Master Flash Loan Arbitrage: High-Risk, High-Reward Strategies Explained

Imagine capitalizing on fleeting market inefficiencies within DeFi, turning a profit in seconds without any upfront investment. That's the allure of flash loan arbitrage, a high-octane strategy for the crypto-savvy adventurer. Flash loans remove the need for collateral, unlike traditional arbitrage, adding an extra layer of intrigue (and risk) to this fast-paced game. But are the potential rewards worth the white-knuckle ride? Let's delve into the world of flash loan arbitrage and explore its potential for both profit and peril.

What is Flash Loan Arbitrage

At its core, flash loan arbitrage revolves around using flash loans, which are uncollateralized and provided by DeFi protocols. These loans allow users to borrow funds without any upfront guarantee, provided they repay the loan within the same transaction block. The key to flash loan arbitrage lies in identifying price discrepancies between different DeFi exchanges or lending platforms.

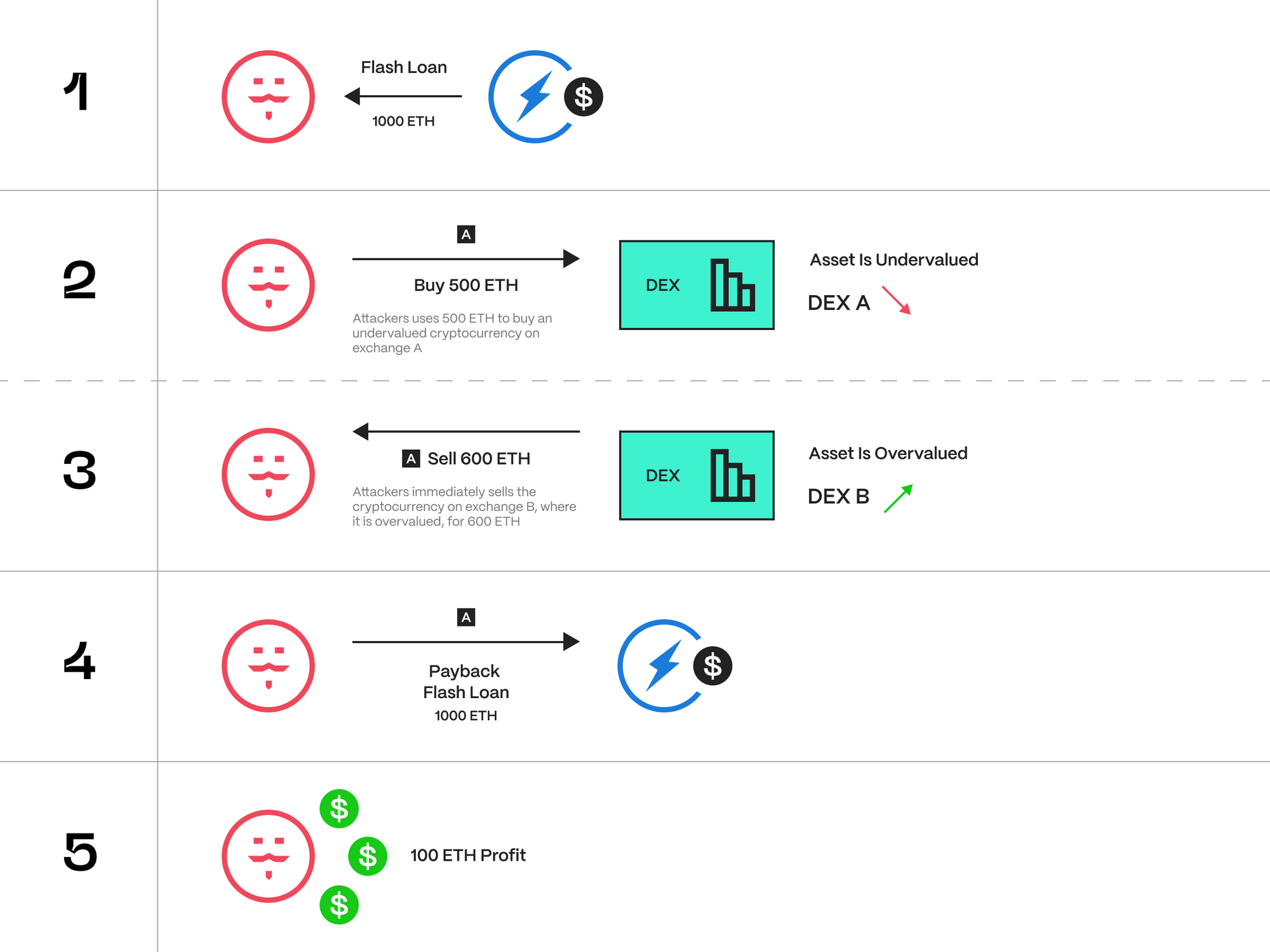

The Process of Flash Loan Arbitrage

The journey of a flash loan arbitrageur begins with scouting for assets trading at lower prices on one platform compared to another. Once a lucrative opportunity is identified, the arbitrageur swiftly acquires the asset via a flash loan from a DeFi protocol such as Aave or Compound. With funds in hand, the arbitrageur executes a series of rapid trades, buying the asset on the cheaper platform and selling it immediately on the more expensive one. Profits are generated from the price difference, but the borrowed asset plus any associated fees must be repaid to the DeFi protocol within the same transaction block.

Benefits and Advantages

Flash loan arbitrage offers several enticing benefits for savvy traders. Firstly, it holds the potential for high profits by exploiting short-term market inefficiencies. Moreover, unlike traditional arbitrage strategies that require significant upfront capital, flash loan arbitrage enables traders to participate in lucrative opportunities without tying up their funds.

Beyond Arbitrage: Expanding Applications of Flash Loans

However, the applications of flash loans extend far beyond arbitrage. Here are some additional ways flash loans are being utilized within the DeFi landscape:

Liquidation Protection

Flash loans can be a safety net for borrowers in DeFi lending protocols. If a borrower's collateral value dips close to the liquidation threshold, they can use a flash loan to acquire more of the collateral asset, increasing the collateralization ratio and avoiding liquidation.

Leveraged Trading

Experienced users can leverage flash loans to amplify their trading positions. By borrowing an asset through a flash loan, they can magnify their holdings and potentially increase profits (or losses) on trades. However, this strategy carries significant risk if market movements go against the trader's predictions.

Portfolio Rebalancing

Flash loans can be used to rebalance a DeFi portfolio efficiently. A user can borrow an asset they are underweight on and sell an overweighted asset, all within the same transaction, achieving the desired portfolio allocation without needing to hold the borrowed asset.

