Navigating the 2024 Crypto Bull Market

The highly anticipated crypto bull market of 2024 has garnered widespread attention, with experts and analysts offering valuable insights into potential trends and catalysts that may define this pivotal period. As we approach the impending bull run, it is crucial to delve into key aspects influencing the crypto landscape, including the potential approval of a spot Bitcoin exchange-traded fund (ETF) by the U.S. Securities and Exchange Commission (SEC).

Upcoming Market Catalysts

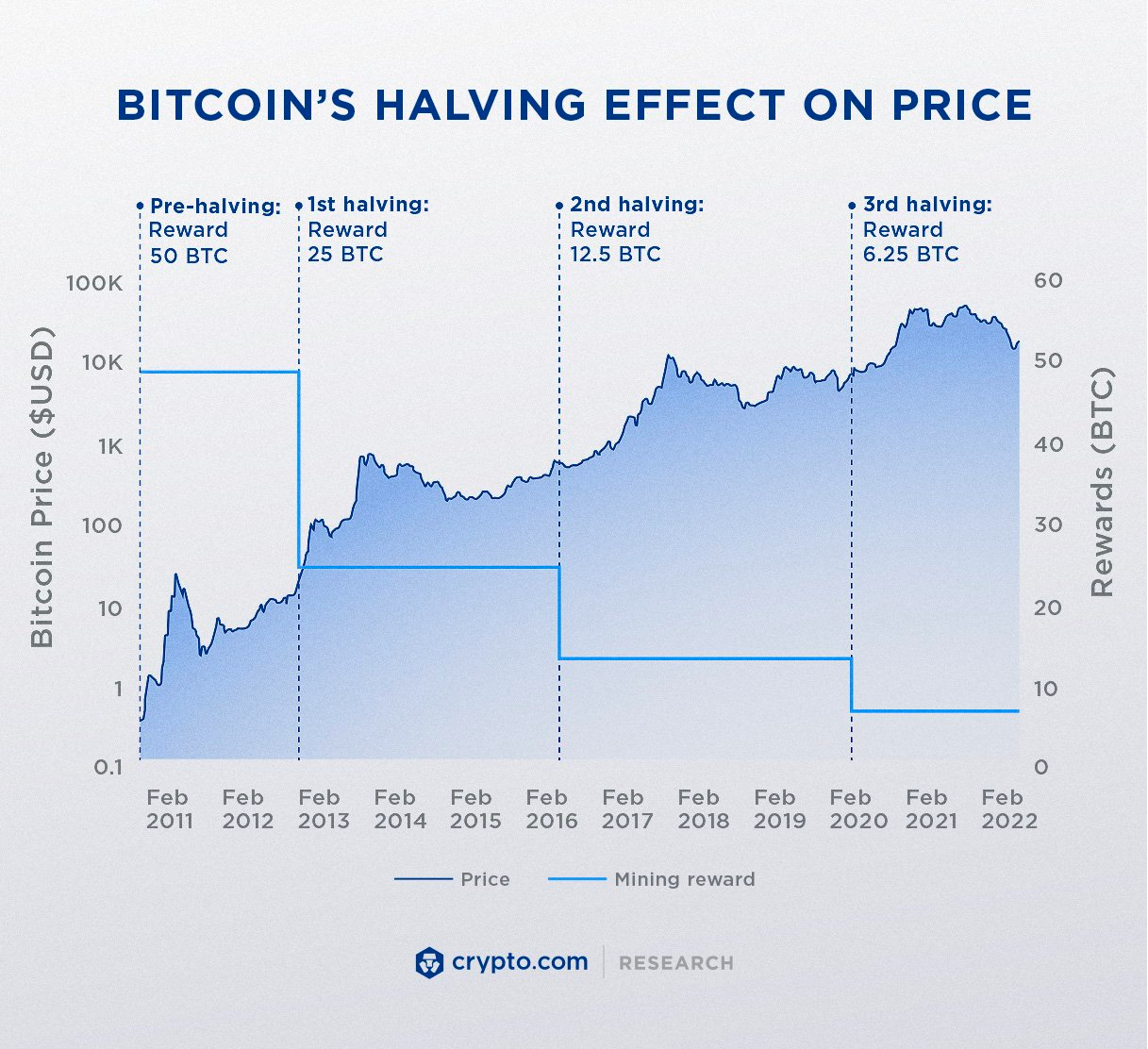

Bitcoin's Halving Impact

In April 2024, Bitcoin's upcoming halving event is poised to be a significant catalyst, historically triggering previous bull runs. The reduction in the rate of new Bitcoin supply creates a supply shock, contributing to a surge in the cryptocurrency's price. Recent data indicates an uptick in Bitcoin wallet creation, suggesting growing retail interest and anticipation ahead of the halving.

