Mt. Gox Repayments: Will This Crash the Bitcoin Market? (Bitcoin Prediction)

The specter of the Mt. Gox saga continues to cast a long shadow over the cryptocurrency market. The once-dominant exchange's 2014 hack, resulting in the loss of 850,000 Bitcoins (BTC), is finally nearing a resolution with the announcement of repayments to creditors starting July 2024. This raises a critical question for anyone searching for a "bitcoin prediction": will the influx of over $10 billion worth of BTC crash the market?

A Shadow Over Bitcoin's History

Mt. Gox's collapse was a watershed moment for Bitcoin. Back then, it handled over 70% of all BTC transactions. The hack not only eroded trust in centralized exchanges but also highlighted the vulnerability of young cryptocurrency infrastructure.

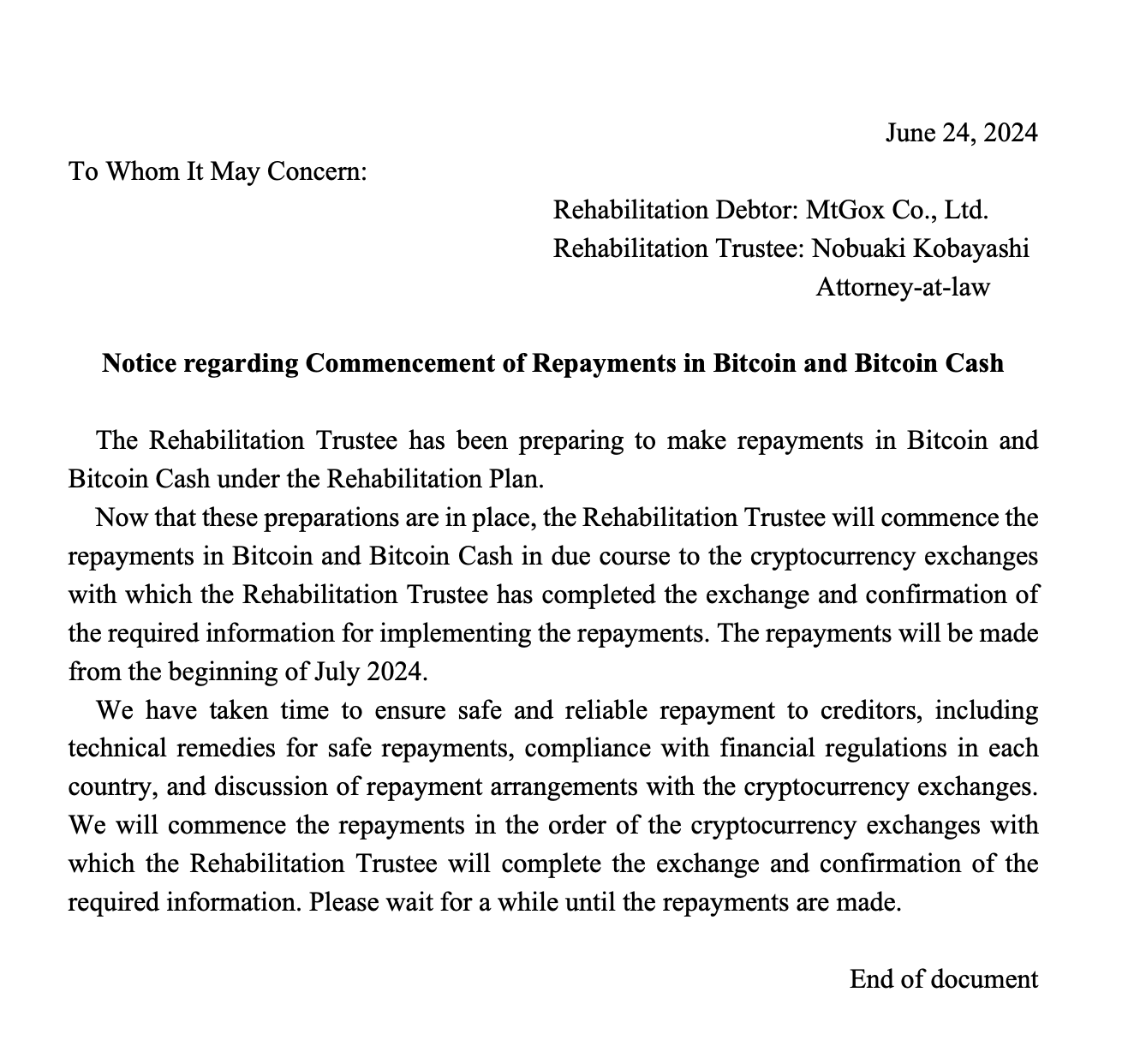

Now, after nearly a decade of legal wrangling, creditors will receive a portion of their lost funds, either in Bitcoin or Bitcoin Cash (BCH), depending on what they held at the time of the hack. The total value of these repayments is estimated to be around $10 billion at current prices, a significant sum that could potentially disrupt market equilibrium.

Market Concerns and Bearish Sentiment

The announcement of Mt. Gox repayments coincided with a downward trend in Bitcoin's price. Some analysts believe this is a direct consequence of the upcoming influx of BTC. Here's a breakdown of these concerns:

- Increased Sell Pressure: The creditors receiving these Bitcoins haven't had access to them for almost a decade. They might be tempted to sell all or a portion to recoup losses or capitalize on the significant price increase since the hack. This sudden surge in selling could overwhelm the market, driving prices down.

- Uncertain Selling Patterns: The timeframe over which creditors will sell their BTC remains unclear. A slow, controlled release could minimize the impact. However, a mass sell-off could trigger a domino effect, leading to further price drops and increased volatility.

- Prevailing Bearish Sentiment: The broader cryptocurrency market is already facing headwinds due to macroeconomic factors and inflation concerns. The Mt. Gox repayments could exacerbate this existing bearish sentiment, potentially influencing technical analysis patterns and short-term price movements.

Calming the Waters: Counterarguments and Market Resilience

While the concerns are valid, several factors suggest the impact of Mt. Gox repayments might be less dramatic than anticipated:

