Meet Nitron, The Most Extensive Money Market In Crypto

Nitron is one of the best money markets with weekly listings ranging from exotic assets, liquid staked derivatives and so much more.

Nitron by Demex is a cross-chain money market that supports assets from the most popular blockchains such as Ethereum, Arbitrum, etc. It whitelists exotic assets such as liquid staked derivatives and value-accruing assets, unavailable anywhere else.

Need for a Money Market

The recent downfall of centralized crypto companies in the trading and lending space has led to a surge in demand for decentralized and non-custodial trading platforms. This shift in demand towards DeFi platforms such as Nitron and Demex is indicative of a sustained trend towards decentralized trading and lending platforms. With the ability to lend and borrow various crypto assets on a money market, users can earn real yield and substantial profits. This new trend is proving to be a game-changer for crypto users, offering users more control over their assets and enabling them to maximize their returns.

FTX gained immense popularity not only for its trading platform but also for its in-built lending platform that enabled users to lend their idle assets with ease. FTX was unique as it combined a trading platform and money market in one. However, until recently, there has been no available perpetual protocol that offers an in-built money market. This has changed with the launch of Nitron by Carbon, a Cosmos money market that is a part of Demex, an orderbook DEX that offers spot, perps, and futures. With Nitron, users can lend and borrow various crypto assets, earning real yield while unlocking capital, all while having access to a wide range of trading options on Demex. This innovative platform is set to transform the DeFi space, providing users with a seamless and intuitive interface to maximize their returns.

What is a Cosmos Money Market

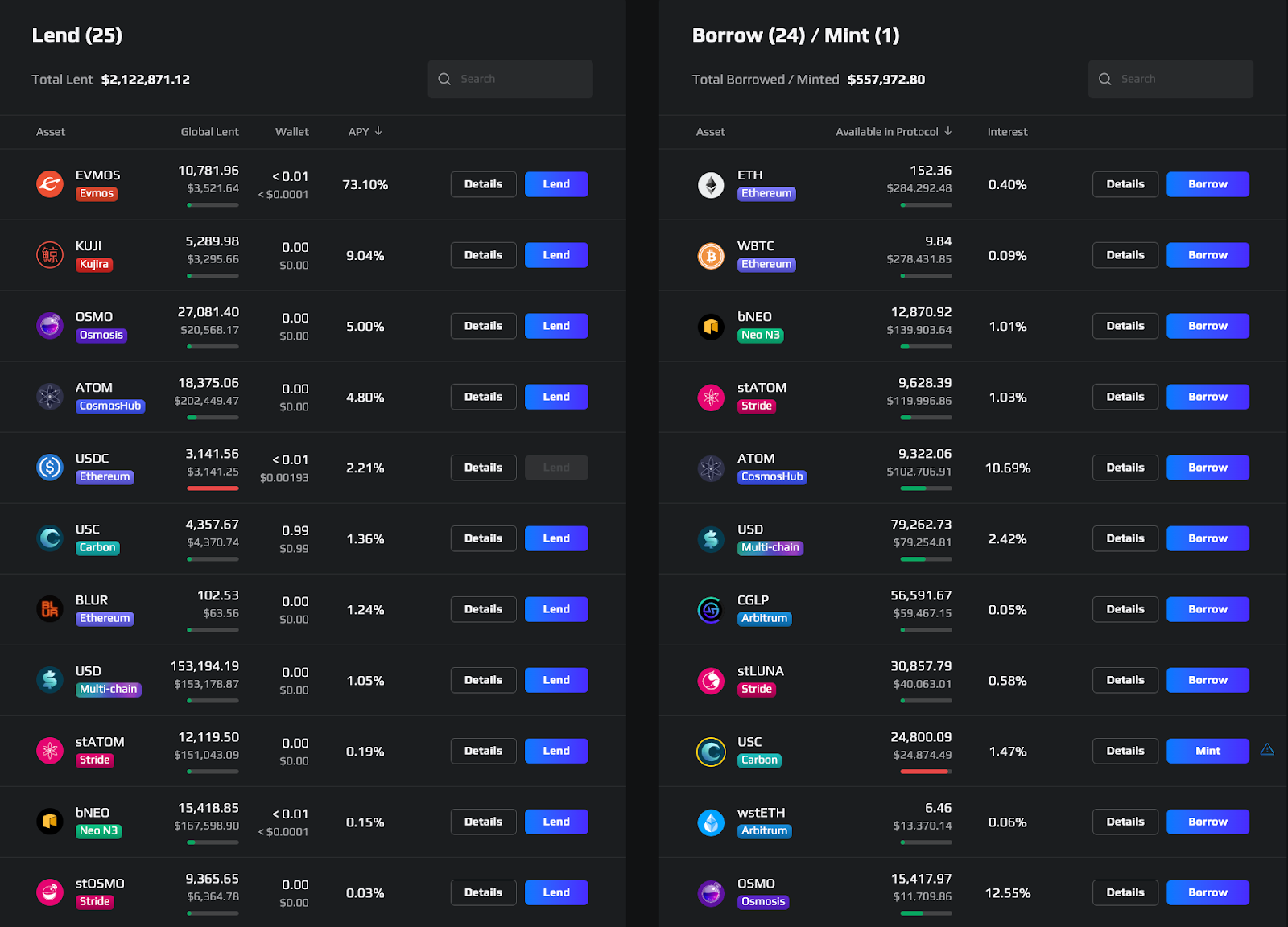

A Cosmos Money Market, or lending and borrowing market, is a DeFi dApp on Cosmos that provides two primary functions.

