Liquid Restaked Tokens and The Rise of LRTFi

Liquid re-staking is shaking up the DeFi space, offering flexibility and higher returns. Re-staking, pioneered by EigenLayer, boosts earnings by reinvesting rewards and increasing yield. EigenLayer's approach streamlines network security and reduces costs for DeFi developers, promoting innovation.

The dynamic DeFi space is continuously evolving, introducing novel concepts to enhance flexibility and potential yields. The latest trend making waves across crypto Twitter is liquid re-staking, a groundbreaking approach that offers a new level of flexibility and increased returns. Let’s unravel the fundamentals of staking, liquid staking, and how liquid re-staking may reshape the DeFi landscape.

Staking and Liquid Staking: A Quick Recap

Staking

Staking involves committing a specific amount of your cryptocurrency as collateral on a Proof of Stake (PoS) blockchain. Imagine it as putting down a deposit in a game to play and earn rewards. Let's say you have 10 tokens of a cryptocurrency like Ethereum. By staking them, you lock them away for a certain time, ensuring the security and functionality of the network. In return, you receive more tokens as rewards, say an additional 2 tokens after a certain period, like a week. It's like gaining extra game coins for participating and helping to maintain the game.

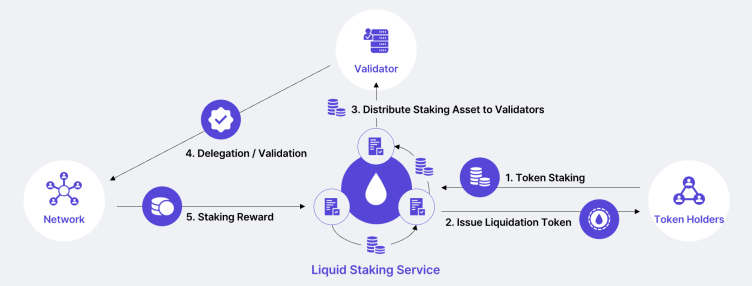

Liquid Staking

Now, imagine you want to keep playing the game but also want the flexibility to use some of your tokens whenever needed. Liquid staking allows you to do just that. Instead of locking up all 10 tokens, you deposit them into a special system that gives you staking derivatives, which represent your staked tokens. These derivatives continue to earn rewards for you, just like staked tokens, and you can trade or use them while they are still staked. So, if you need to access some tokens for another game or activity, you can do so without interrupting your staking rewards, making your gameplay more flexible and enjoyable.

The Drive for Re-Staking in DeFi

The emergence of re-staking was spurred by the desire for new protocols to tap into Ethereum's existing validators and security infrastructure. EigenLayer pioneered this concept, allowing developers to harness pooled security, reducing operational costs and paving the way for a more capital-efficient model in the realm of decentralized finance.

Furthermore, renowned liquid staking protocols such as Lido Finance and Rocket Pool offer steady yields, typically hovering around ~4%. However, DeFi enthusiasts are constantly seeking ways to optimize these yields, aiming for higher returns. This demand has fueled the emergence of re-staking, a strategic move aimed at maximizing earnings and enriching the DeFi experience.

EigenLayer: The Pioneers of Re-Staking

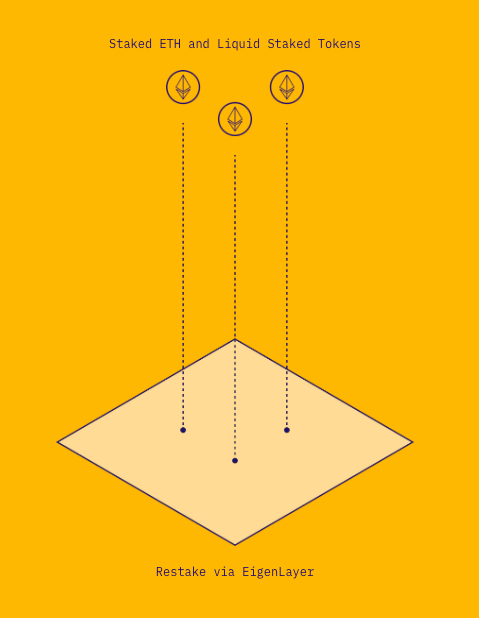

EigenLayer, at the forefront of innovation within the Ethereum ecosystem, introduced the groundbreaking concept of re-staking. Restaking allows staked ETH to serve as cryptoeconomic security for protocols beyond Ethereum, earning additional protocol fees and rewards. Users who opt for re-staking on EigenLayer contribute their LSDs (Liquid Staked Derivatives) to the pooled security layer, bolstering network security and unlocking increased rewards.

