Liquid Restaking And EigenLayer Take The Spotlight

Liquid Restaking Takes Center Stage

In this episode, we delve into the buzz that's captured Crypto Twitter's attention—the compelling realm of Liquid Restaking. Our exploration encompasses various liquid restaking protocols and those that have recently opened their doors to restaking and shared security.

For a quick recap on the concepts of liquid staking and restaking, refer to this article.

EigenLayer: Trailblazing Restaking

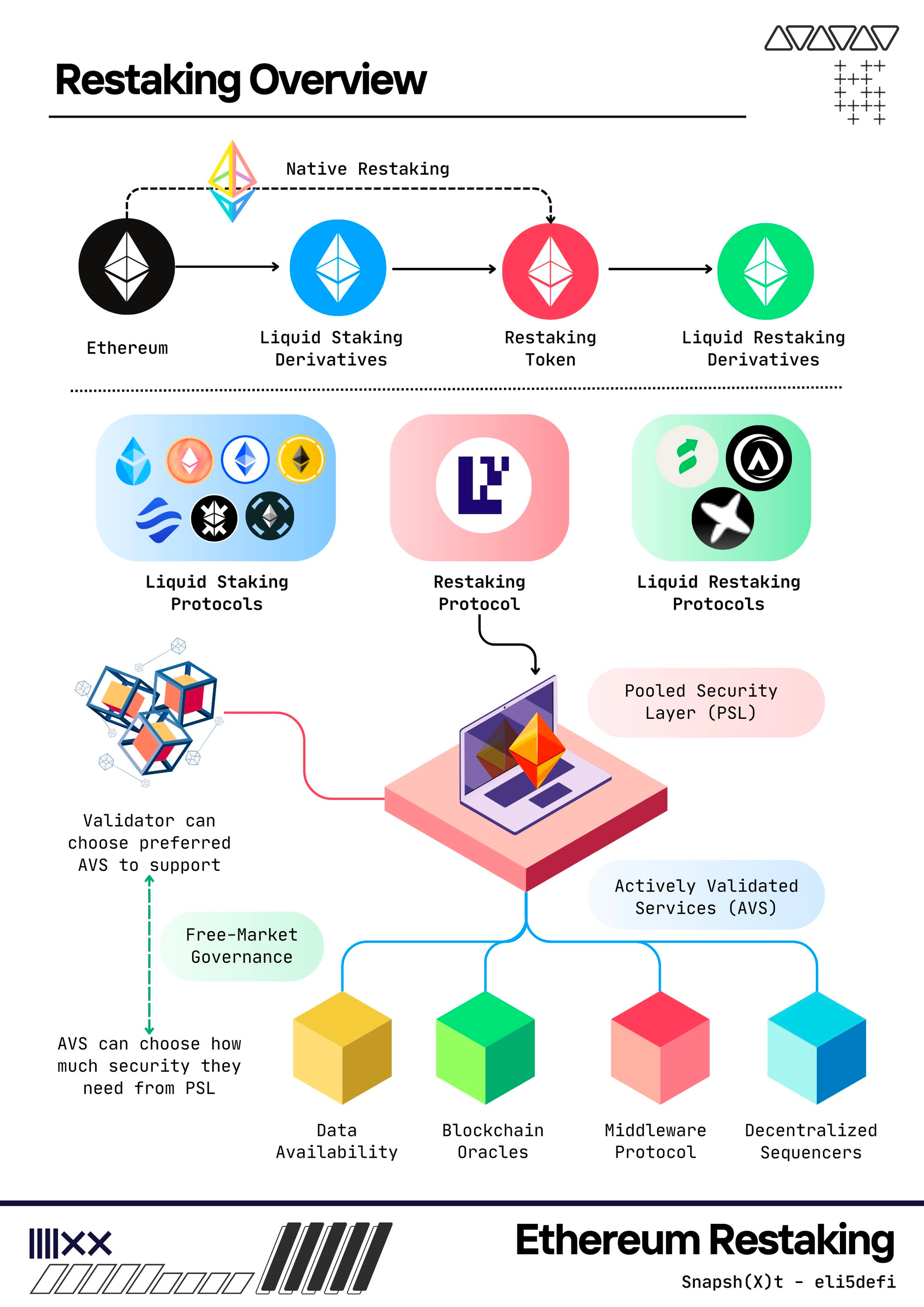

Restaking is a strategic maneuver within blockchain networks where users, post-staking assets for network security, actively reinvest the earned rewards back into the staking process. This approach allows users to compound their earnings, contributing to increased yield and network security.