- Lending: It enables users to lend their assets and earn interest from the lending process.

- Borrowing: It allows users to borrow against whitelisted collateral assets.

Lenders deposit their assets into the market and supply liquidity to the protocol, earning an income when their assets are being borrowed. They can also withdraw their collateral at any time, giving them complete control over their assets. Borrowers, on the other hand, are able to borrow assets in an overcollateralized way, meaning they have to supply a higher value of whitelisted collateral than they borrow to ensure the safety of the market. This ensures that borrowers also become lenders. Borrowers have the flexibility to repay their loans at any time without penalty, making it a convenient option for those seeking to maximize their profits.

Meet Nitron

Nitron is a cross-chain money market by Demex that is built on Carbon.. With Nitron, users can lend and borrow crypto assets permissionlessly, making it an excellent platform for those seeking to maximize their profits. The platform provides an opportunity for users with idle assets to earn real yield by loaning them out or by borrowing against them.

#Nitron by Demex is LIVE!

— Demex (@demexchange) December 6, 2022

The ONLY money market you need for lending, borrowing & minting assets across various chains!

Experience the true power of DeFi:

⚜️ Lend and borrow $USDC, $ETH and $WBTC

⚜️ Mint $USC, @0xcarbon’s decentralised stablecoinhttps://t.co/LUcClhA3bO pic.twitter.com/3tc3gD6Mro

Unlike centralized finance platforms (CeFi), all loans are done on-chain and can be tracked with the CarbonScan explorer, offering complete transparency and visibility into the lending and borrowing process.

Permissionless Listings

Nitron, the DeFi Cosmos money market built on Carbon, currently only supports public pools. These pools are shared and similar to AAVE, requiring a governance vote to add or remove assets or adjust risk parameters. While public pools have high TVL, they are not truly permissionless and can add friction to adoption.

However, in the upcoming update, Nitron will introduce private pools, allowing anyone to create a lending and borrowing market in the spirit of DeFi. Private pools enable users to create markets for any asset as long as there is a DEX listing, and customize parameters such as interest rate, oracle, risk parameters, and fee structures. This means that anyone can create a private pool for any asset, including for liquidity pool bootstrapping, all done permissionlessly.

With the addition of private pools, Nitron on Demex will provide a more flexible and truly permissionless experience for users, allowing them to maximize their profits and achieve real yield by lending and borrowing various crypto assets.

Carbon Stablecoin, $USC

Carbon, the blockchain powering Nitron, launched its own Cosmos-native stablecoin named USC. This decentralized stablecoin is overcollateralized and backed by assets deposited into the public pools, enabling users to mint USC by depositing whitelisted collateral, including liquid staked derivatives for leveraged staking rewards. Once the user wishes to redeem their collateral, the protocol will burn the USC and return the user's collateral. The introduction of USC has increased revenue for SWTH stakers.

Carbon Stablecoin: Adding Utility to $SWTH 💎

— Carbon - SWTH 💎 (@0xcarbon) November 25, 2022

You can mint Carbon Stablecoin on Nitron by @demexchange *soon*, but before that… What’s Carbon stablecoin? And how will it add value to $SWTH token holders and stakers? 👀