Unveiling the Benefits of Pooled Security

Utilizing EigenLayer's pooled security model offers numerous advantages for DeFi developers, fostering a more efficient and cost-effective approach to network management and development.

Reduced Operational Costs

Developers leveraging EigenLayer can sidestep the demanding task of constructing and maintaining their own validator network. This significantly reduces both initial setup costs and ongoing operational expenses associated with running a successful network.

Leveraging Ethereum's Robust Validator Base

By integrating with EigenLayer, developers gain access to Ethereum's vast and decentralized base of validators, capitalizing on their extensive expertise and experience.

Mitigated Security Provisioning Challenges

EigenLayer's pooled security eliminates the necessity for high token inflation rates to incentivize security provision. This removes a significant hurdle for new blockchain projects, making security more attainable and cost-effective.

Enhanced Innovation Focus

With EigenLayer handling the foundational security aspects, developers can channel their focus and resources toward specific innovations without the need to recreate an entire blockchain technology stack. This streamlines development efforts and expedites the pace of innovation within the DeFi landscape.

Unpacking the Re-Staking Process

Let’s return to our previous example. Now, let's talk about restaking. After a while, you have more coins, let's say 12, due to the rewards from the magic chest. Instead of just keeping these extra 2 coins aside, you decide to put them back into the same magic chest for the next round. This means the next time the magic chest creates more coins, it'll do so not just based on your initial 10 coins, but on the 12 coins, including the rewards you previously earned. It's like saying, "Magic chest, work your spell on these 12 coins now!" The result? The next time rewards are given, you might get 2.5 or 3 extra coins instead of just 2.

Restaking is akin to using the newly generated game coins to buy additional game coins, allowing you to participate more vigorously in the game and potentially earn even more rewards. It's a strategy to make the most out of the magical duplicating chest, ensuring that each round of rewards generates a larger return than the previous one. In the DeFi world, this translates to increasing the staked amount, which, in turn, amplifies the rewards in subsequent staking cycles. Restaking is a way to level up your earnings and optimize your game (or in this case, holdings) by compounding the rewards you receive from staking.