EigenLayer plays a pivotal role in the restaking landscape by pioneering and introducing this concept within the Ethereum ecosystem. Through EigenLayer's restaking model, users not only contribute to the security of the original blockchain but extend their influence by reinvesting rewards. This innovative approach strengthens network security beyond Ethereum and aims to maximize earnings, providing a pragmatic and sustainable evolution within decentralized finance (DeFi) ecosystems.

Proof of Stake to Proof of Restake

Transitioning from the familiar Proof of Stake (PoS) model to the newer Proof of Restake introduces a subtle yet impactful transformation in blockchain dynamics. In PoS, users stake assets for network security and rewards. However, Proof of Restake, pioneered by EigenLayer, adds a strategic layer. Here, users not only secure the network through staking but also reinvest the earned rewards, a process termed restaking. This method aims to optimize earnings, enhance network security across different blockchains, and foster a more interconnected decentralized finance (DeFi) landscape. Proof of Restake represents a purposeful evolution, turning staking into an active mechanism for sustained yield and innovation within blockchain ecosystems.

A New Economic Paradigm

The advent of restaking in decentralized finance (DeFi) introduces the prospect of a new economic landscape within blockchain ecosystems. Restaking, as a transformative approach, redefines the traditional staking model by actively reinvesting earned rewards, propelling blockchain networks toward a more dynamic and interconnected future. This evolving concept signifies a shift towards an economy where securing networks becomes not just a protective measure but a strategic driver for sustained economic growth and innovation. The new DeFi economy, shaped by restaking, emphasizes efficiency, flexibility, and the potential for maximizing returns within decentralized financial ecosystems.

Cosmos Embraces the Liquid Restaking Momentum

EigenLayer's pioneering work in introducing the restaking concept within the Ethereum ecosystem has catalyzed a ripple effect in the blockchain space. Cosmos, quick to grasp the evolving narrative, is now actively integrating and discussing liquid restaking protocols. This strategic shift signifies the industry's recognition of the potential advantages tied to actively reinvesting rewards for bolstered network security and economic sustainability.

