Experience The Power of Liquidity with Demex’s Perp Pools!

For those familiar with Demex, Perp Pools have likely become a cornerstone, particularly among Liquidity Providers (LPs). These pools function as specialized liquidity reserves tailored for perpetual markets. While they share similarities with spot liquidity pools, they distinguish themselves by employing AMM smart contracts to allocate user-provided liquidity across the order book for perpetual markets using a single asset. Spot AMMs are well-established, but Perp AMMs revolutionize liquidity provision, attracting LPs without the need for costly token incentives. This innovation ensures seamless market operations and efficient liquidity management.

For a deeper dive, visit our previous blog here!

Carbon Perp Liquidity Tokens (CPLT)

Each dollar deposited in the liquidity pool yields CPLT tokens, also known as Carbon Perp Liquidity tokens. These tokens represent the liquidity deposited and the LP's share of the pool.

It's crucial for liquidity providers to understand that the USDG to CPLT ratio isn't 1:1. CPLT is a yield-bearing token, deriving yield from makers' rebates, funding fees, and traders' P&L. The value of CPLT fluctuates based on market performance and the contributions from these sources.

Learn more about CPLT and how you can earn real yield here.

Advantages of Perp Pools Over Spot Pools

| Basis for Comparison | Spot Pools | Perpetual Pools |

|---|---|---|

| Asset Required | 2 assets are necessary for liquidity provision, balancing the pool according to the set liquidity curve ratio | Only 1 asset (USDG) is needed for liquidity provision, regardless of the liquidity curve set |

| Sustainability | Dependent on token emissions for incentives, risking long-term sustainability due to token dumping | Generates a healthy APY from maker rebates, funding fees, and traders’ PnL, ensuring long-term sustainability |

| Volume | Volume limited by market conditions and lack of leverage | Consistently high volume irrespective of market conditions, with leverage availability significantly increasing volume size |

| Scalability | Connected to a single market, restricting scalability | More flexible and scalable, connected to multiple markets for increased scalability |

| Lock-up Period | Requires liquidity commitment for a minimum of 1 day to a maximum of 30 days | No lock-up period, allowing instant deposit, stake, unstake, and withdrawal of liquidity |

How Deposits and Withdrawals Work

Your deposits and withdrawals are instant, providing greater flexibility compared to spot pools where token commitment is encouraged for maximum yield potential.

For example, when you deposit your USD(G), you receive CPLT based on the pool's current performance and your share of the total liquidity, determined by the amount of USD(G) you've deposited.

Determining Pool Performance

You can determine the pool's performance based on the APY shown on the Perp Pools Page. Essentially, the APY depicts the annualized returns for $1,000 of liquidity deposited into each pool.

For example, the Celestia Ecosystem Perp Pool displays a positive APY of 111.74%. This APY is the annualized estimated returns, based on past performance of the pool since inception. This indicates that in one year, if the APY remains constant, your initial $1,000 will grow to $2,117.4 [(initial deposit + APY multiplier) = ($1,000 + 111.74/100*1000)], provided you hold your liquidity for a year in the pool.

Conversely, a negative APY results in a formula where your net holdings = the initial deposit + (-) APY multiplier.

It's advisable to make a calculated decision on fund allocation based on your perception of the pool’s performance. However, note that since the APY period is adjusted annually, the net gains and losses may be averaged out, which may not be the best performance indicator for short-term depositors or indicate the perp pool's performance in the last week.

In the future, we will provide more detailed insights, including a weekly APY, for you to understand the real-time performance of the pool.

