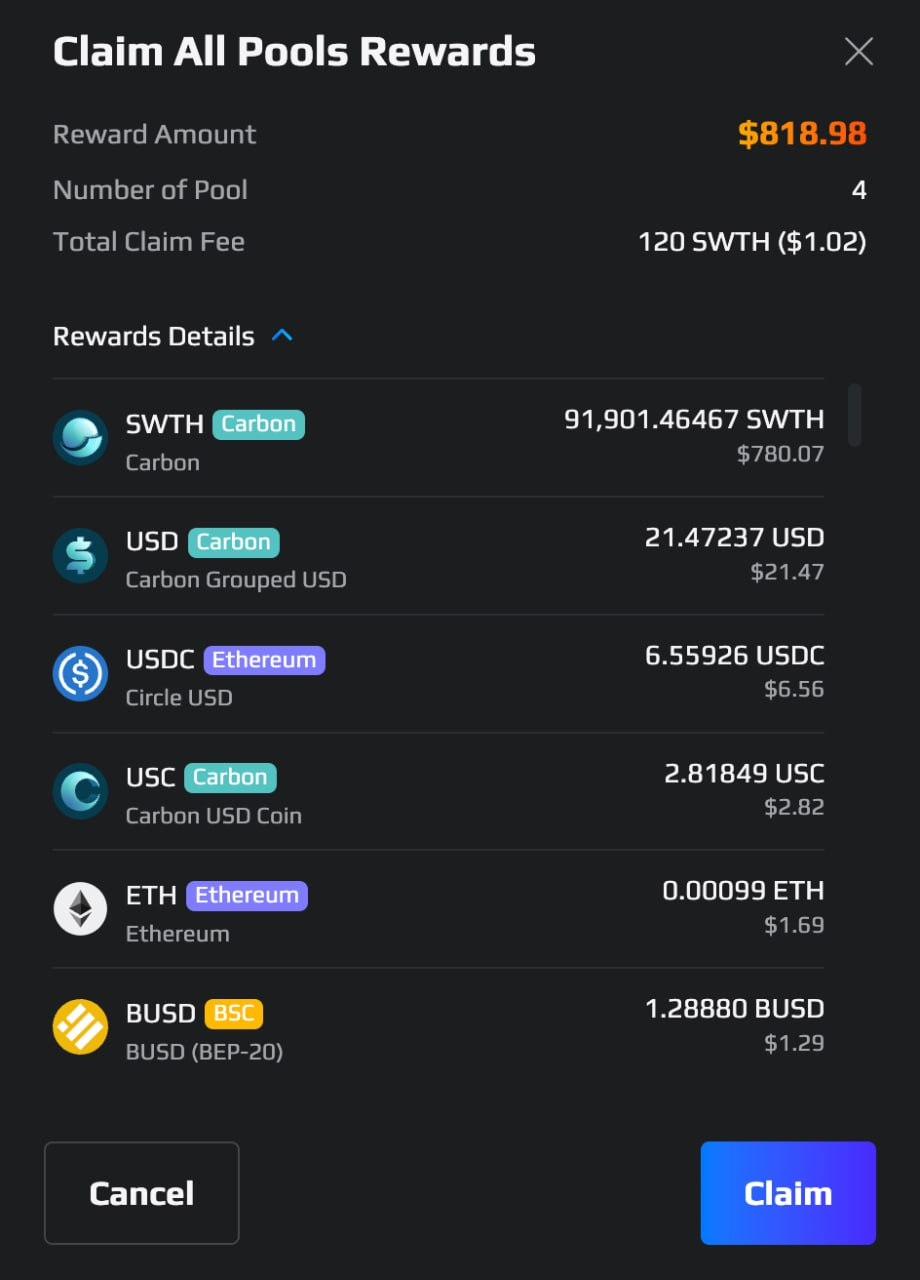

Earn market-making fees: By providing liquidity to the platform, you can earn market-making fees on trades that are executed using your liquidity. This can be a lucrative way to earn passive income on your assets, as these fees can add up over time.

Earn liquidity rewards: Demex also offers liquidity providers the opportunity to earn liquidity rewards in a plethora of tokens. These rewards are paid out based on the amount of liquidity you provide to the pool and the length of time you keep your liquidity locked in the pool. This incentivizes long-term participation in the platform and provides additional income for liquidity providers.

Diversify your portfolio: By providing liquidity on Demex, you can diversify your portfolio and earn income on assets that you may not otherwise be actively trading. This can help reduce risk and increase overall returns.

Support a decentralized ecosystem: Demex is a decentralized platform that is built on the blockchain, meaning that it operates without a centralized intermediary. By providing liquidity to the platform, you are helping to support a decentralized ecosystem that is designed to be more transparent, secure, and accessible for everyone.

Low fees: Demex offers low trading fees and allows for fractional trading, which means that even small traders can participate in the platform. By providing liquidity to the platform, you are helping to keep these fees low and accessible for all users.

The TLDR

Demex's innovative approach to liquidity provision and hybrid trading model make it the best place for liquidity providers to commit liquidity. By offering deep liquidity and tight spreads, and providing incentives for liquidity providers, the platform provides a reliable and efficient trading experience for traders across various asset classes. Additionally, the platform's permissionless liquidity pool creation feature provides more opportunities for liquidity providers to earn market-making fees and liquidity rewards while promoting a more decentralized ecosystem.