Read more on our recent article, Bitcoin: The Flight To Safety.

The Potential Spot Bitcoin ETF Approval

The approval of a spot Bitcoin ETF by the SEC is a topic dominating discussions within the crypto community. A spot Bitcoin ETF would directly invest in the digital asset, providing increased accessibility and potentially drawing in substantial institutional capital. Noteworthy is Grayscale's proactive approach, updating the Grayscale Bitcoin Trust (GBTC) agreement for an anticipated uplisting to a spot Bitcoin ETF. Analysts speculate that the first approval of a spot Bitcoin ETF could materialize early in 2024, with multiple ETF listings on the same day.

While the potential approval of a spot Bitcoin ETF is eagerly anticipated, existing Bitcoin-related ETFs, including GBTC, have already experienced significant growth in assets. Investors have demonstrated a keen interest in GBTC, a Bitcoin-tracking ETF that correlates with the spot price of Bitcoin.

Institutional Embrace and Regulatory Milestones

Institutional adoption within the crypto industry is on the rise, with major financial institutions and corporations increasingly investing in Bitcoin and other digital assets. Regulatory developments, such as the potential approval of a spot Bitcoin ETF in the United States, could mark a significant milestone, legitimizing the industry and attracting more institutional capital. Notably, recent reports highlight a surge in institutional Bitcoin purchases, indicating growing confidence in the asset class.