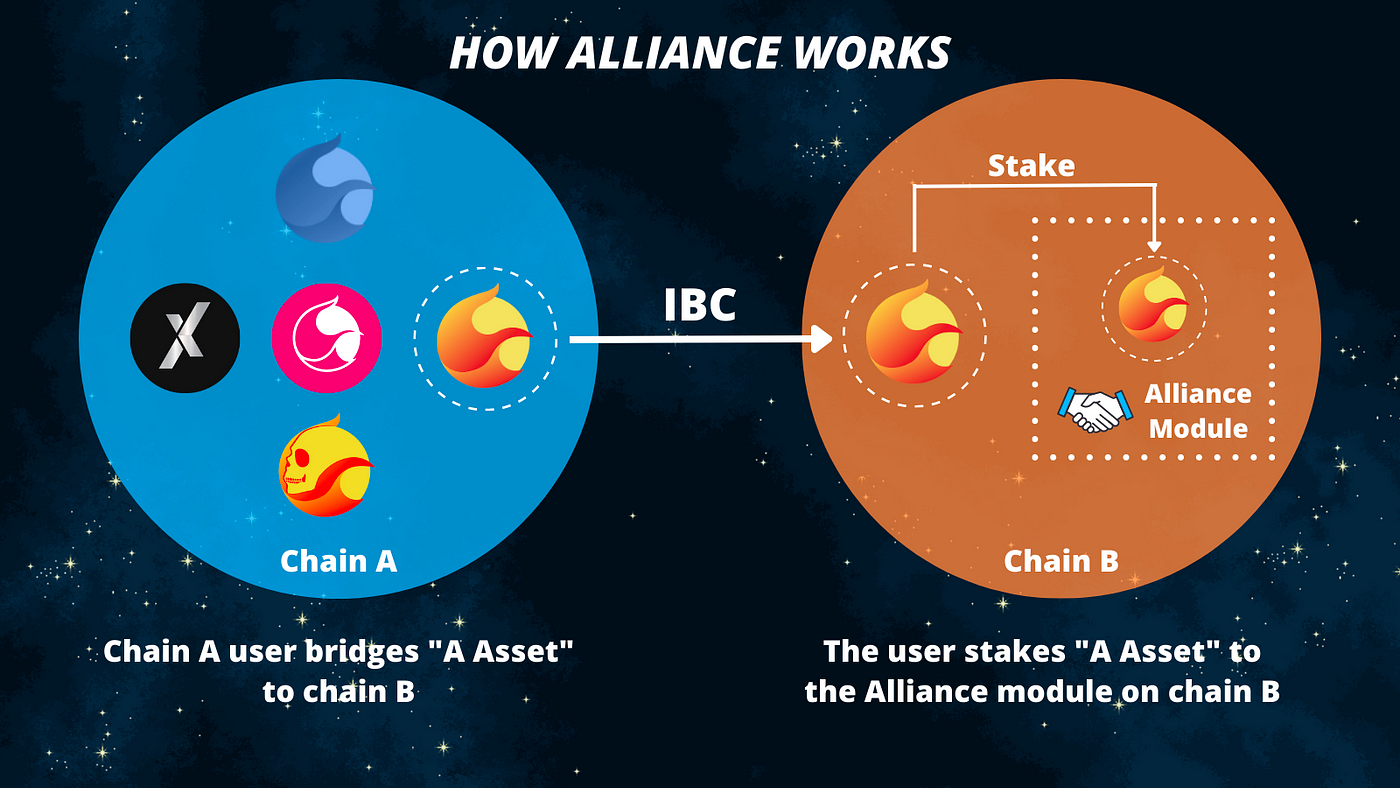

Terra's Alliance Module Sets the Stage

Cosmos, no stranger to the restaking concept, has a well-established foundation with the Terra Alliance Module, predating EigenLayer's foray into restaking. The Terra Alliance Module, a precursor to the restaking trend, has played a crucial role in enabling economic alliances between different blockchains. Cosmos, building upon this familiarity, is now at the forefront of discussions surrounding liquid restaking, showcasing a commitment to integrating established concepts with emerging trends in blockchain innovation.

Cosmos Expands Horizons

Beyond the Ethereum ecosystem, liquid restaking is gaining momentum, and Cosmos is actively contributing to this shift. The integration of liquid restaking protocols and ongoing discussions within the Cosmos community highlights a collective understanding of the potential benefits associated with this approach. The rapid adoption of liquid restaking underscores the adaptability of blockchain ecosystems and the industry's dedication to exploring innovative avenues for heightened network security and diversified yield opportunities.

First Movers in Cosmos

Terra Alliance: Fostering Economic Alliances for Staking

The Terra Alliance Module, an integral component of the Cosmos SDK, has become a driving force in redefining blockchain ecosystems through its innovative approach to shared security and staking. This module, exemplified by platforms like Carbon, facilitates the creation of economic alliances among networks, allowing for collaborative staking of assets. Its impact extends beyond the Cosmos ecosystem, influencing the broader crypto landscape.

At its core, the Alliance module enables networks to form economic alliances by allowing their assets to be staked reciprocally with another party's network. This two-way mechanism fosters collaboration and shared security among interconnected networks. For instance, Carbon's integration with the Alliance module enables participants to trade staking yields, unlocking real staking yield for all parties involved.