Terra's Alliance Module vs. Eigen's Restaking Module: A Close Comparison

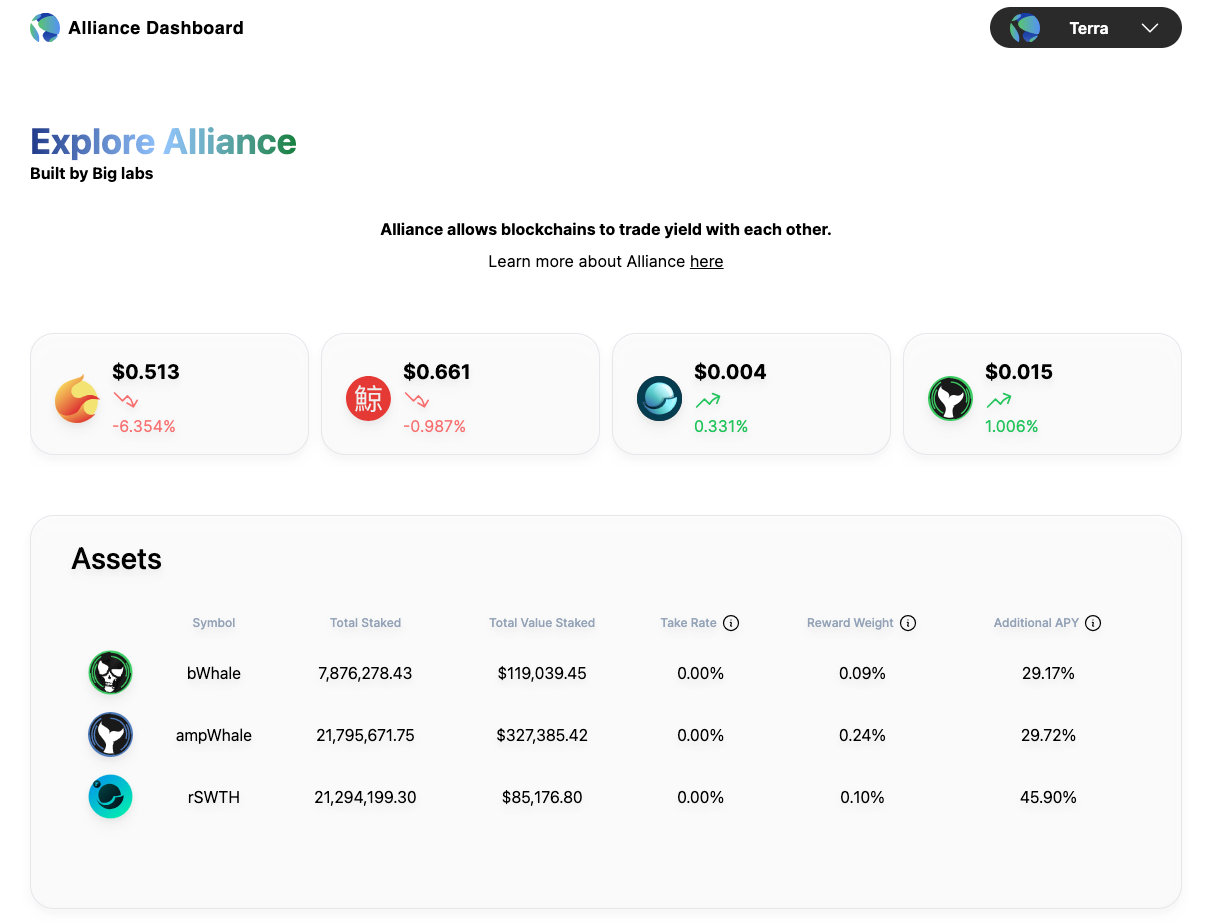

Terra's Alliance module and Eigen's restaking module share similar goals in enhancing the DeFi ecosystem through interchain collaboration and optimizing staking rewards. While Terra's Alliance allows for assets from one blockchain to be staked on another, Eigen's restaking module permits staked ETH to serve as security for protocols beyond Ethereum, earning additional protocol fees and rewards.

Terra's Alliance module primarily focuses on enabling economic alliances between networks by allowing their assets to be staked with each other. Similarly, Eigen's restaking module amplifies rewards by reinvesting them, aligning with the fundamental idea of compounding returns.

Both models foster economic partnerships and aim to maximize rewards for users, showcasing the growing trend of interchain collaboration and innovation within the DeFi landscape.