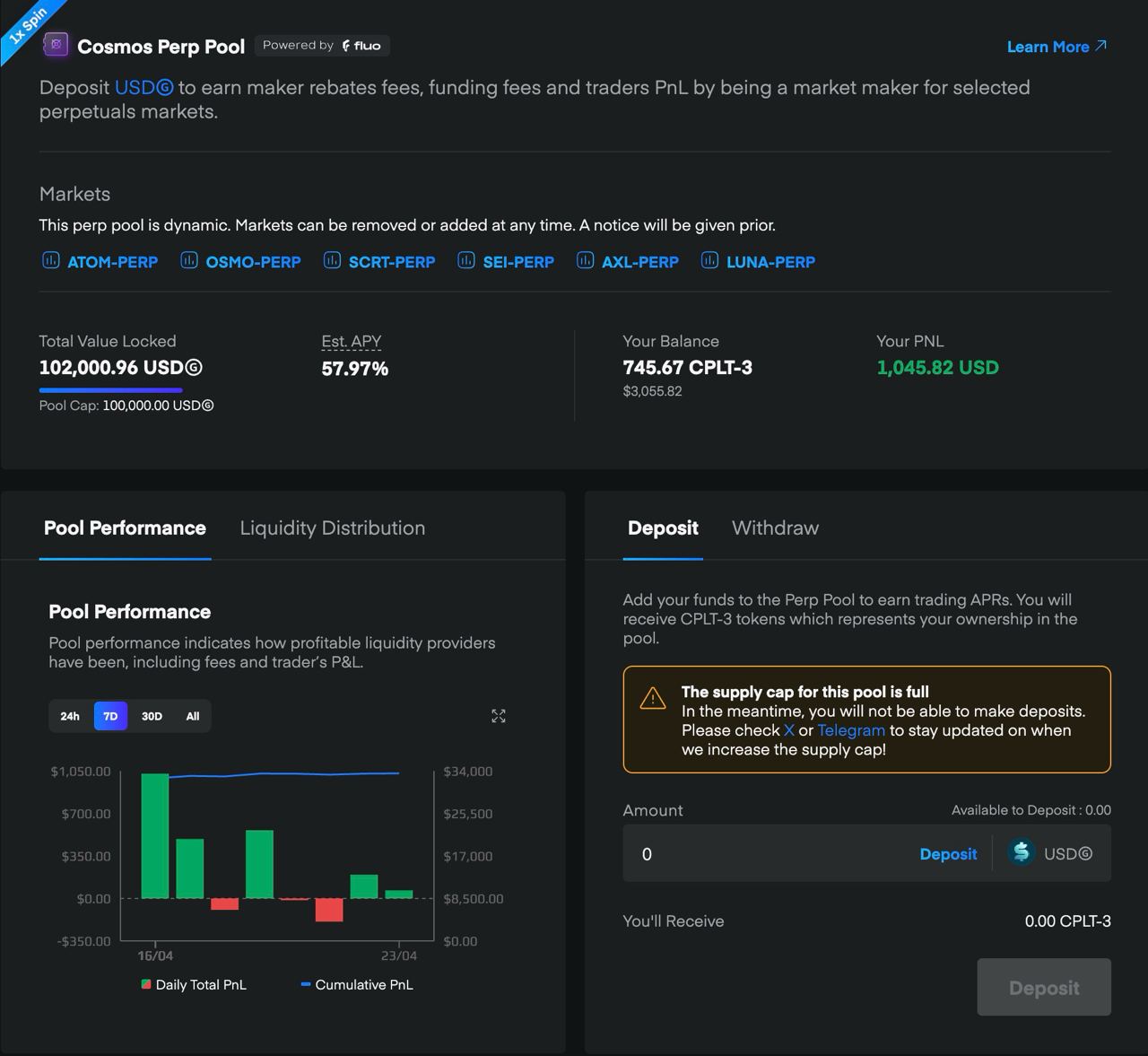

Monitoring Your Liquidity's Performance

Keep track of your liquidity's performance through the "Your PNL" section, offering insights into your investment's growth. See how your deposited funds evolve into significant profits, reflecting the pool's sustainable growth.

For example, a user who deposited $2010.00 in the Cosmos Perp Pool saw their initial investment grow to $3,055.82, indicating a substantial profit. This growth is evidence of the pool's sustainable and positive performance, benefiting liquidity providers.