The module operates on a strategic model with the introduction of Alliance assets, each assigned a Take Rate and Reward Weight. The Take Rate serves as a commission to the Carbon network, redistributing staked Alliance assets to native chain stakers. Simultaneously, the Reward Weight determines the distribution of Carbon staking rewards to Alliance asset stakers. This nuanced design ensures a balanced and mutually beneficial incentive structure for all participants.

The benefits of the Alliance module extend beyond immediate staking rewards. By fostering economic alliances, networks attract new users, liquidity, and developers, contributing to community growth. This reciprocal relationship assists networks in expanding their user base, enticing developers to explore native DeFi modules, and building a resilient and thriving ecosystem.

Persistence One: The Vanguard of Cosmos Liquid Restaking

Persistence One is at the forefront of shaping the landscape of liquid restaking within the blockchain ecosystem. The project's strategic plans involve the establishment of a robust infrastructure within the Cosmos ecosystem, leveraging the capabilities of Terra's Alliance Module. This framework allows users to deposit a variety of Liquid Staked Tokens (LSTs), including assets like ATOM, TIA, and DYDX, onto the Persistence chain.

One key aspect of Persistence One's liquid restaking initiative is enabling users to restake their assets and secure additional chains. The process commences with the Persistence Core-1 chain and extends further, providing users with the opportunity to diversify their staking portfolio while earning additional rewards.

The reward structure for liquid restakers on the Persistence chain is designed to be comprehensive. By integrating Terra's Alliance Module, Persistence One introduces a dual-reward system. Participants not only receive staking rewards from the underlying LSTs but also earn XPRT, the native staking token of Persistence One. This approach enhances the incentive structure, fostering a more secure and interconnected ecosystem for chains enabled by the Inter-Blockchain Communication (IBC) protocol.

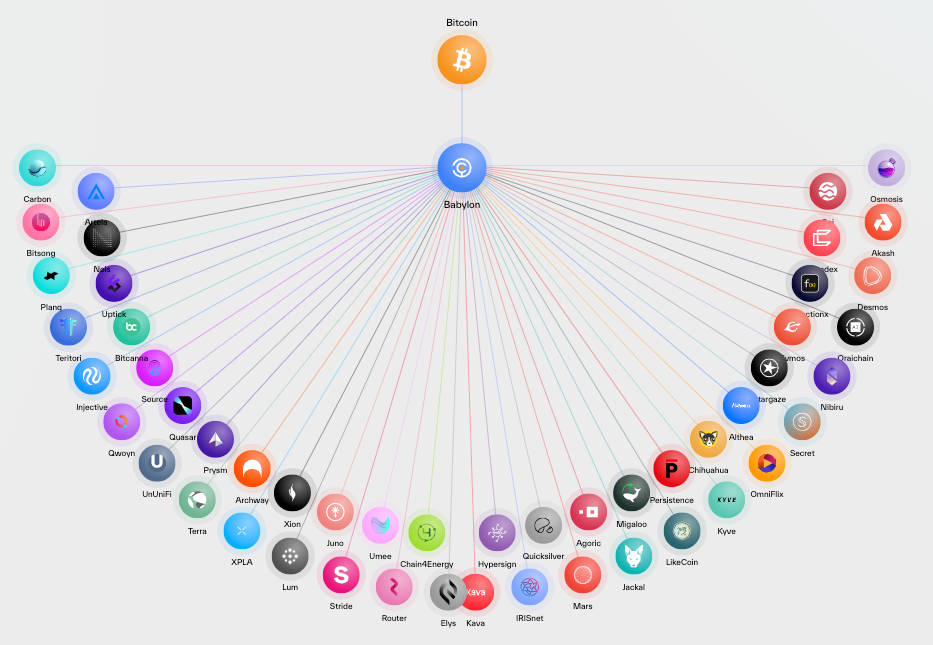

Babylon: Enhancing Security with Bitcoin Restaking

Babylon, a novel project within the Cosmos ecosystem, is pioneering a transformative approach by integrating Bitcoin's robust security for restaking purposes. The central premise revolves around utilizing the security infrastructure of Bitcoin to enhance the security and validation of Cosmos zones and other Proof-of-Stake (PoS) chains. The project's vision is driven by the idea that Bitcoin, with its unparalleled security rooted in Proof-of-Work (PoW), can serve as a reliable source of trust to fortify diverse blockchains in the broader ecosystem.