Arbitrage Across Blockchains

Flash loans can bridge the gap between different blockchains. Users can exploit price discrepancies between DeFi protocols on separate blockchains by borrowing an asset on one chain, selling it on another chain for a higher price, and repaying the loan within a single transaction.

A Cautionary Tale: The bZx Exploit (2019)

While flash loans offer innovative opportunities, it's crucial to remember their potential pitfalls. A prime example is the bZx exploit in 2019. Attackers manipulated a vulnerability in the bZx protocol's smart contract to leverage flash loans and drain millions of dollars worth of cryptocurrency from the platform. This incident highlighted the importance of robust smart contract security in DeFi, especially when dealing with complex functionalities like flash loans.

Remember: Flash loans are a powerful tool, but they require a deep understanding of DeFi, smart contracts, and market dynamics.

Risks and Challenges

The complexity of DeFi protocols, smart contracts, and market dynamics can pose significant challenges for even the most experienced traders. Smart contract vulnerabilities are a constant threat, potentially leading to devastating losses. Additionally, fees associated with flash loans can eat into profits, while rapid market movements demand lightning-fast execution. As competition in the flash loan arbitrage space intensifies, profit margins thin, amplifying the risk of liquidation if trades fail to yield the expected returns.

Additional Considerations

It's essential to recognize that flash loan arbitrage isn't without its ethical and regulatory implications. While it can be a legitimate trading strategy in the right hands, it can also be misused for market manipulation or draining liquidity from pools. As regulatory scrutiny surrounding DeFi and flash loans continues to evolve, traders must stay abreast of legal developments and ensure compliance with relevant regulations.

Is Flash Loan Arbitrage Right for You?

In conclusion, flash loan arbitrage offers a tantalizing glimpse into the world of high-stakes. Flash loan arbitrage offers a tempting glimpse into the world of high-stakes DeFi trading. For experienced traders with a strong understanding of DeFi protocols, smart contracts, market dynamics, and risk management, it can be a potentially lucrative strategy. However, for beginners or those unfamiliar with the complexities of DeFi, the risks far outweigh the potential rewards.

Here are some key takeaways to consider:

- Flash loan arbitrage is a complex and high-risk strategy.

- In-depth research, a strong understanding of DeFi, and a high-risk tolerance are essential.

- Start small, manage risk effectively, and always prioritize capital preservation.

The TLDR

Flash loan arbitrage leverages uncollateralized loans to exploit short-term price discrepancies between DeFi platforms. While it offers the potential for high profits, it's fraught with risks like smart contract vulnerabilities, high gas costs, and impermanent loss. Only experienced traders with a deep understanding of DeFi and risk management techniques should consider this strategy.