- Vested Interest: Many creditors are likely long-term Bitcoin holders who may choose to hold onto their recovered coins, especially considering their low-cost basis (the price at which they originally acquired the BTC). This could minimize selling pressure and potentially lead to a bullish signal for the market.

- Market Maturation: The cryptocurrency market of 2024 is much larger and more robust than in 2014. The total market capitalization of cryptocurrencies is now in the trillions, making it more resilient to sudden price fluctuations and potentially mitigating the impact of the Mt. Gox repayments.

- Gradual Release: The repayment process is expected to be gradual, potentially mitigating the impact on price stability. Additionally, some creditors may opt to receive their repayments in BCH, further diffusing the selling pressure on BTC.

Expert Opinions and Market Predictions

To get a clearer picture, let's look at what industry experts are saying:

- Sam Callahan, Senior Analyst at Swan Bitcoin: Believes the impact is overblown. He argues that creditors who wanted to sell likely already did through claims trading. Additionally, the low cost basis incentivizes holding, potentially leading to a bullish signal for the long term.

- Ryan Lee, Analyst at Bitget Research: Acknowledges the potential for selling pressure but highlights the resilience of the market due to other factors. He emphasizes the importance of monitoring market signals and technical analysis to gauge potential price movements.

- Scott Melker, Host of The Wolf of All Streets Podcast: Views this as a positive development, showcasing Bitcoin's growth and resilience since the hack. He believes it could ultimately lead to increased institutional adoption of the cryptocurrency.

The TLDR

The Mt. Gox repayments are a significant event for the Bitcoin market, but their exact impact remains uncertain. Here's a quick summary:

- Potential for Short-Term Volatility: Increased sell pressure from creditors could lead to temporary price dips and market volatility, but long-term trends might not be significantly affected.

- Market Resilience: The larger and more mature cryptocurrency market might absorb the influx of BTC smoothly, potentially minimizing long-term price impact.

- Long-Term Outlook: The event could have positive consequences, boosting institutional adoption by showcasing Bitcoin's stability and driving further development in secure exchanges and DeFi solutions.

While predicting the exact impact on Bitcoin's price is difficult, this event serves as a reminder of the evolving nature and a strong signal of the cryptocurrency market.