At its core, Babylon seeks to address the inherent security limitations of PoS chains, particularly Cosmos zones, by strategically incorporating Bitcoin into the restaking process. The fusion of PoS and PoW strengths in a well-designed architecture aims to create a symbiotic relationship, bolstering the security of Cosmos zones without compromising their autonomy. Babylon's innovative use of Bitcoin introduces a new dimension to restaking, providing a unique solution to the challenges faced by PoS chains.

Beyond its role in security enhancement, Babylon positions Bitcoin as a valuable asset for fast staking, unbonding, bootstrapping new zones, safeguarding critical transactions, and ensuring censorship resistance. The project envisions a future where Bitcoin's security capabilities are seamlessly integrated into the fabric of Cosmos, offering a robust and reliable foundation for the evolving landscape of decentralized finance (DeFi).

First Movers in Solana

Picasso: Expanding Horizons on Solana

Picasso, a key player in the evolving landscape of decentralized finance (DeFi), is set to bring the restaking revolution to the Solana ecosystem through its innovative Solana <> IBC connection. This move signifies a major expansion of the restaking concept, previously predominant on Ethereum, to the vibrant and rapidly growing Solana blockchain.

In essence, restaking involves a strategic process where users stake an asset with a blockchain's validators, receive a receipt token representing this stake, and subsequently restake the receipt token. Picasso's foray into Solana aims to not only amplify potential yields for users but also contribute to reinforcing the overall security of the ecosystem.

Picasso's initial plan involves enabling the staking of various tokens, including SOL, mSOL, jitoSOL, and Orca LP tokens, into Picasso's Solana <> IBC validators hosted on trustless.zone. The restaking mechanism propels the idea of rehypothecating a token on the consensus layer, offering users the opportunity to stake the same assets twice and receive yield while supporting PoS validation.

The tokens eligible for restaking include SOL, the native token of the Solana ecosystem; mSOL, the liquid staking token from Marinade Finance; jitoSOL, the liquid staking token from Jito; Orca LP Tokens, representing liquidity providers in the Orca decentralized exchange (DEX); and bSOL, the staked token from Solblaze.

Picasso's Solana <> IBC validators present users with the chance to stake these tokens, accumulating rewards proportionate to their staking amount and time. The process not only enhances the yield on the original stake but also facilitates the yield from restaking. The move is particularly significant given Solana's massive staking market, with over 392 million SOL staked, representing a staggering 92% of the total circulating supply.

Demex Gears Up For Restakers

Demex is home to traders, degens, and liquid stakers but now we're gearing up to welcome liquid restakers! Demex will be integrating with EigenLayer via a popular liquid restaking protocol Ethos. We will also be enabling greater shared security with Bitcoin Staking powered by the Babylon Chain.

Beyond the integrations, and the commitment to greater shared security, Demex will be providing a greater DeFi field for restakers to earn more rewards on top of their staking and restaking rewards!

Demex will list these LRTs or Liquid Restaked Tokens on Nitron, our in-app money market to be used as collateral. Soon, users can use this collateral as margin to participate in trading powered by a multi-asset collateral module.

The TLDR

Liquid restaking, a prominent trend in blockchain, is gaining traction with key players like EigenLayer, Cosmos, Terra's Alliance Module, Persistence One, and Babylon. EigenLayer pioneers restaking in the Ethereum ecosystem, introducing Proof of Restake, revolutionizing staking dynamics. Cosmos embraces liquid restaking, leveraging the Terra Alliance Module for economic alliances. Persistence One stands out, shaping the liquid restaking landscape within Cosmos, integrating Terra's module, and offering a dual-reward system. Babylon innovatively integrates Bitcoin for enhanced security in Cosmos zones. Additionally, Picasso takes the restaking concept to Solana, marking a significant expansion in decentralized finance ecosystems.