Future of Cryptocurrency and Digital Assets

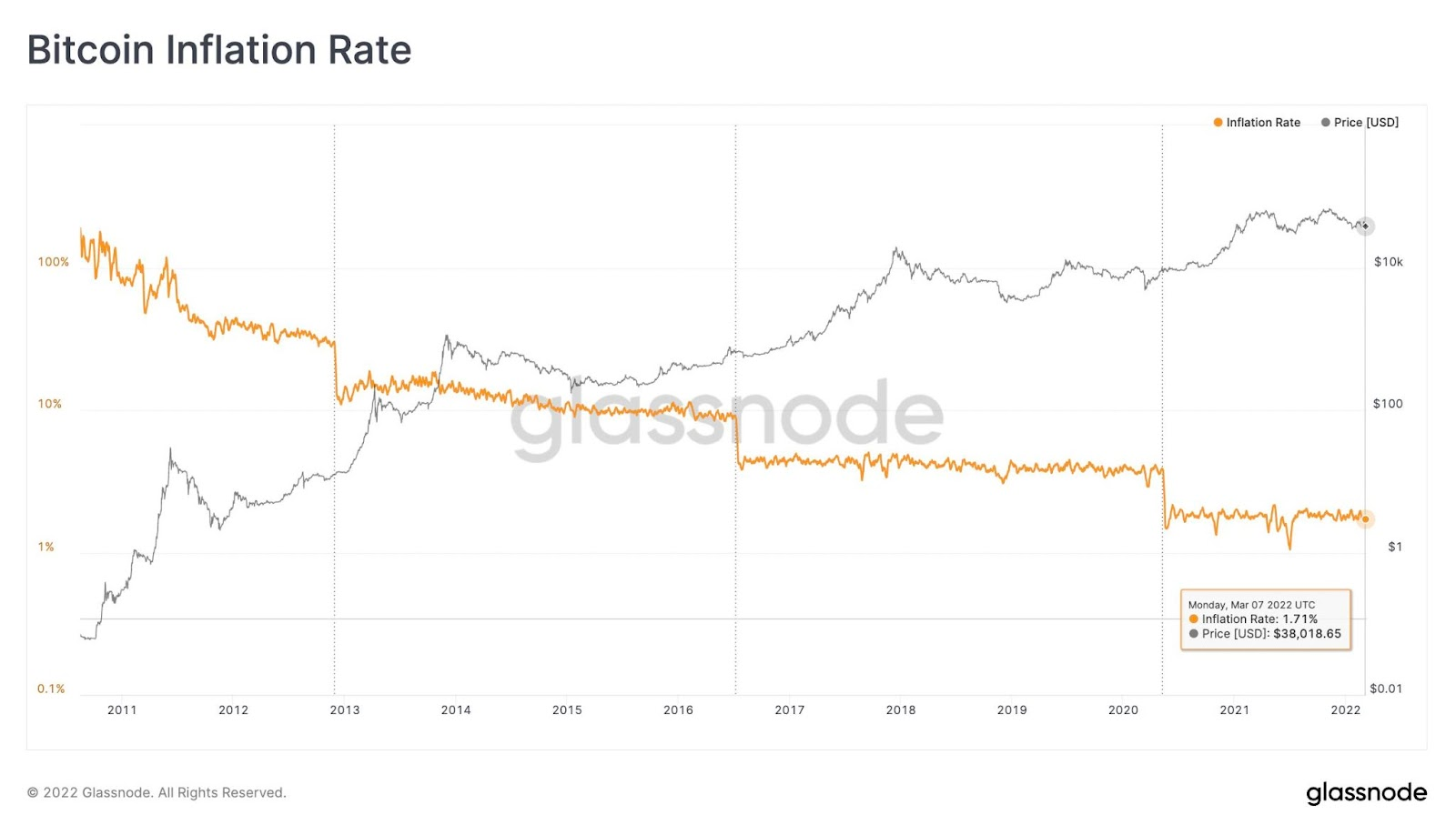

A Hedge Amid Global Inflation

In the wake of surging global inflation rates, cryptocurrencies and digital assets have emerged as a formidable hedge against the diminishing purchasing power of traditional fiat currencies. With the value of conventional money on the decline, decentralized alternatives, exemplified by the likes of Bitcoin, have gained significant traction. Cryptocurrencies, distinguished by their finite supplies and borderless transactions, are increasingly recognized as a means to safeguard wealth independently of central authorities. Investors, spanning from individual enthusiasts to institutional giants, are drawn to the uncorrelated nature of digital assets, acknowledging their potential to diversify portfolios and mitigate risks in the face of ongoing inflationary pressures.

Reshaping Wealth Preservation in Uncertain Times

As the world contends with economic uncertainties and rising inflation, cryptocurrencies stand out as resilient instruments reshaping the financial landscape. Their ability to serve as a hedge against inflation is not only fostering widespread adoption but also prompting individuals and institutions to rethink traditional wealth preservation strategies. In this evolving landscape, digital assets offer a compelling and decentralized approach, providing individuals and entities alike with a strategic avenue to protect and grow their wealth amidst the challenges posed by inflation-prone environments.

Demex: Empowering Traders in the 2024 Bull Market

In the transformative landscape of the 2024 crypto bull market, aligning with advanced platforms becomes paramount. Demex, a cross-chain derivatives decentralized exchange (DEX), emerges as the ideal platform for perpetual traders gearing up for the impending bull run.

Demex stands out as the preferred choice for traders navigating the dynamic shifts of the 2024 crypto market. Its innovative cross-chain trading approach offers the perfect platform for trading the most exotic and hot trending perpetual contracts including pre-launch markets. With advanced features and a user-friendly interface, Demex empowers traders to navigate the crypto landscape with ease.

As the market gains bullish momentum, Demex becomes the ultimate companion for traders, providing a robust foundation for strategic moves in derivatives trading. Elevate your trading experience and position yourself for success with Demex, where the future of decentralized exchanges converges with the exciting possibilities of the crypto bull market. Seize opportunities confidently on Demex, your gateway to the future of cross-chain derivatives trading.

The TLDR

The anticipated 2024 crypto bull market brings forth significant catalysts, including Bitcoin's upcoming halving and Ethereum's upgrades. Institutional adoption and the potential approval of a spot Bitcoin ETF further shape the landscape. Real-time data indicates heightened retail interest and increased DeFi activities. Amid global inflation concerns, cryptocurrencies serve as a hedge, drawing attention from both individual and institutional investors. Demex, a cross-chain derivatives DEX, emerges as a powerful platform for traders gearing up for the 2024 bull market, offering advanced features and a seamless trading experience. Stay informed to navigate the evolving crypto landscape.