Find your answers here: https://t.co/Rvea3qEWvs pic.twitter.com/NrMZInYZ2A

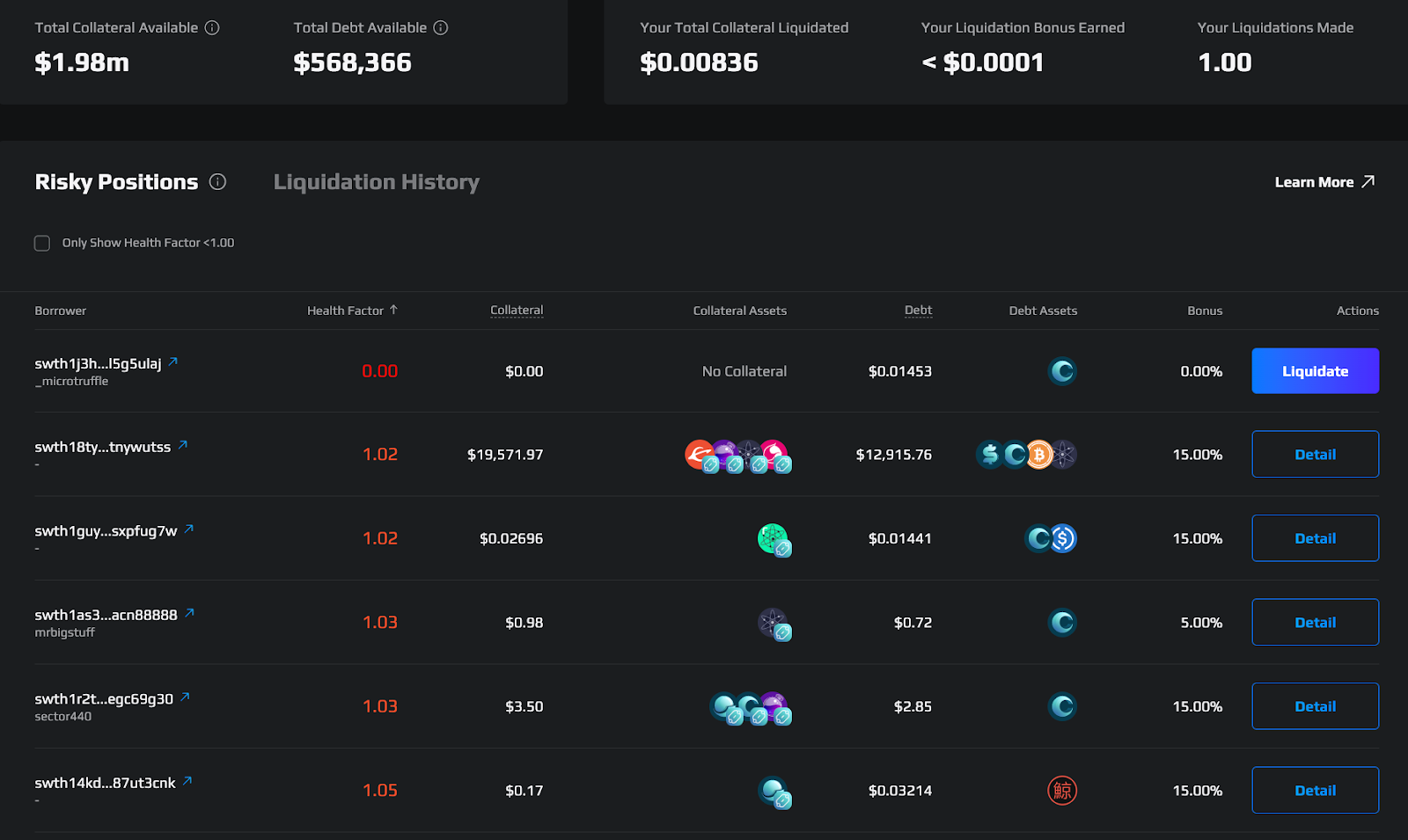

Liquidation Platform

The Nitron platform operates on an overcollateralized borrowing model, which means that users must deposit collateral worth more than the borrowed amount. However, in the event that market movements cause the deposited asset to be insufficient, the loan may become undercollateralized and be subject to liquidation. In the past, bots have dominated the liquidation process on platforms like AAVE, giving them an unfair advantage. To promote fairness and inclusivity in the DeFi space, Nitron has a user-friendly front-end liquidation interface that allows anyone to participate in liquidations and acquire discounted assets.

Nitron Liquidations, the liquidation hub for #Nitron, is LIVE! 🔥

— Demex (@demexchange) December 7, 2022

In the spirit of #DeFi, we are saying bye bye to liquidation bots. Nitron is opening up the liquidation market for you to participate and buy liquidated assets at a discount!https://t.co/8CCfhs4paW pic.twitter.com/UZ76EoHQgT

Stability Reserves

In the future, Nitron plans to introduce a stability pool feature inspired by Vesta Finance, which will offer additional protection against liquidations for public pools.

With the stability pool, users can deposit borrowable assets into the reserve to act as a buffer for liquidations when those assets have undercollateralized loans. These reserves will be used first to liquidate underwater loans, reducing the risk of bad debts.

For instance, if a user borrows ETH against their ATOM collateral and the price of ATOM drops, causing their ETH loan to be undercollateralized, stability pool providers who deposited ETH and selected ATOM as one of their preferred collateral will be the first to use their ETH to repay the loan and take the user's collateral, which in this case is ATOM.

The TLDR

Nitron is a powerful platform that offers a multitude of features and benefits to crypto users who are looking to maximize their yield. By providing high APY rates, low fees, and a user-friendly interface, Nitron enables users to earn more and unlock from their assets with minimal effort.

In a world where the crypto market is constantly evolving and becoming increasingly complex, Nitron provides an ever-evolving platform for users to experience the true power of DeFi and unlock their capital.