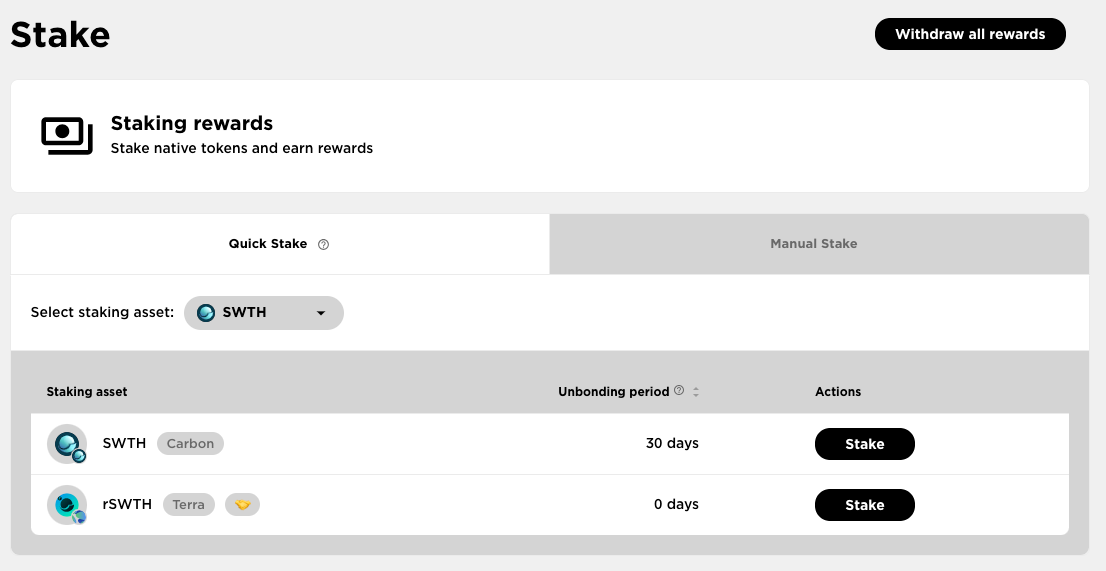

Carbon Embraces Alliance

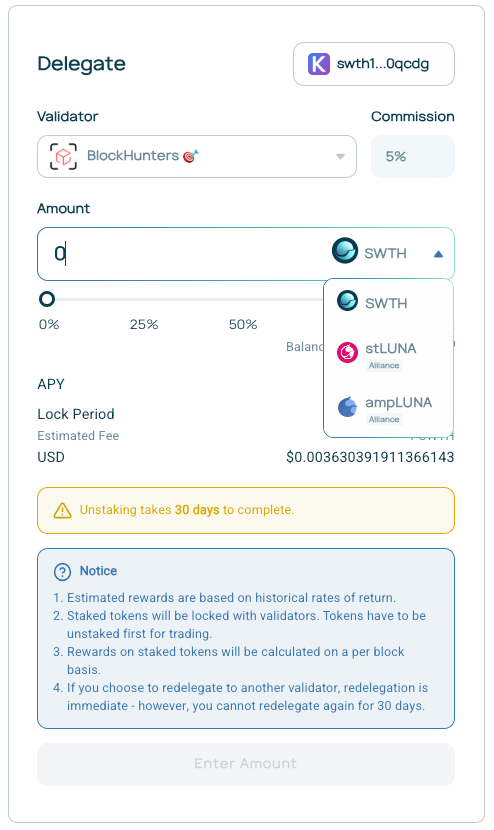

Carbon, the blockchain that powers Demex has actively embraced the Alliance module, specifically by integrating with it and offering its native token, SWTH, for staking on other compatible networks like Terra.

By forming an alliance with Carbon, anyone can validate the Luna chain by staking SWTH or rSWTH as an alliance asset while earning additional rewards!

Furthermore, other alliance assets such as stLUNA and ampLUNA can be staked and used to validate the Carbon chain on the CarbonHub! This collaboration not only benefits SWTH stakers but also contributes to Carbon's ecosystem growth by attracting more users and liquidity.

Carbon's alliance strategy involves providing diversified yield opportunities, aiming to attract and retain users within its ecosystem. The innovative approach includes the potential to stake other networks' assets on Carbon, fostering a symbiotic relationship and mutual growth.

Carbon's proactive participation in the Alliance module exemplifies its commitment to enhancing user rewards and expanding its network's reach by forming strategic alliances within the wider crypto ecosystem.

Liquid Restaked Tokens and Nitron: A Perfect Match?

EigenLayer's introduction of re-staking paves the way for a multitude of opportunities for DeFi farmers. Through re-staking across various protocols, users can amplify their yields and contribute to the security and expansion of multiple applications. Nitron, a thriving DeFi hub, has already demonstrated its support for numerous liquid staked tokens from leading protocols such as Lido, Stride, and StaFi. Nitron may become a home to LRTs, providing restakers a chance to earn even more yield on their tokens!

The TLDR

Liquid re-staking is shaking up the DeFi space, offering flexibility and higher returns. Re-staking, pioneered by EigenLayer, boosts earnings by reinvesting rewards and increasing yield. EigenLayer's approach streamlines network security and reduces costs for DeFi developers, promoting innovation.