More Indicators

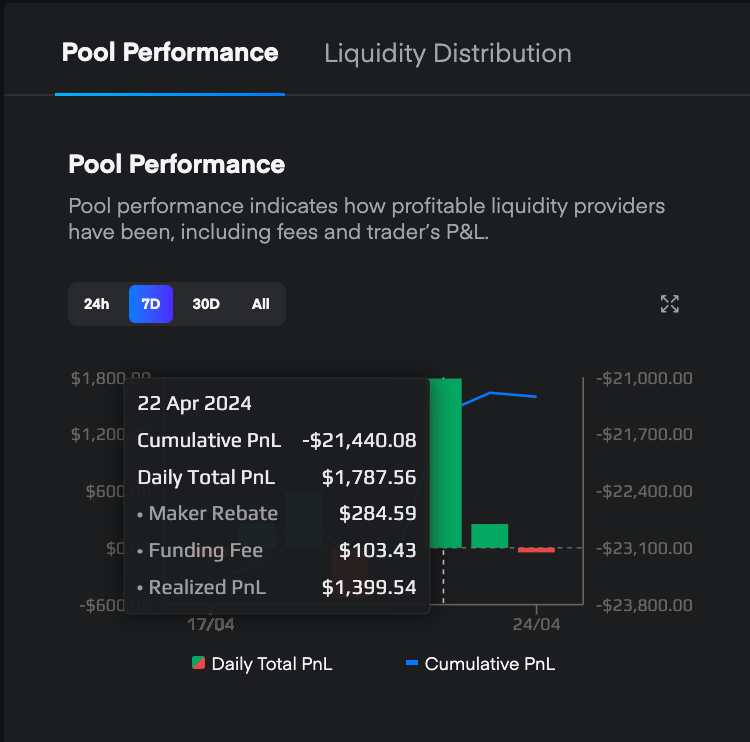

Pool Performance

Below is the Pool Performance for the Fomo Perp Pool, reflecting its 7-day performance. This comprehensive overview illustrates the fluctuating nature of perp pools, with highs and lows observed on different days. It delineates the breakdown of the maker rebate (maker fees), funding fees, and the perp pool’s realized PnL. Maker rebates are contingent upon the pool's open interest and demand, while funding fees denote the costs traders incur to maintain their positions. Realized PnL represents traders’ net combined profit and loss across associated perp markets.

Various external factors influence pool performance, including traders’ actions and sentiments. In a bullish market, heightened trader activity often leads to increased long positions, potentially resulting in decreased pool performance if traders realize substantial profits. Conversely, during a bear market, trading volume may decrease due to negative sentiment, with traders leaning towards short positions.

Despite traders' activity, studies and historical evidence suggest that traders tend to incur losses over time. Consequently, liquidity providers, or the "house," consistently benefit from traders’ losses in the long run.

Liquidity Distribution

You can observe the liquidity allocation of the perp pool for each associated perp market. For instance, in this Cosmos Perp Pool, six perp markets are linked to it: ATOM, AXL, LUNA, OSMO, SCRT, and SEI.

The bar graphs below display the allocated liquidity for each market. Liquidity is distributed on a "first-come, first-serve" basis while ensuring deep liquidity and tight spreads for all markets simultaneously.

Within each market's bar graph, you can monitor the real-time maximum allocated liquidity. Each market maintains its maximum liquidity ratio to prevent one perp market from depleting the pool's liquidity, ensuring access for other markets.

Additionally, you can observe the total sum of long and short positions to assess whether traders will generate a net profit or loss on the pool.

The TLDR

Demex's Perpetual Pools enable instant deposits and withdrawals, offering flexibility without the need for token commitment. Users receive CPLT tokens based on pool performance and deposited USD(G) amounts. The displayed APY on the Perp Pools Page provides insights into potential growth over time. Monitoring liquidity performance is simplified through the "Your PNL" section. Detailed analysis of pool performance, including maker rebates, funding fees, and realized PnL, informs strategic decisions. Real-time updates on liquidity distribution ensure fair access and optimal trading conditions, empowering users to maximize market opportunities effortlessly.